One of the essential parts of filing freelancer taxes is a tax return.

An important component of that is filing a Schedule C (Or Form 1040/1040-SR), which is how you report your business income aka reduce 1099 taxes.

Don’t be intimidated by the numbered forms and lettered schedules required by the Internal Revenue Service (IRS). We’re here to help with Schedule C instructions, to make tax time easier.

Note: if you want to easily fill out your net profit or loss statement with an app that automatically records your write-offs, try Bonsai Tax. Our tax software will scan your credit card/bank account statements to discover tax deductions at the push of a button. In fact, the majority of our users save at least $5,600 from their tax bill. Claim your 7-day free trial today.

A Schedule C form is used to report profit or loss from your sole proprietorship. Your business is considered such if you are engaging in it with the intention of making a profit and you conduct business on a continual and regular basis.

The IRS does not require Schedule C if you’re pursuing a hobby or a not-for-profit activity. But as a freelancer, that likely doesn’t include you. As a sole proprietor operating with the intention of making a profit from your business, you’ll have to file a Schedule C.

The information you submit on Schedule C is used by the IRS to determine how much profit you made for the purposes of assessing whether you owe taxes or will receive a tax refund. If you own more than one business, you must complete a separate Schedule C for each business.

The IRS used to make it even simpler with a Schedule C-EZ, which was just as it’s called: EASY. It was a simpler version intended for smaller businesses, such as those that didn’t claim home office deductions. But beginning with the 2019 tax year, you have to use Schedule C if you have a sole proprietorship.

There are different types of business entities, and Schedule C refers specifically to a sole proprietor.

Here’s the definition of a sole proprietor: someone who owns an unincorporated business by himself or herself.

Other business entities include a partnership and a corporation. And if you’re an employee of an organization, you obviously don’t need to file a Schedule C unless you run your business on the side.

As a sole proprietor, you annually file your personal income tax return, known as a Form 1040, the United States Individual Income Tax Return (or in the case of seniors, a 1040-SR).

Along with it, you file Schedule C (Form 1040 or 1040-SR), Profit or Loss from Business. Self-employed individuals or sole proprietorships are required to file an annual return.

You’re obligated to to file an income tax return if your net earnings from self-employment are $400 or more. To figure out your net earnings, you subtract your expenses for business use from your taxable income. You can do a rough calculation to determine if it’s more than $400.

Then you’re ready to proceed with filing Schedule C.

Before you get started filling out Schedule C with a 1099, you will need the following information:

There are also specific areas of the IRS instructions that you’ll need to complete the form, such as the business codes section.

It’s a good idea to walk through our Schedule C instructions in their entirety, and then return and go through the Schedule C instructions as you complete the form.

That’s because there are some sections later in the form (Parts 3 and 5, for instance), which are calculated and then added into the calculations in Parts 1 and 2.

Let’s dive into our Schedule C instructions by starting with Sections A-J, the introductory part of the form. Most of these boxes are straightforward, where you include your name, your Social Security Number, and your business activity, business name and other information.

Here are some of the fields in the form for which you made need clarification:

A & B go together, where you insert your principal business in A, and assign it a code in B. The code is based on IRS instructions which provide codes for different businesses, defining your principal business or profession, including services or products that you sell. You simply check the IRS instruction guide and complete the code.

For instance, a freelance photographer would be found under Professional, Scientific, & Technical Services, and be assigned the code 541920 - Photographic services. A consultant falls in the same category and would be assigned Code 541600 - Management, scientific, & technical consulting services.

D: Employer Identification Number: The EIN is used to identify a business entity, and most businesses need an EIN. There is a long list of EIN benefits for a sole proprietor.

Most of the other fields are straightforward, such as whether you started the business in that tax year and whether you materially participated in the business.

This section takes you through a calculation of your business income, including gross income (receipts from clients or sales), returns and allowances, and cost of goods sold. As a self-employed solopreneur, your self-employment income and business income are the same (unless you are a statutory employee).

As you work your way through the Schedule C form, you do the math as instructed.

Here’s how it goes:

Did you know that you can use Bonsai for accounting? Or that Bonsai can help you be prepared for self-employment tax by providing tax estimates, filling date reminders, and identifying your tax write-offs? You could use a tax write-off template or have an app record all your expenses for you automatically.

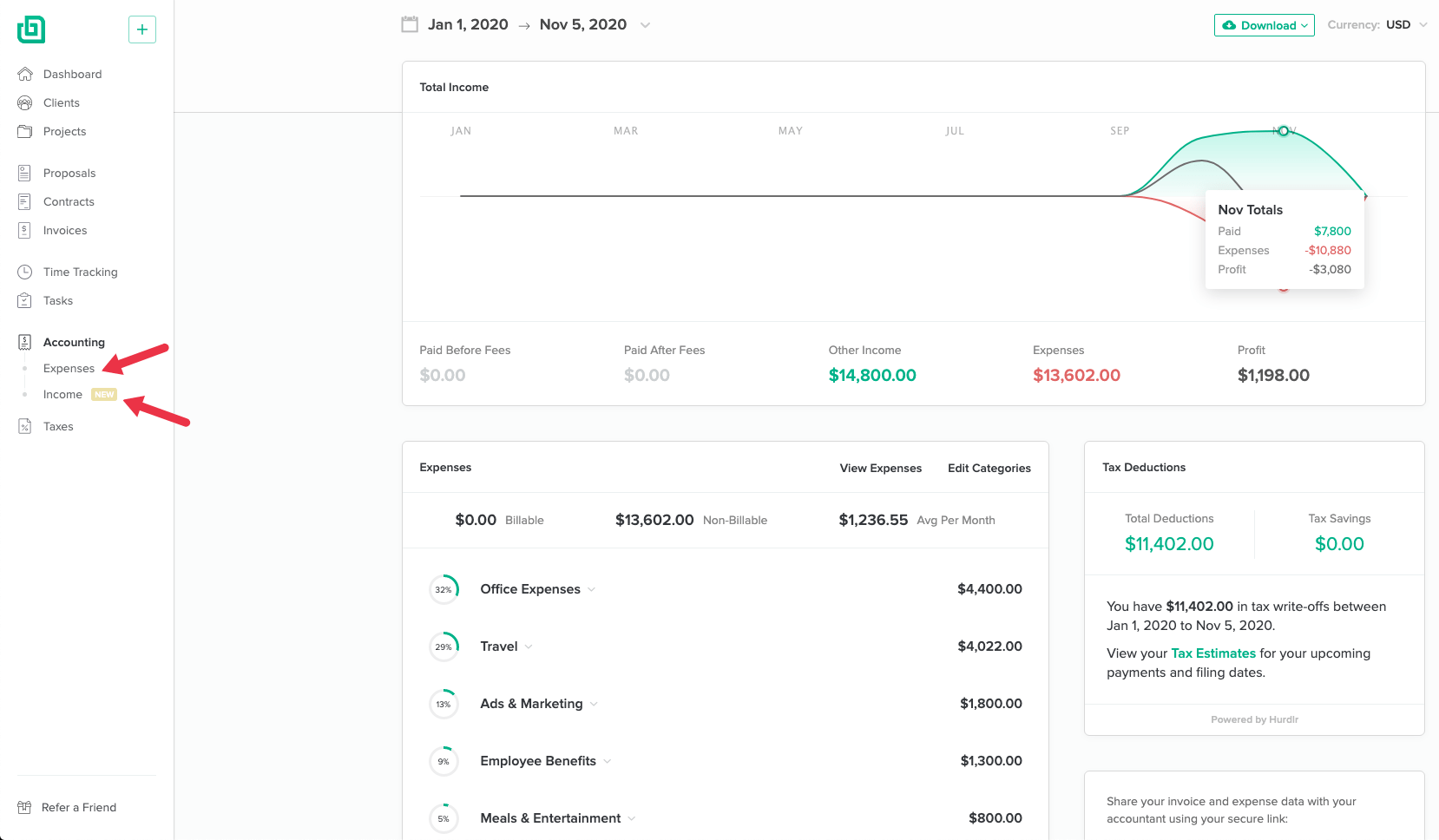

Let's see how that works. First, head to your main Bonsai dashboard and have a close look on the left side - we'll be working with the accounting and taxes sections. First click on "Accounting".

Inside the accounting section, you'll see a breakdown of your income and expenses. Both can either be automatically imported from your bank account, or manually added. Work you got paid for via Bonsai will also be registered here.

Make sure this section is properly filled in and click on "Taxes" next.

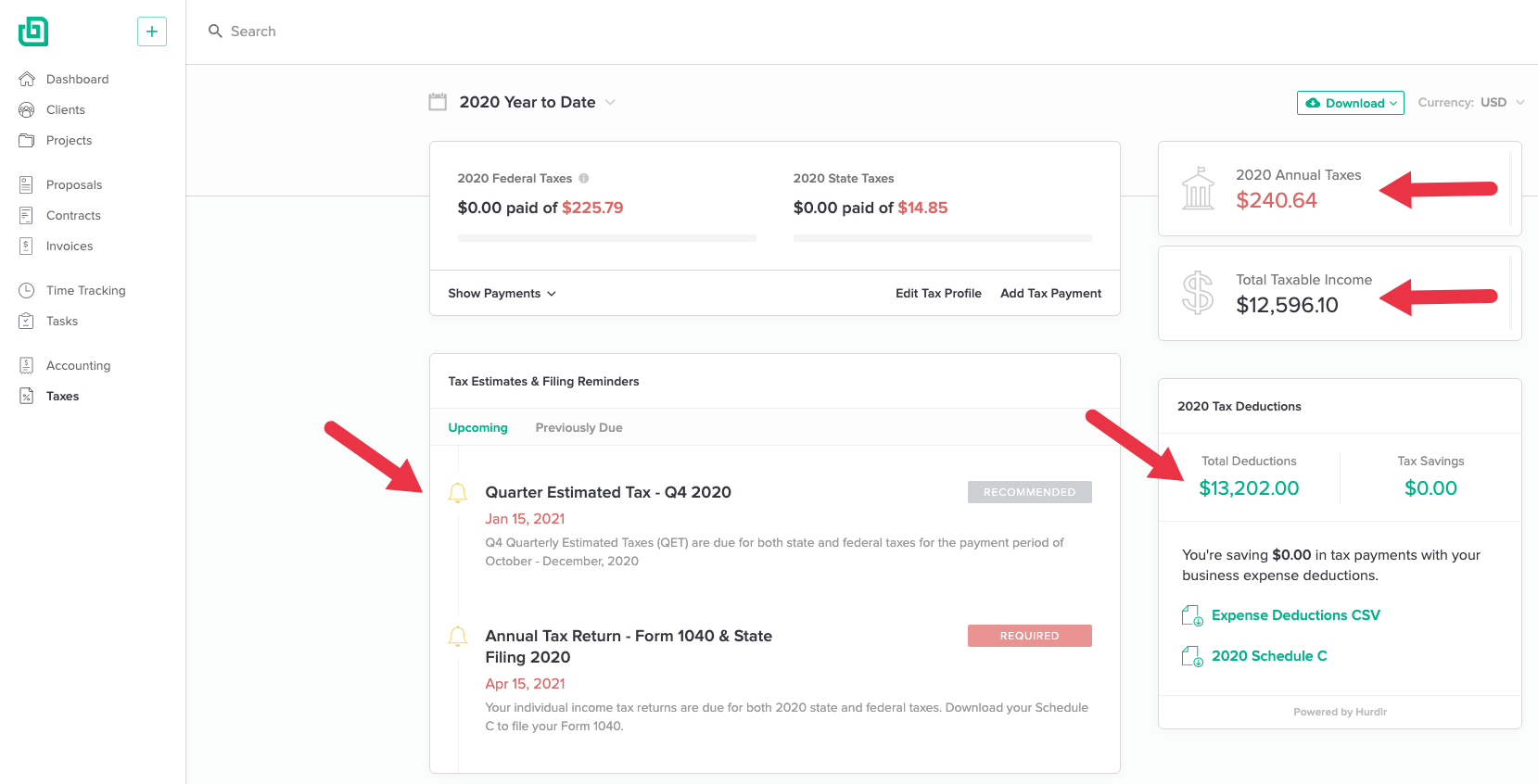

This is where the magic happens: Bonsai tax will do all the calculations for you, and we'll provide you with an overview of your tax estimates, a list of tax deductions you can use for the upcoming tax season, and reminders for all the upcoming filling dates.

Simple, right? If you're ready to check out Bonsai and explore all the features, go ahead and sign up for the free trial!

This section is where you report your business expenses. Lines 8 through 27b allow you to report expenses like Advertising, Commissions and Fees, Legal and Professional Services, Taxes and Licenses, and more. If you have expenses that aren’t reflected in the boxes, you’ll record those later in Part 5, and then record those on line 27a.

In Line 28, you add lines 8 through 27a to determine your total expenses before including any expenses for your business use of your home. Then you subtract line 28 from line 7 to arrive at line 29 which is your tentative or estimated profit or (loss).

Line 30 is dedicated to expenses incurred for using your home as your office or other business space, such as a studio. There are two ways to calculate this:

Using either form 8829, or the Simplified Method Worksheet in the IRS instructions, you will arrive at an amount that is entered on line 30.

You then subtract those expenses (line 30) from your tentative profit (line 29) to arrive at your net profit, if expenses are less than your income. That amount then gets reported on page 1 of Form 1040 or 1040-SR.

If your calculation determines that expenses are more than your income, then the net loss can usually be deducted from your gross income on page 1 of Form 1040 or 1040-SR.

This section is specific to those sole proprietorships that sell goods. If your business falls in this category, you will need information such as the inventory at the beginning and end of the year, costs of labor, materials, supplies and more.

You’ll arrive at Line 42, the cost of goods sold, which is the amount that you insert back in part 1, line 4.

If you’re claiming truck expenses and car deductions in Part 2, this is where you complete the documentation required by the IRS.

That includes:

And more.

Note that if you do use a personal car for your business, you can either take a mile deduction or claim the exact expenses. Either way, you need to have documentation that proves your case.

The final section of Schedule C allows you to list any business expenses that are not included on lines 8-26 in Part 2, Expenses, or on Line 30, business use of your home.

The total of these expenses get recorded in the Expenses section on Line 27a.

With these detailed instructions, you’ll be able to complete Schedule C with the necessary documentation for your small business, along with your personal income tax return.

Schedule C highlights the fact that it’s important for you to keep detailed records all year long, by keeping receipts from clients, expenses for the business, tracking mileage for business use of your vehicle, and determining costs of using your home as your business space.

Armed with this knowledge, tax time should be easier for any freelancer. Now, sign up to a free trial of Bonsai to see how we can put your freelancing on autopilot.

At the end of the tax year, we always recommend you contact a tax professional if you have any questions in regards to your form 1099, the accounting method to use for your tax return, or anything related to paying your self-employment taxes.