One of the best parts of being a freelancer is that you can handle your financial tracking and reconciliation or create invoice templates in any way you want. The downside is that you'll also be managing your self employment taxes and most likely need to file your own income tax return, something that many self-employed business owners don't have a lot of experience dealing with. While you can hire an accountant or tax professional to complete and file your taxes each year (or even each quarter), most of the tax needs of the average freelancer can be handled with many of the small business software products on the market. In fact, most have been updated with freelance-focused topics, and their help sections have extensively addressed the concerns of a typical independent contractor – regardless of your industry. The good news is that it's now easier than ever for anyone with an internet connection to get help and handle their taxes and bookkeeping tasks like a pro.

What should you know before getting started? For one, it’s much easier to do things right from the get-go, rather than try to make sense of many months of and organize tax receipts as well as invoices. Since it can be difficult to determine just what your needs are at first, however, it might be beneficial to try out a few different solutions to see what feels best. While many of the software products on the market offer the same functionalities, the look or feel of an independent contractor app may be all you need to feel at home.

If you’re not currently using software to run the money side of your freelance business, it’s time to get started. Check out our list of the top tools all freelancers should check out when making sure their money matters are in tip-top shape!

Note: If you want to skip the reviews and test drive the #1 freelancer business expense tracker, try a 7-day free trial. Track your deductions, get notified for filing dates and get access to all of the tools in our freelancer tool suite. On average, users save $5,600 from their tax bill.

What Is Tax Software?

The idea behind tax software is simple – it provides accurate tax calculations by guiding you through the filing process for federal and, in many cases, state tax returns. However, the specific things you can do depends on the software you choose. While any software simplifies the tax filing process, you may find that one offers audit support whereas another supports multiple forms and schedules for uploading.

So, you can’t choose any old software and assume it’ll do the job.

For instance, let’s assume you’re a 1099 contractor. In your situation, you’ll ideally have software that helps you to make all of the appropriate deductions based on your work expenses. Plus, you’ll need the software to be able to scan in your 1099 forms – ensuring they meet the current standards for 1099 nonemployee payments in the process – to deliver accurate income reports.

However, a W-2 employee won’t need these features. Instead, they’ll simply use the software to ensure the personal tax returns they file align with the information they see on their W-2. On the other end of the scale, small business owners may need software that helps them handle tax issues related to their employees, as well as the provision of 1099 forms to any contractors they use.

Still, once you’ve found the right software, you should find that it makes filing your returns quicker and easier thanks to the array of navigational tools at your disposal. Use those tools to find the right place to enter your information – some software packages even automatically add that info to your tax returns – and make any relevant deductions.

In addition to their navigational tools, many of these software packages also ask questions as you go through the information-uploading process. Typically, these mirror the questions that an accountant or financial advisor would ask, making the software akin to hiring a professional, though at a much lower cost.

Who Needs to Use Freelance Tax Software?

While any 1099 worker or freelancer can use tax software, it’s especially beneficial for the following groups.

People with Simple Tax Situations

The more complex your tax situation, the higher the likelihood that you’d benefit from working with a tax professional. That’s not to say software is out of the question. However, software that goes beyond offering assists in tracking expenses and income while generating tax returns tends to cost more. Once you start bringing employee taxes into the equation, you need software that can do a lot more, such as a package that integrates with financial software that your company uses.

Thankfully, most 1099 contractors and freelancers tend to have simplistic tax situations. Their income should be stated on the 1099 forms that receive from their clients, meaning their main concern is keeping up with deductions, such as calculating equipment depreciation. Good tax software should make both tasks much simpler.

Those Operating on a Budget

Self-employed workers operating on a tight budget may prefer to use tax software because it’s usually more cost-effective. According to the Bureau of Labor Statistics, the median hourly rate for an accountant is $34.40, with multiple hours usually being required to sift through 1099 forms and your assorted invoices and receipts. The amount you spend on a professional to complete your tax returns could easily be several hundred dollars if you have several clients and a wide range of expenses.

With tax software, you handle the invoice and expense inputs yourself.

That’s a time cost, but you also benefit from lower monetary costs. The software can start from as little as $25, resulting in a huge saving. If you have the time to work with the software yourself – and want to save money as you do – it’s a better choice than working with an accountant.

Self-Employed People Who Desire Confidentiality

By its nature, tax software allows you to store confidential information that should be shielded from the eyes of everybody but those who need to know your company’s financial situation. Even if you don’t handle your taxes yourself, you can use the software as a data store while setting up specific access rights for those who will handle your books.

Secure file transfers and password protection are also offered by these types of software – two more layers of defense that ensure data security.

Before You Get Started With Tax Software

Before you can even begin to think about filing taxes, you'll need proper accounting of every expense and wage you've had for the year (so you can identify all 1099 business expenses that can be deducted from your taxable income). While it's possible to go back through all your bank and credit card statements when taxes are due, it's much easier to plan from day one to keep good records with innovative accounting software solutions. You don't need a degree or even much experience to make these options work for you. Check out or review of the best apps to track receipts for taxes.

See which accounting software are most popular among today's freelance professionals.

1. Bonsai tax

What list would be complete without our own service included? Designed to be the all-in-one 1099 expense tracker, Bonsai lets you import all your expenses and keep track of everything. No need to switch from what platform to the others, login to your Bonsai account and keep track of all your proposals, contracts, revenues, and expenses!

Did you know that you can use Bonsai for accounting? Or that Bonsai can help you be prepared for your taxes by providing tax estimates, filling date reminders, identifying and tracking your tax write-offs?

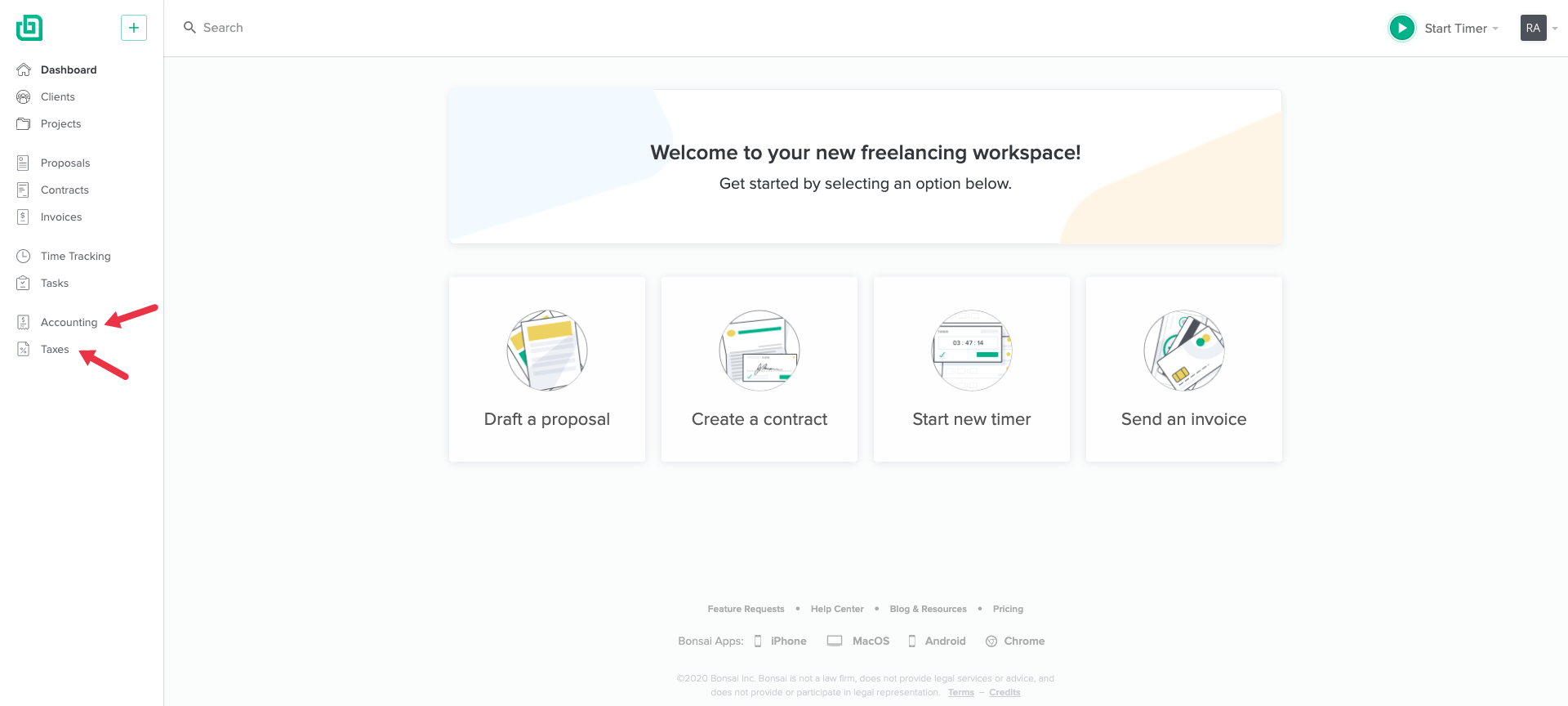

Let's see how that works. First, head to your main Bonsai dashboard and have a close look on the left side - we'll be working with the accounting and taxes sections. First click on "Accounting".

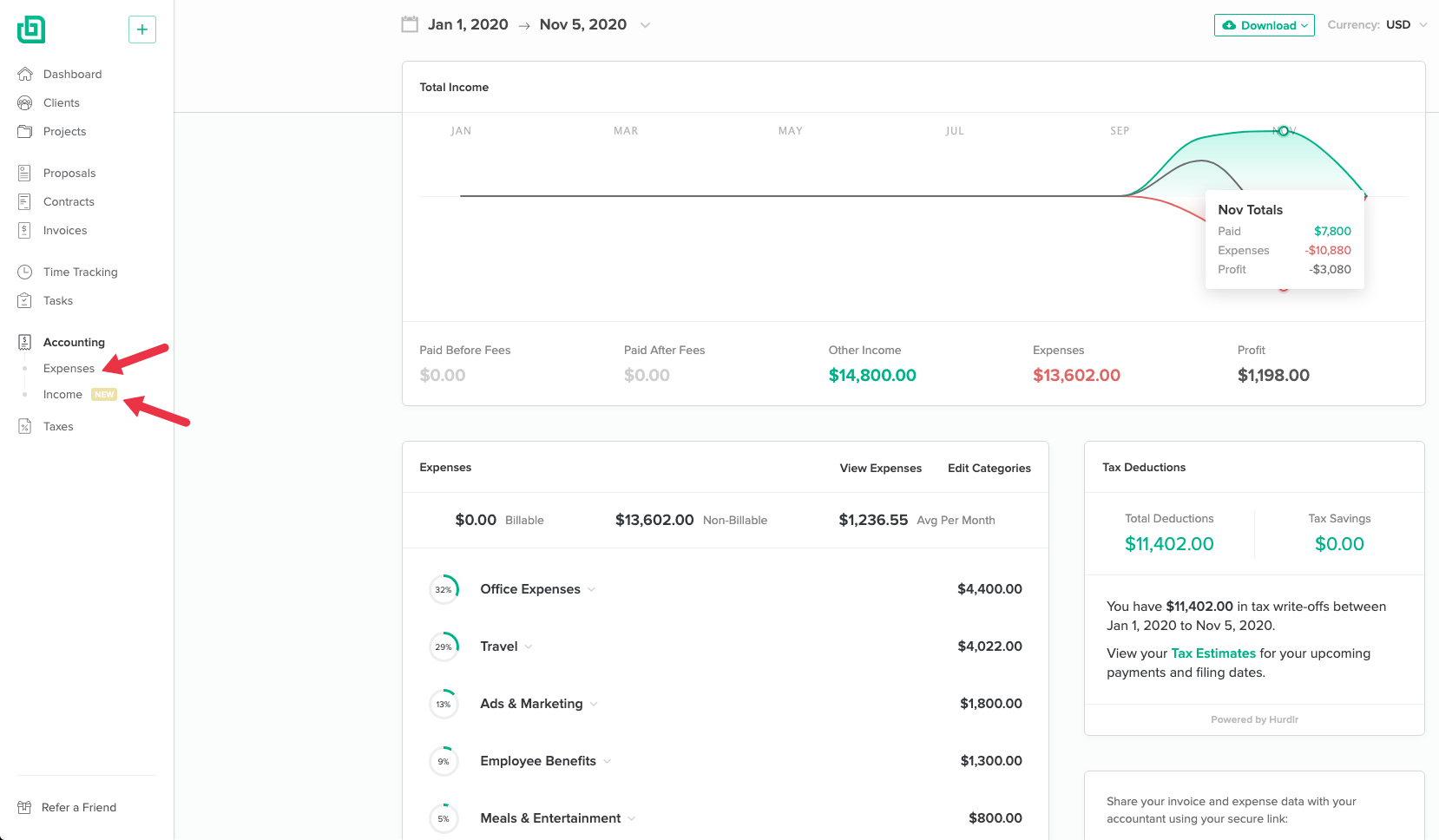

Inside the accounting section, you'll see a breakdown of your income and expenses. Both can either be automatically imported from your bank account, or manually added. Work you got paid for via Bonsai will also be registered here.

Make sure this section is properly filled in and click on "Taxes" next.

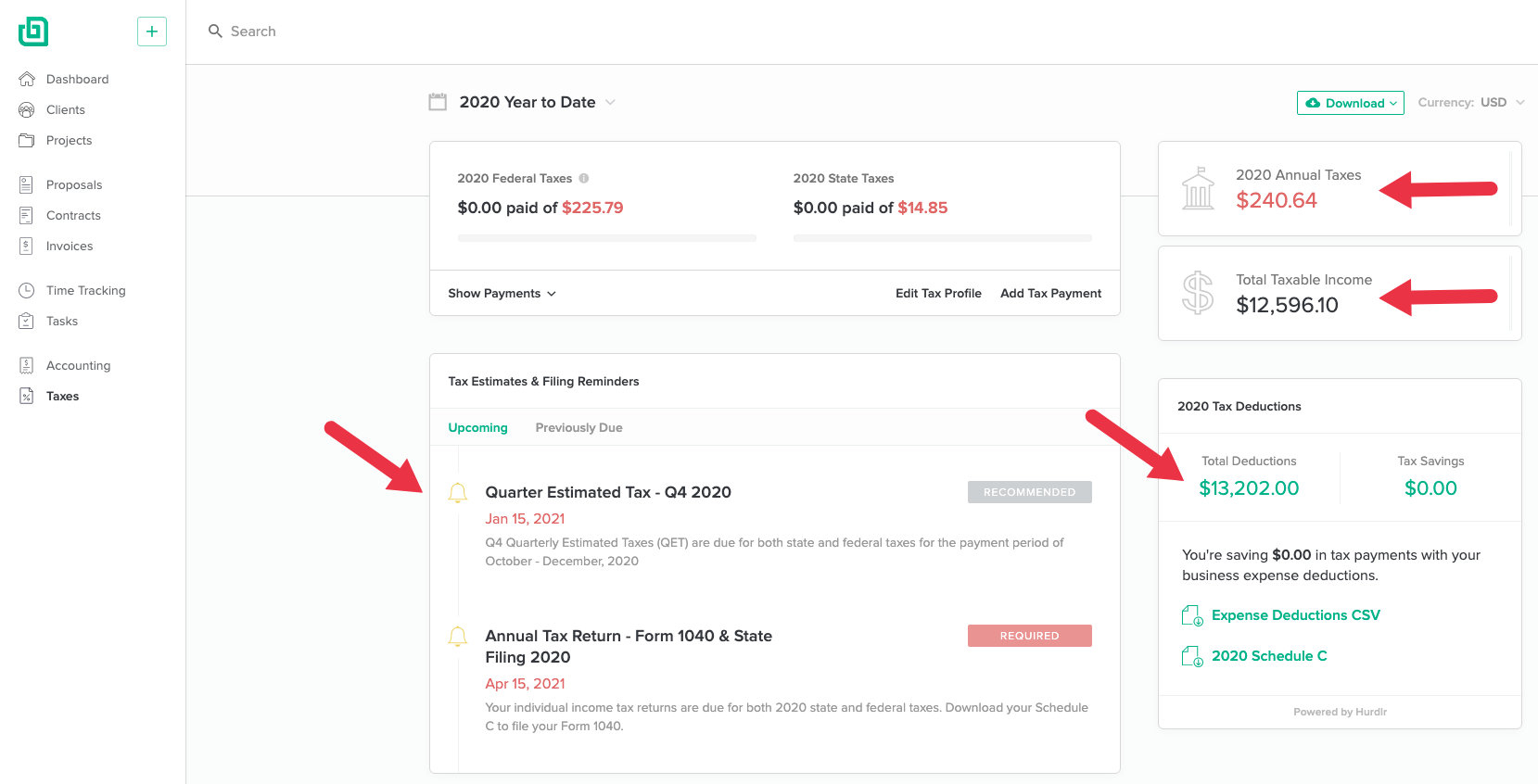

This is where the magic happens: Bonsai will do all the calculations for you, and we'll provide you with an overview of your tax estimates, a list of tax deductions you can use for the upcoming tax season, and reminders for all the upcoming filling dates. Not to mention, with its online storage, it doesn't matter how long to keep receipts for an IRS audit because you can access them whenever.

Simple, right? If you're ready to check out Bonsai and explore all the features, go ahead and sign up for the free trial!

2. GoDaddy Bookkeeping

Formerly Outright, this is among the most popular tools for independent contractors. An all-in-one time tracking, billing, invoicing, and reporting tool, the GoDaddy Bookkeeping web-based service makes it easy to go from finished client project to Schedule C. It can also tell freelancers at a glance where they stand for the quarter with taxes owed. At a price of less than $12 a month, its recurring subscription model fits most budgets.

The software operates on three payment tiers, starting with “Get Paid.” At $4.99 per month, this allows you to automatically create and send invoices, as well as accept payments via debit and credit cards using your mobile device. It can even track mileage – useful for your deductions – and generate several types of business reports.

Upgrading to the “Essentials” tier, which costs $9.99 per month, nets you everything in the “Get Paid” tier, plus some much-needed tax help. You get some helpful tax worksheets, with the Schedule C sheet being most useful to 1099 contractors. Plus, this tier allows the automatic importing of card-based transactions, both debit and credit cards, as well as sales data from major ecommerce platforms, including Amazon and eBay.

Finally, there’s the “Premium” tier, which costs $14.99 per month and provides support for recurring invoices on top of everything in the other two tiers. For freelancers, the “Essentials” tier is often enough to help them through their taxes.

3. QuickBooks

Preferred by over 4 million business owners worldwide, Intuit’s QuickBooks software can be used by freelancers for as little as $5 per month. The beautiful interface and integration with most major banks, as well as tools like Shopify and PayPal. It’s also easy to keep track of expenses on the go with their mobile “photo” feature that allows for digital tracking and categorizing. Even the most basic plans use the same proprietary tech that is loved by professional bookkeepers using the more advanced plans. Take a peek at our other alternatives to QuickBooks self-employed.

4. FreshBooks

This cloud-based accounting solution for business owners has earned the praises of notable entrepreneurs such as Pat Flynn and Roman Mars. Designed to help busy freelancers save hours of time each year, FreshBooks is a mobile-friendly solution that boasts 4 million active users. It's powerful enough for big agencies but available as a more modestly-priced freelance plan; pay just $15 for the lite plan after a 30-day free trial. Check out our list of alternative accounting software.

5. Wave Accounting

Not sure that paying for a monthly plan is for you? The unique difference with Wave is that you pay as you go. No monthly minimums are needed for this cutting-edge billing, invoicing, receipt-scanning, and expense-tracking tool.

Invoicing is the app’s bread and butter, as it allows you to manage an unlimited number of invoices, all with customizable payment terms and templates. There’s even a Wave app – perfect for managing invoices when you’re on the go. Combine that with the ability to add as many users to your Wave account as you like – each with their own access rights – and it’s a tax software that can scale alongside your business.

There are drawbacks, though. The software provides no audit trail, meaning it may not be useful if the IRS comes calling and you need to create an audit defense. Plus, the base version of the software offers no integrations with third-party apps, meaning you have to port any data you currently have over to Wave manually.

Still, the software is a great choice for the budget-conscious because Wave makes its money by processing all major credit cards used to get you paid. If you don’t process any payments in a month – you pay nothing! Check out our list of Wave alternatives.

6. TurboTax

Owned by financial products powerhouse Intuit, TurboTax is one of the most popular and reliable tax products on the market today. Available as a download or CD, many freelancers also opt for their online web service, which lets you fill out your taxes and see what you’ll owe (or get back) before you commit to filing.

You only pay if you file, and the cost for the federal return product is between $89 – 120. State returns are extra, typically requiring you to pay for a “Deluxe” package that costs $69 upfront, plus $59 for each state in which you need to file. (Note: If you choose the CD or downloadable option, it’s easy to import last year’s info for even speedier filing.)

Still, you can’t argue with the level of guidance it provides as you work through the software. TurboTax works using a chat-like interface, which facilitates easy data import/export, as well as helping you with “real-time” advice based on whether you’ve donated to charity, have dependents, and a variety of other tax situations. It’s also one of the few tax software programs that offers crypto support – perfect for the non-traditional contractor or freelancer.

7. H&R Block

Made famous by their brick-and-mortar shops, freelancers can now use H&R Block’s trusted tax services from the comfort of their own home. The Self-Employed version of their online software starts at $75, plus extra for state returns and optional review of your return from a tax professional. In addition to containing all the forms a freelancer would need (such as Schedule C), there is a unique transfer function to help Uber drivers and any businesses who use Stride in transferring information from their work records directly to their tax forms.

It’s intuitive, too.

Navigation is clear since it offers a user-friendly interface that quickly points you in the direction of whatever forms you need for your particular tax circumstances. There’s also context-sensitive help – you get tips and guidance in real-time as you navigate – and a useful resource section that goes into detail on an array of tax advice. You can also get help from a tax expert, at a price, if you’re not sure about the state of your taxes.

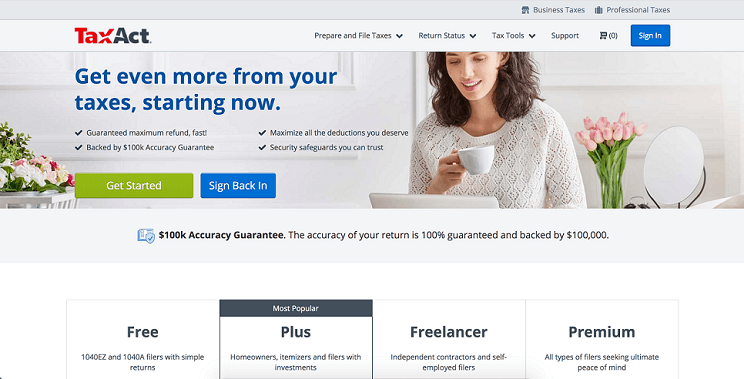

8. TaxAct

Known for its free filing option for the simplest of returns, TaxAct now has a suitable software option for freelancers. For less than $45 (the cheapest in the industry), independent contractors can maximize deductions and file the forms for free – with an additional charge for state forms.

The downside comes when you look into how it provides customer support. In short – it doesn’t. Or, at least, there’s no live chat or integrated support features, meaning you’re left to your own devices when compiling your tax return. That’s fine for people who have worked with 1099s and federal tax returns before and already know what they’re doing. But if you’re new to self-employment, you may prefer software that holds your hand a little more than TaxAct.

But we’ll keep returning to the fact that its base version is free to use and less restrictive than most other free software packages. It helps you to claim various tax credits – including child tax credits and earned income tax credits – and supports various types of filings. However, you can’t itemize your deductions with the free version (it only supports the standard deduction), meaning you have to upgrade to the “Deluxe” version for itemization.

Choose to download the software or use the program online.

9. TaxSlayer

Overlook the gimmicky name and you’ll soon see that TaxSlayer is a solid option because of its versatility and unique pricing structure. Rather than charging based on features – which leads to a frustrating game of trying to figure out how much you have to pay to unlock what you need – TaxSlayer charges based on support. That means you get access to every feature it has out of the box, only paying more if you need guidance from a tax expert or, sadly, if you’re self-employed.

For those who know their way around a 1040 form, TaxSlayer generates tax reports for federal tax returns and one state return for free. But there’s a catch. Despite its support-based payment system, the free version has limits. Your taxable income has to be below $100,000 and you don’t get the option to itemize.

Upgrading to the “Classic” tier – which costs $34.95 for federal returns plus $39.95 for every state filing – unlocks the whole thing. It’s there that you’ll find that TaxSlayer supports multiple forms and schedules, along with deductions. But herein we see a problem. TaxSlayer has a special tier for self-employed people that unlocks access to Schedule C and 1099 compatibility. That tier costs $64.95 for your federal filing, plus the standard $39.95 charge for each state.

The end result is software that’s great for the average W-2 employee but comes with strings attached for self-employed filers.

10. FreeTaxUSA

Simple, slick, and free – those are the three words that best describe FreeTaxUSA. It lives up to its moniker by providing you with the ability to e-file your federal tax return for free, though there are paid bolt-ons for other filings. For instance, each state return costs an additional $15 – still reasonable – and you have to pay another $8 if you want live chat and assistance with audits. But even those bolt-ons are reasonably priced considering the versatility on offer.

Contractors and freelancers who accept payments in cryptocurrency are catered for here, as are those who maintain rental properties. You can also enter as many 1099 forms as needed for your tax return, with the only downside being the lack of importing options. So, the software is best for contractors who have enough time to handle the manual data entry portion.

The resource center is detailed, though sparse on graphics. You’ll also find that FreeTaxUSA supports Form 1099-LTC – a rarity for free software. The only reason not to try it – outside of it being less intuitive than other options in this list – is that the software doesn’t allow you to handle any foreign employment income.

What Should You Look for in a Tax Software Program?

While there are eight solid options on this list, there are tons more tax software programs available to the self-employed for you to sift through. That sheer volume can leave you feeling overwhelmed – which software should you choose for your business?

The following are “must-haves” for any software that a 1099 contractor considers:

- 1099 Form Support – It sounds obvious, but support for 1099 forms isn’t a given with all types of tax software. Many don’t offer it as standard, typically requiring you to upgrade to a more expensive package to upload your forms. Keep an eye out for that – you don’t want to pay for software only to find you have to pay more for the features you need.

- Itemized Deductions – Similar to 1099 form support, not all tax software packages allow filers to itemize their deductions. Instead, they’ll default to the standard deduction and may charge you higher fees if you want to deduct mileage or other business-related costs. Again, check the feature list for each software’s payment tiers.

- Support – The level of support you’ll need depends on your familiarity with the self-employed tax process. If you’ve done it all before – successfully – you can opt for a barebones and cheaper software that simply gives you the tools to create your tax return. But if you’re new to filing taxes as a self-employed contractor or freelancer, dig into the software’s support options. Ideally, you’ll find live chat or similar connections to professionals who can guide you if needed.

What’s the Best Way to File Taxes if You’re an Independent Contractor?

The challenge you’ll face as an independent contractor is two-fold.

First, you have to file Schedule C alongside your standard tax return. Doing that means maintaining all of the 1099 forms you receive during the year, as well as itemizing all potential business deductions to see if it’s worth claiming those rather than the standard deduction. So, there’s more admin work.

The second issue is that you have to pay self-employment taxes, which generally cover the Social Security and Medicare taxes you’d have deducted from your check as a W-2 employee. They total 15.3% of your income, though you can at least deduct half of the payment. You file for these with Schedule SE.

Knowing that independent contractors face these issues, the best way to file is usually by using some form of tax software. Not only do they give you access to the relevant forms, but you’ll get what essentially acts as a central storage for all of the information that’s relevant to your year’s tax returns.

When Are Tax Payments Due for the 2026 Tax Year for Independent Contractor Filers?

Self-employed tax filers need to get their final income tax forms submitted to the IRS by April 15, 2026, to stay within the IRS’s deadlines. It’s possible to apply for an extension – adding six months to the deadline – for extenuating circumstances, though there’s no guarantee the IRS will grant it and you have to at least submit that extension request by April 15.

If you do need an extension, you have to file Form 4868, though you’ll only have reasonable cause for an extension if you’ve paid at least 90% of your total tax owed by the April 15 deadline and you pay the remaining balance by October 15, 2026.

However, there’s a twist for independent contractors. They also have to make estimated tax payments four times per year – once per quarter – based on the income they’ve received for each of those quarter periods. So, you’ll pay throughout the year, but will file (and handle any discrepancies) by April 15, 2026.

How Can You File Your Taxes for Free as an Independent Contractor?

If you’ve earned $73,000 or less during the year, you may be able to file your taxes for free using the IRS’s Free File service, which opens up every January. The service is essentially tax software, as it guides you through the process and may even help you with some state filings. All of the forms are available to contractors who earn more than $73,000, too. You just lose out on the tax preparation support and have to file the forms yourself.

Other than that, some of the tax software packages on our list – such as FreeTaxUSA – offer free filing with a little more support.

Can You Deduct Your Independent Contractor Taxes From Your Tax Returns?

You may be able to deduct a portion of the self-employment tax mentioned previously from your federal tax return. The exact amount varies – though it can go up to 50% - and is usually calculated by working out the employer-equivalent payment that would be made if you were a W-2 employee.

What Business Deductions Can I Claim as a Freelancer?

The IRS divides the deductions you can claim into two general categories – “ordinary” and “necessary.”

Ordinary expenses are any that somebody working in your field would be expected to incur as part of their work, such as fuel if you run a taxi service. A necessary expense may not be one that you’d ordinarily incur, but it’s one that’s required to complete a job. For example, a software developer may need to invest in a certain program to complete a project for a client.

Check out the best 1099 deductions you can make to get started, and use Bonsai’s self-employment calculator to work out if it’s best to claim those deductions or the IRS’s standard deduction.

How Much Should an Independent Contractor Put Aside for Taxes?

Best practice is to set aside between 30 and 35% of your self-employed income, which should be enough to cover your federal and state taxes, along with self-employment tax. And if you don’t need all of that money after you’ve made deductions, you at least have a nice little bonus to pay yourself at the end of the tax year.

How Your Business Benefits From Using Tax Software

Finally, the big question – is it worth paying for tax preparation software in the first place when you’re a contractor or freelancer? If any of the following benefits matter to you, then the answer is likely yes:

- Automated record keeping, imports, and exports

- Central storage for all documents relevant to your filing

- Built-in resources and, in some cases, live chat help when filing

- Filing may be handled for you through the software

- Lower costs than hiring a tax expert to handle the filing

- Fewer errors made as the software may catch duplicate deductions and similar issues

In short, tax software makes the filing process simpler because it streamlines the work based on the resources it provides. The key is simple – find the right software that suits your specific circumstances as a contractor or freelancer.

Save time by using Bonsai

It takes both pieces – accounting and tax filing – to ensure a stable financial footing for independent contractors. Even if this is your first year handling taxes on your own, it can be made much simpler with the right tool. Whether you choose to use a mobile app, online program, or downloadable software, the features of today's tax and accounting products are intuitive enough for almost every freelance business need. Save money by doing your accounting and filing and put the extra toward investment in your freelance career!

Start tracking your expenses, identifying tax deductions, and estimating your quarterly taxes with Bonsai by signing up for a free trial today.