There are a lot of administrative tasks to manage when you run your own business, such as creating invoice templates, drafting and signing agreement templates, or crafting winning scope of work templates and quotation templates. Unfortunately, filing self employment taxes as a freelancer is also one of those tasks.

And paying taxes is a big one.

Let’s say you’ve determined that you are in fact a freelance business, that you earn enough income to result in the need to claim that income. Now you need to know how to do taxes as a freelancer. By law, you need to file taxes. Hopefully, you’ve tracked your business expenses along with your income and self-employed tax deductions throughout the year.

Now it’s time to actually file the taxes. And filing taxes now includes income tax and self-employment taxes. It’s a lot to figure out.

Note: if you would like an all-in-one solution to make your freelancer taxes a breeze, try Bonsai Tax. We can help you record all of your tax deductions, remind you of filing deadlines, estimate quarterly taxes, and much more. Claim your 14 day free trial here.

So it’s time to understand the 5 things you must know about filing taxes as a freelancer.

1. Keep track of all the forms, income and expenses

If your business earns $400 or more in a year, you’ll be filing taxes for freelance work, and you’ll be paying income tax and self-employment tax. It is vitally important to know how much to set aside for 1099 taxes. It might be smart to have a savings account you dedicate to set aside money and pay taxes for.

It doesn’t matter what your expenses are, the threshold is $400 of income.

It also doesn’t matter if you are a full-time employee who freelances on the side. You’ll have to learn how to file taxes as a freelancer.

IRS 1099 Tax Forms

So the first thing you need to do before filing taxes for freelance work is to ensure you have complete records. When you’re an employee, that’s easy enough to do. You’ll get a single W-2 form and that’s what you would include with your tax return. Plus, you'll usually get a tax refund at the end of the year. But when you’re filing taxes as a freelancer, you’ll need to ensure you get a 1099-MISC or 1099-NEC form from each client that has paid you more than $600. Prior to 2020, non-employee compensation was reported on a 1099-MISC. Now, the form has been replaced by a Form 1099-NEC. As for how to report freelance income without a 1099, you still need to do it!

Keeping Track Deductible Expenses

Freelancers must record all income, including that income for which you don’t get a 1099--including cash income. And if none of your clients paid you more than $600, but your annual income was still over $400, you have to file taxes without 1099 forms. Your clients will also request that you complete a W-9 form, which is how they record your name, address, and Taxpayer Identification Number (TIN). This is the information they use when it’s time to complete the 1099. You’ll also need to track all of your 1099 expenses, as this information will be important when it comes time to figure out how to file taxes as a freelancer.

If you need a free tool to track income and expenses, try our free self-employed ledger.

Lower Your Tax Bill With Write-offs

Here is a list of 1099 deductions to claim during the tax year:

- business meals

- office supplies

- home office

- vehicle expenses or mileage

- travel expenses

- cell phone expenses

- insurance

- fees

We recommend you consult with a tax professional to discuss how to lower your tax bill. You could also try our tax software for freelancers. Our app automatically scans your bank/credit card statements to discover tax write-offs and maximize savings.

And when you’re ready to actually handle filing taxes, the Internal Revenue Service (IRS) is the federal agency to which you do the filing. With all these forms and other information to track, you can understand why record keeping is so important when it comes to filing taxes for independent small businesses.

Did you know that you can use Bonsai for bookkeeping? Or that Bonsai can help you be prepared for self-employment tax by providing tax estimates, filling date reminders, and identifying your tax write-offs?

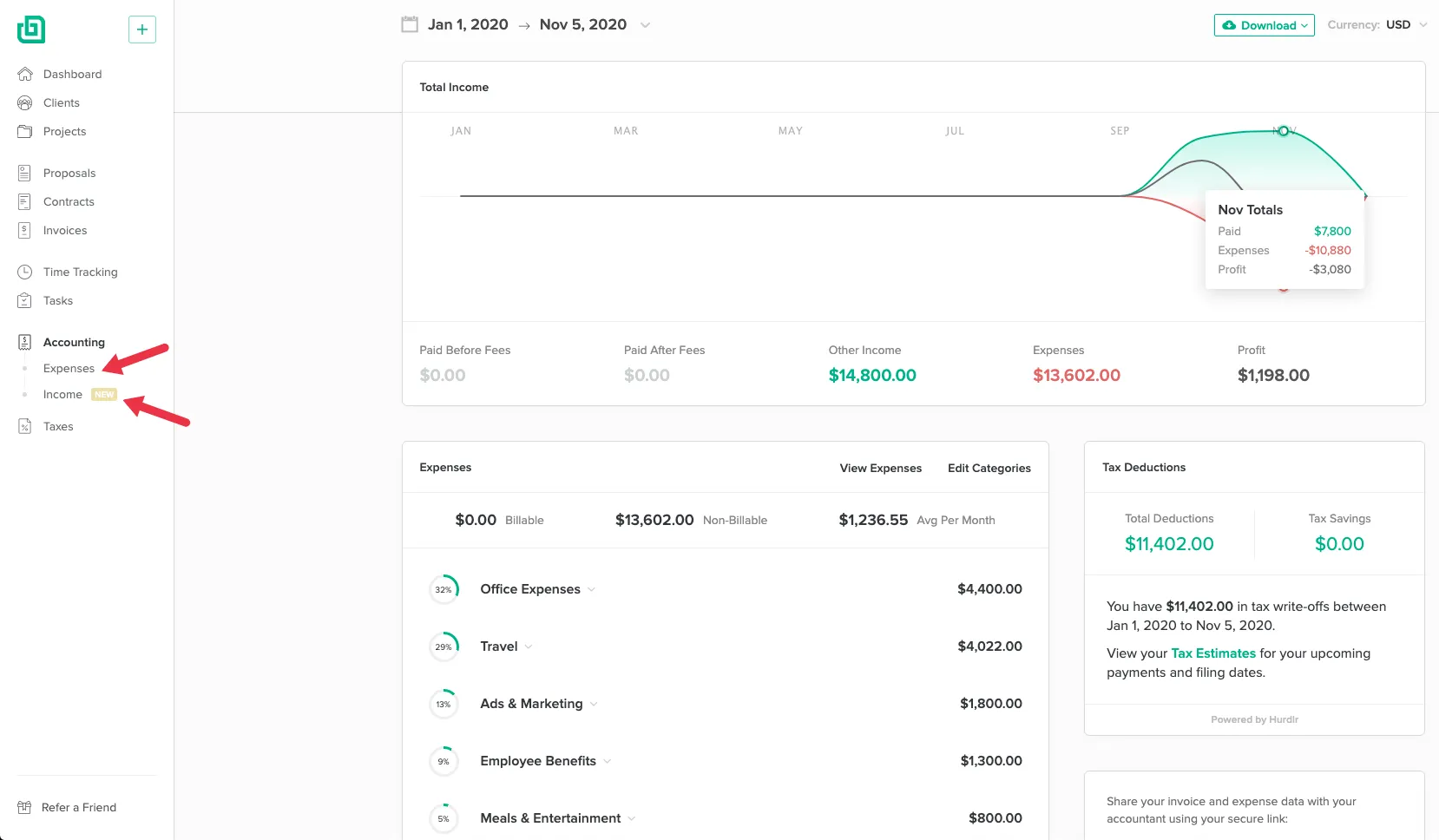

Let's see how that works. First, head to your main Bonsai dashboard and have a close look on the left side - we'll be working with the accounting and taxes sections. First click on "Accounting".

Inside the accounting section, you'll see a breakdown of your freelance income and business expenses. Both can either be automatically imported from your bank account, or manually added. Work you got paid for via Bonsai will also be registered here.

Make sure this section is properly filled in and click on "Taxes" next.

This is where the magic happens: Bonsai will do all the calculations for you, and we'll provide you with an overview of your tax estimates or how much you should expect to owe, a list of tax deductions you can use for the upcoming tax season, and reminders for all the upcoming filling dates. You'll add these deductions to your Schedule C.

Simple, right? If you're ready to check out Bonsai and explore all the features, go ahead and sign up for the free trial!

2. Pay the self-employment tax (Social Security and Medicare taxes)

One of the biggest learning curves when figuring out how to file taxes for freelance work is that you have to pay self-employment tax.

In fact, it will surprise you when you realize you’re paying more than you did as an employee, and that’s because you have to pay all of your Social Security and Medicare deductions. You no longer have an employer to share those costs and you are responsible for paying all of it.

The current self-employment tax rate in the U.S. is 15.3%; it’s divided into an amount of 12.4% for Social Security and 2.9% for Medicare. Social Security is applied to the first $133,000 in earnings, and the Medicare portion is applied no matter how much you earn. Earnings are defined as both freelance income and any money you make as an employee.

In terms of the actual tax paperwork, the self-employment tax is calculated on Schedule SE (the rate you'll need to pay) and then reported on the “Other Taxes” section of Form 1040. As a freelancer, you pay both sides of your self-employment taxes on Form SE; you will get a deduction for half of these taxes on the front of the 1040.

SE tax, or self-employment/ Social Security and Medicare tax, is therefore kept separate from income tax.

To help with those, you could use a professional service like Bonsai, which has integrated services developed specifically for freelancers or independent contractors, including a product focused on freelance taxes. Bonsai tax can provide estimates by looking at incomes, expenses, and deductions from a linked bank account, and all you have to do is complete the forms. Sign up for a free trial of Bonsai now, to help ease the burden of filing taxes as a freelancer.

3. Pay quarterly estimated taxes

On top of handling your Social Security and Medicare taxes, another key part is to calculate and pay estimated taxes throughout the year, on a quarterly basis.

To pay estimated taxes, you use what’s known as form 1040-ES. Paying quarterly will ensure you are up to date with income taxes. It also reduces any chance that you face a penalty or additional taxes, because if you don't make estimated tax payments that are due, you may be subject to an IRS penalty come tax time. There's no need to pay more money to the IRS than you need to.

Since your income is completely untaxed, you have to figure out how much tax you owe on that income and make quarterly estimated tax payments. Tax rates can vary by state and income bracket.

The IRS, where you file your taxes, has a handy tool known as a Tax Withholding Estimator, that can help you figure out what you owe. It’s particularly useful for those who are employees as well as freelancers.

You can use the tool to enter self-employment income as well as wages, and it calculates the self-employment tax, estimated tax and the self-employment tax deduction, to provide an overall tax liability estimate. You’ll also find out if you qualify for any tax benefits.

You can also use an online tool like Bonsai tax to calculate the estimated taxes of what you owe for freelance taxes, whether you’re learning how to file taxes as a freelance writer, freelance artist or freelance photographer.

4. Know your dates to file estimated taxes

When it comes to filing taxes as a freelancer, you need to keep track of important dates. Let’s say you’re planning for the coming year, and you want to know what to add to your calendar.

When You Need To Pay Your Taxes Every Quarter

Your quarterly payments to the IRS will be due on the following dates in 2023:

- April 15, 2023

- June 15, 2023

- September 15, 2023

- January 15, 2025

And even though you handle this filing quarterly, you still have to ensure you file your annual tax return by April 15 every year. If you need more time to file, you can always request an extension.

5. Stay up to date on possible changes to filing taxes

Rules around how to file taxes as a freelancer don’t stay the same forever. So it’s a good idea to stay on top of any news about tax changes or impending tax changes.

After all, there are almost always tax reforms being discussed, and some of those could benefit your business if they become law.

Final thoughts

One of the most important skills to learn when you start your own business is how to file taxes for freelance work. That’s true whether you’re learning how to file taxes as a freelance writer, how to file taxes as a freelance artist, or how to file taxes for one of the many other types of gig economy jobs.

Understanding our 5 key things you must know about filing taxes as a freelancer will help set you on the path to gathering the right information, and figuring out the important steps how to file taxes as a freelancer. If you have any questions about your income tax return or quarterly tax payments, we advise you to speak with a tax professional

As freelancer CJ Haughey says, “Naturally, it takes a little time to get acquainted with managing your own taxes and filing returns.” But you can do it!

An Easy Solution For Self-employed Freelancers

To ease the stress of knowing all the steps to filing taxes, consider the option of the integrated tools available to you as part of Bonsai’s freelance suite by signing up for a free trial now - start with expense tracking, identify tax deductions, and estimate quarterly taxes.