There is no doubt that cash flow forecast templates are vital tools for businesses. Usually, it aids in the cash flow forecasting process by providing a structure for projecting future cash inflows as well as outflows.

The obvious thing is these templates can detail daily cash forecasting or offer a broader view through a monthly cash flow forecast.

It is important to highlight that these templates typically include a forecasting model.

Introduction to cash flow forecast templates

It is well known that a cash flow forecast template provides a structured way of assessing financial inflows (cash inflow) and outflows (cash outflow) that offers detailed insights into the future financial health of a business.

The cool thing about these templates is they enable accurate cash flow projections. This makes the cash flow forecasting process as easy as pie!

What is a cash flow forecast template?

It's a matter of fact that a Cash Flow Forecast Template is a tool that helps businesses sketch their financial future. Consequently, it reflects cash flow categories such as cash receipts along with payments.

What’s fascinating is this forecasting model outlines potential cash inflows and outflows too.

Why is cash flow forecasting important for agencies?

Notably, cash flow forecasting is crucial for agencies as it helps them manage cash outflows and inflows. It’s just astounding how this aids in making informed cash-planning decisions!

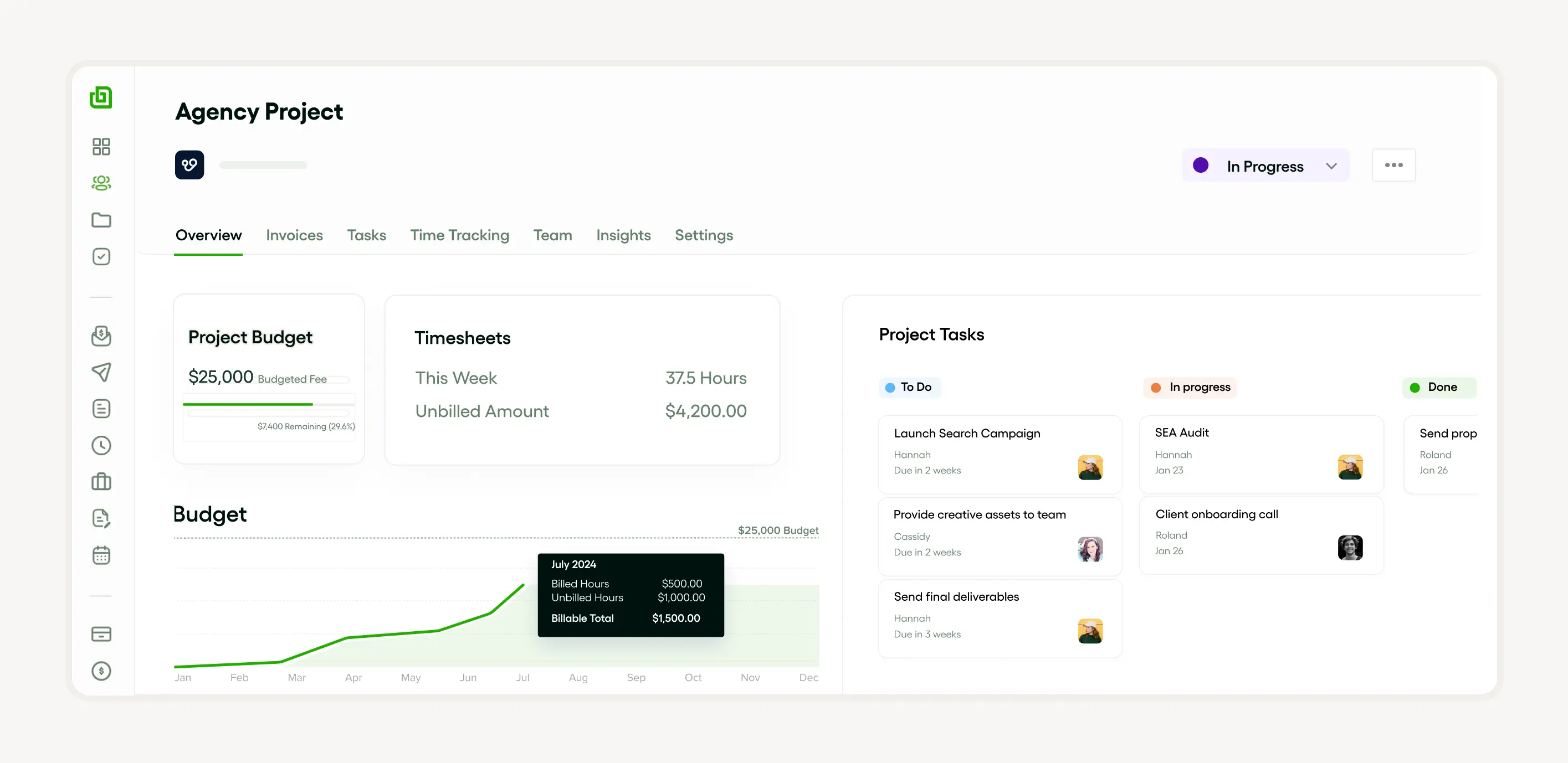

Using Bonsai software offers numerous benefits for simplifying business operations and managing tasks effectively. Bonsai is a comprehensive business management software that offers a suite of tools for project management, client management, and financial management.

A project profitability forecast report in Bonsai provides a forward-looking analysis of a project's financial health. It includes projected revenues, estimated costs, and expected profit margins. The report leverages Bonsai's insights to predict future profitability, considering variables like labor costs, billable rates, and expenses.

It helps managers anticipate financial outcomes, adjust strategies, and make informed decisions to ensure the project remains profitable. By analyzing trends and performance data, Bonsai's forecast report is an essential tool for proactive financial planning and maintaining a project's fiscal integrity.

Typically, the forecasting model will take into account different cash flow categories, offering a comprehensive view of financial health.

It is beyond dispute that a robust cash flow forecasting process allows agencies to better control their daily cash forecasting. The cool thing is this can prevent any potential cash flow issues.

Key components of a cash flow forecast template

It's interesting to note that the key elements of this template include the cash flow categories that detail cash receipts together with cash payment lines.

Certainly, the foundation of the forecasting model is either daily cash forecasting or monthly cash flow forecast or both. What’s worth mentioning is that these forecasts contribute to more accurate cash flow projections.

Understanding income and expense categories

It’s an undeniable truth that income and expense categories are vital components of the cash flow forecasting process. Commonly, they are primarily determined by cash inflows (income), comprising elements like:-

- Cash receipts from sales

- Cash outflows (expenses), such as cash payments for goods or operational costs

One thing is for sure: These categories are crucial for constructing a viable cash flow projection along with guiding the business in its cash-planning decisions.

It's significant to note that the interplay between these categories shapes the forecasting model.

The role of time periods in forecasting

It is commonly accepted that time periods play an essential role in cash flow forecasting. Obviously, it affects the accuracy of cash flow projection and the overall forecasting model. Shorter time periods like daily cash forecasting allow for more precision, but they require more detailed information on cash receipts.

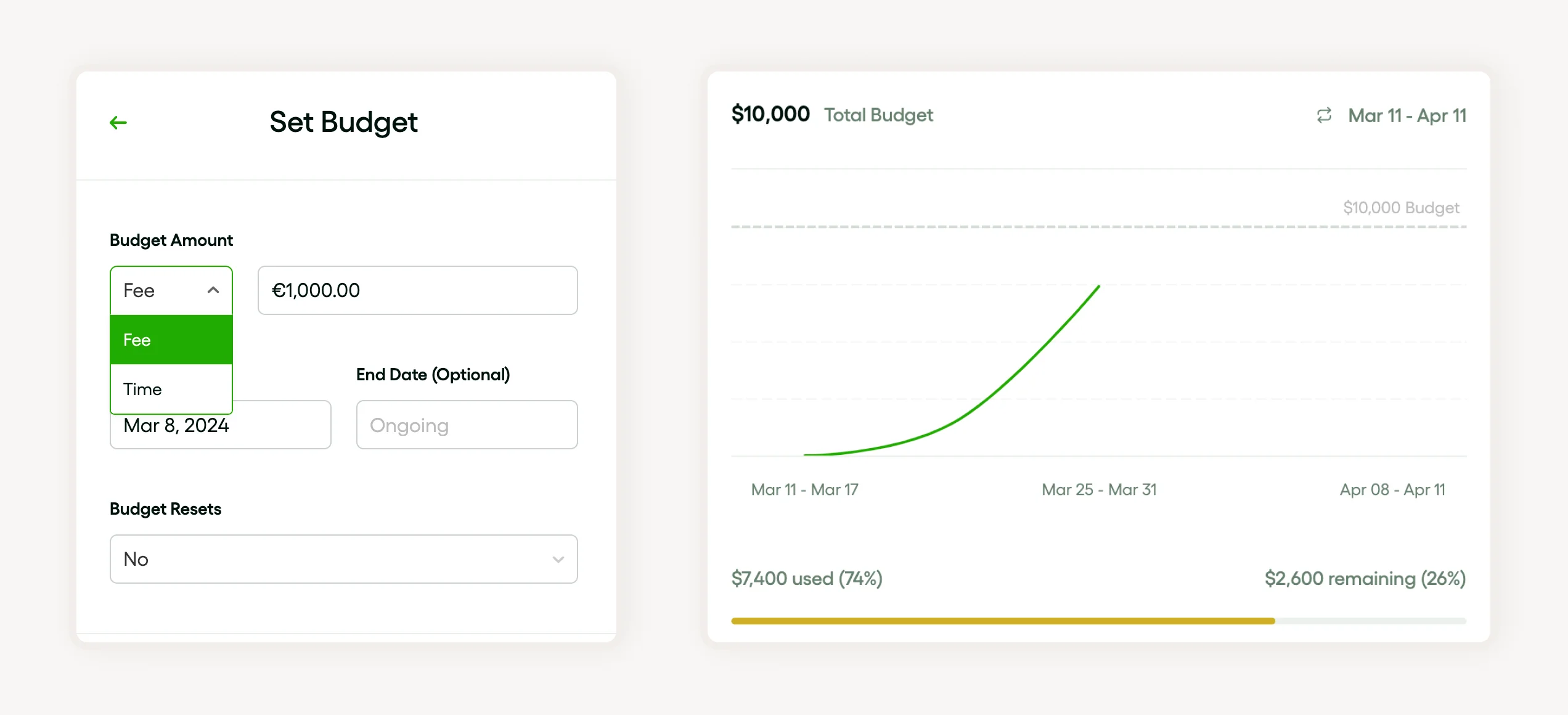

The role of time periods in forecasting within Bonsai for setting budgets is crucial for accurate financial planning. Time periods, such as weekly, monthly, or quarterly, provide a structured framework for anticipating expenses and revenues. By analyzing historical data and current trends, Bonsai's forecasting tools enable businesses to set realistic budgets for designated time frames.

This temporal segmentation allows for more precise resource allocation and helps in adjusting strategies to meet financial targets. Regularly revisiting these forecasts ensures that budgets remain aligned with project goals and market dynamics, fostering a proactive approach to financial management.

On the other hand, longer time periods such as monthly cash flow forecasts provide a broader perspective on cash inflows and outflows.

Remember, the choice of time period depends on the cash flow categories relevant to the business.

Importance of cash balance in forecasting

It is important to mention that maintaining an accurate cash balance aids in the following things:-

- Making informed cash-planning decisions

- Understanding cash flow categories

- Prediction of cash inflows and outflows

It is fair to say that different forecasting models can assist a business in preparing daily cash forecasting or a monthly cash flow forecast.

Furthermore, a well-executed forecast helps businesses make certain adequate cash flow for anticipated cash payments, along with formulating a realistic business plan template.

How to use a cash flow forecast template

It's evident that using a cash flow forecast template starts with identifying cash flow categories such as cash receipts and cash payments. Don’t forget to input this information in the template, together with the cash inflow and outflow figures.

Depending on your needs, you might utilize different forecasting models such as daily cash forecasting or a monthly cash flow forecast. What’s notable is these help you regularly update and monitor your cash flow forecasting process. The best thing about using the cash flow projections in your business plan template is it presents potential investors with a clear overview of your financial strategy.

Step-by-step guide to filling out a template

When filling out a business plan template, first look at your cash flow projection. Generally, this is an essential part of the process as it gives clear insight into your future financial status.

Secondly, segment your finances into different cash flow categories.

In the end, always perform a monthly cash flow forecast. Don’t forget that it provides a broader view of the financial condition over time.

Common mistakes to avoid when using a template

It's worth noting that templates are incredibly useful for many tasks. However, remember to use the template as a guide and not a rule.

Please avoid copying the template exactly and instead, adapt it to your needs – make sure to customize it regarding your specific cash outflows and inflows or specific cash flow categories of your business. Also, ensure you thoroughly understand the template. The sad thing is misinterpreting categories like cash payments and cash receipts can lead to incorrect cash planning decisions.

Never rely solely on a template for your entire forecasting model. What's worth mentioning is a template may not encompass all aspects of your specific business and might overlook certain details.

Most importantly, update your template continuously. Whether it's for cash flow forecasting process or cash flow projections; business circumstances change often. And, for that reason, your template should mirror these changes.

The worst thing about an out-of-date template is it may result in off-track cash inflow and outflow calculations.

Benefits of using cash flow forecast templates for agencies

It is crucial to highlight that using a cash flow forecast template provides a comprehensive forecasting model. The best thing about this is it allows agencies to better manage cash inflows and outflows.

One thing is for certain: Cash flow projection templates also guide in making informed cash-planning decisions.

Moreover, these tools simplify cash flow forecasting. With an appropriate business plan template, it’s fascinating how agencies can improve their cash flow projections!

Improved financial planning

One thing is clear: Improved financial planning largely involves making well-informed cash-planning decisions based on a reliable cash flow forecasting process.

One notable thing is it also entails creating an accurate monthly cash flow forecast, daily cash forecasting, etc.

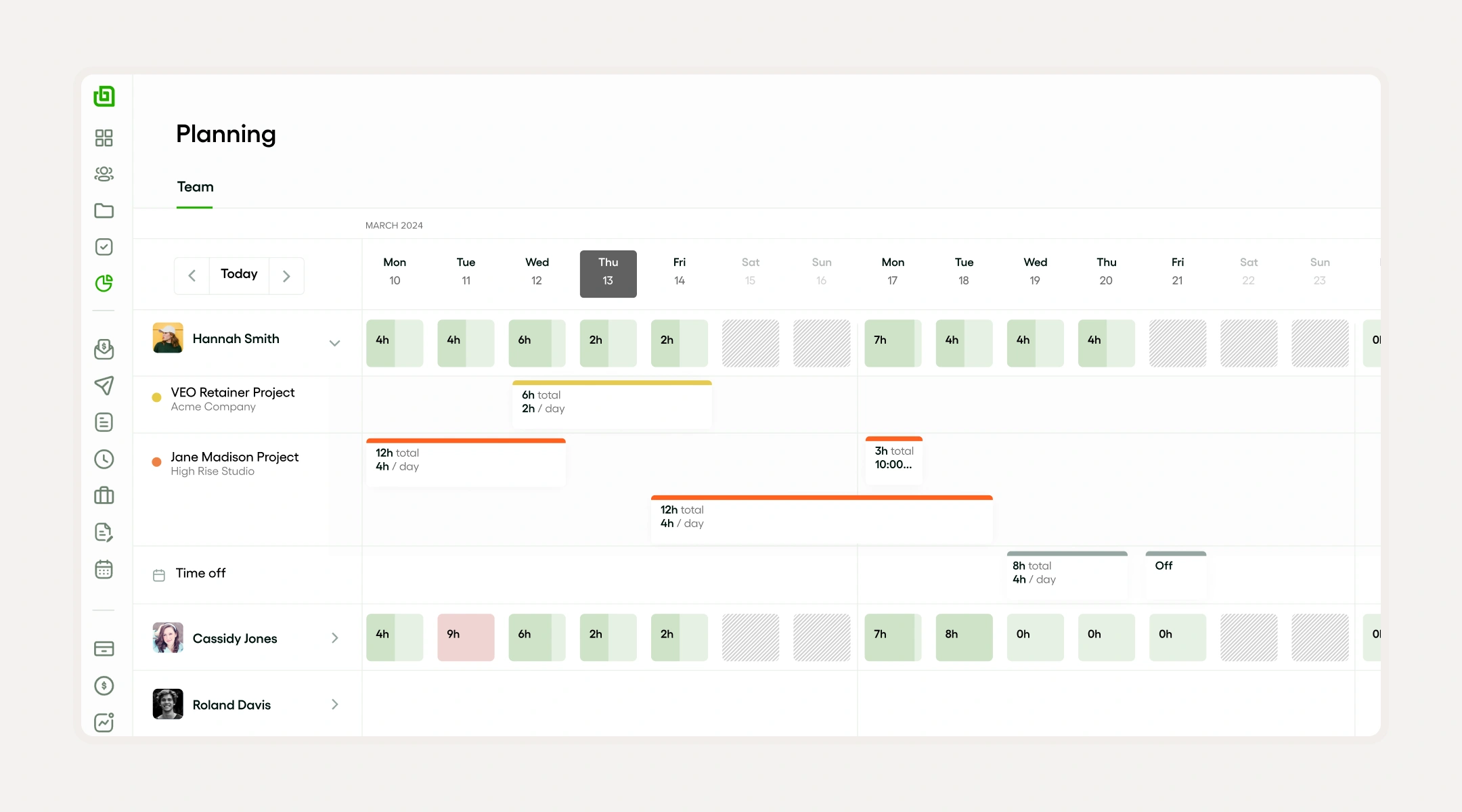

Capacity planning in Bonsai is integral for improved financial planning. It allows for the estimation of resources needed over short to medium term time-frames. This process helps avoid the pitfalls of inadequate resources, which can lead to performance issues, and over-provisioning, which results in wasted funds.

This strategic management of capacity aligns with project demands, enhancing operational efficiency and contributing to a more predictable and stable financial planning process.

Note that this model should divide your finances into distinct cash flow categories, and provide a comprehensive cash flow projection.

The fantastic thing about forecasting cash outflows and inflows is they will help you manage your finances better.

What’s more, a business plan template can help you create cash flow projections.

Enhanced decision making

It is essential to acknowledge that the cash flow forecasting process is crucial for enhanced decision-making in businesses.

Commonly, this process involves a forecasting model, which is used to predict cash outflows and inflows.

What’s fascinating is these projections aid in proper cash-planning decisions. Several cash flow categories are considered in daily cash forecasting that includes:-

- Cash receipts

- Cash payments

It's clear that a monthly cash flow forecast provides an overview of the business's financial situation which is beneficial for creating a sound business plan template.

One thing is proven: Cash flow forecasting plays a significant role in making efficient financial decisions for a company.

Effective risk management

It is generally agreed that effective risk management necessitates reliable cash flow forecasting, which involves creating a forecasting model to accurately predict cash inflows and outflows. What's worth highlighting is this process is essential for making informed cash-planning decisions.

Curiously, it encompasses the classification of cash flow categories, providing a clearer overview of the financial situation.

Remember, tools such as daily cash forecasting, and cash flow projections should be included in your business plan template.

Top cash flow forecast templates available

It's well known that several cash flow forecast templates are available to aid businesses in their cash-planning decisions. What’s notable is that popular templates cater to different needs.

Mostly, they help with forecasting model building and segregating cash flow categories.

One thing is for certain: Such templates can also organize details about your cash inflows and outflows. As a result of that, making sound business decisions becomes a piece of cake!

Bonsai cash flow forecast template

The Bonsai cash flow forecast template is a vital tool for predicting financial liquidity over time. It typically includes sections for projected cash inflows from sales or services, cash outflows for expenses, and net cash flow. With Bonsai, this template is likely customizable, allowing for adjustments based on specific business needs and financial scenarios.

QuickBooks cash flow forecast template

It is evident that the QuickBooks Cash Flow Forecast Template provides businesses with an efficient cash flow forecasting process.

What's obvious is that the template uses a forecasting model that categorizes cash inflows and outflows for daily cash forecasting and monthly cash flow forecasting. It is essential to acknowledge that this makes planning and decision-making regarding cash like a walk in the park!

The fantastic thing about this template is it offers organized sections for cash receipts, cash payments, and other cash flow categories.

By employing the QuickBooks Cash Flow Forecast Template, it is beyond question that financial accuracy and reliable cash flow projection are within reach.

Smartsheet cash flow forecast template

It is significant to note that the Smartsheet Cash Flow Forecast Template simplifies the cash flow forecasting process for businesses of all types and sizes.

Usually, the template allows users to track cash inflows and outflows, categorizing them according to various cash flow categories. This not only aids in daily cash forecasting but also enables stakeholders to make informed cash-planning decisions.

Microsoft Excel cash flow forecast template

Impressively, Microsoft Excel provides a cash flow forecast template that enables businesses to make cash-planning decisions using a forecasting model.

It is relevant to mention that this template aids in grouping transactions into cash flow categories.

It is vital to recognize that payment of cash, and various other factors are taken into consideration during this process to derive the monthly cash flow forecast.

The beneficial thing about this tool is it is incredibly helpful in the cash flow forecasting process. It’s staggering how MS Excel can easily integrate into any business plan template!

Customizing cash flow forecast templates for your agency

It's crucial to be aware that creating accurate and personalized cash flow forecasts for your agency requires a thorough understanding of cash flow categories.

Whether you're using a daily or monthly cash flow forecast; it is imperative to note that the forecasting model should fit your agency's operational needs and cash-planning decisions.

Don’t forget to use a business plan template customized to reflect your cash flow projection.

What’s worth mentioning is you should always consider factors such as accurate forecasting of cash receipts, meticulous tracking of cash payments, etc.

Adapting templates to your agency's needs

It is beneficial to understand that your agency can utilize various business plan templates to its advantage.

Undoubtedly, these can aid in constructing cash flow projections based on cash inflow and outflow. This takes into account the different cash flow categories.

The good news is this can facilitate cash-planning decisions. It can provide an overall streamlining of your cash flow forecasting process too.

It is essential to acknowledge that daily cash forecasting becomes more manageable with these tools. Evidently, there is no doubt that adopting these tools can help refocus your forecasting model for better accuracy and predictability.

Integrating templates with other financial tools

It is important to emphasize that templates can be seamlessly integrated with other financial tools.

They aid in making cash-planning decisions as they provide valuable data on:-

- Cash flow categories

- Projections of cash flow

Inarguably, this helps streamline your cash flow forecasting process. It's surprising how the use of these integrated tools generates a more accurate cash flow projection!

Conclusion: maximizing the use of cash flow forecast templates

It goes without saying that maximizing the use of cash flow forecast templates significantly aids in making effective cash-planning decisions. By enabling an accurate cash flow forecasting process, definitely, businesses get a clear projection of future cash inflows and outflows.

One thing is proven: Having daily cash forecasting or even a monthly cash flow forecast offers valuable insights into future cash flow categories. This includes anticipating receipts of cash and payments of cash.

Therefore, it's indisputable that a well-strategized use of these tools promotes a better understanding of future cash flow projections along with the financial health of the business.