It is crucial to realize that keeping an organized and accurate record of expenses is essential for any business. Notably, free expense report templates, such as:-

- The weekly expense report template

- Monthly expense report template

- Employee expense report with mileage template

The remarkable thing about these templates is they facilitate expense tracking.

It is evident that they help systematically classify business expenses into different expense types and categories. Moreover, they provide expense totals too. One thing is for sure: By utilizing business-related expense templates, organizations can streamline their expense reporting process.

Understanding the importance of expense report templates

It is well known that an expense report template is crucial for accurately tracking business expenses.

It is important to mention that these templates simplify the complex process of expense tracking by categorizing expenditures into various expense categories. What’s worth mentioning is it enables an organized calculation of total expenses.

Specially designed templates like the employee expense report with mileage template also cater to unique business-related expenses.

It comes as no surprise that expense report templates aid in the following things:

- Easy reimbursement

- Tracking of receipt

Why agencies need expense report templates

It is a well-established fact that agencies need expense report templates for efficient expense tracking and management.

Whether it's a business expense report template, or a monthly expense report template; the cool thing about these tools is they allow agencies to monitor expense totals along with simplifying reimbursement processes.

It is crucial to highlight that the use of an employee expense report with mileage template can specifically address tracking of business-related expenses that involve travel.

It’s fascinating how the effective use of the expense report templates ultimately leads to more accurate recording and reporting of total expenses!

Benefits of using expense report templates

It is beyond dispute that expense report templates offer numerous benefits to businesses. For instance, they simplify expense tracking, and make expense reporting more efficient by pre-defining expense categories and types.

It's worth noting that the use of an expense report template can aid in the precise calculation of total expenses. What’s remarkable is it enables businesses to better manage their finances.

Plus, the noticeable thing about these templates is they aid in tracking business-related expenses.

Exploring free expense report templates

It's significant to note that these templates aid in expense tracking, particularly in differentiating expense categories and calculating total expenses. The noticeable thing about these expense report templates is they simplify the reimbursement process by providing a uniform format for recording expenses.

Commonly, they allow for detailed recording, such as:-

- Receipt tracking

- Noting various expense types

What’s amazing is it offers an efficient way to manage business expenses.

Key features to look for in an expense report template

Remember that when choosing an expense report template, consider its ease of use. Furthermore, it's essential to understand that an efficient business expense report template will include areas for receipt tracking and total expense calculation.

The obvious thing about this is it will save time along with reducing potential errors during the expense reporting process. Commonly, the template should also cater to different business-related expenses and provide an option for reimbursement, especially, when using an employee expense report with a mileage template.

Top four expense report templates

It is a worrying thing that managing your expenses can be a daunting process.

The cool thing is by using an expense report template, it stands to reason that tracking becomes easier. Usually, these templates have been designed to track all costs associated with business expenses.

They can be weekly, and surprisingly they can even cater to the specific needs of employees!

Among the free options you will find:

- The 'Business expense report template': Obviously, this is perfect for inputting different expense types

- 'Employee expense report with mileage template': Note that it is ideal for those incurring business-related expenses that need consideration for distance covered

- The ‘Weekly or Monthly expense report template’: offering easy expense tracking, and classification into different expense categories

Bonsai Excel expense report templates

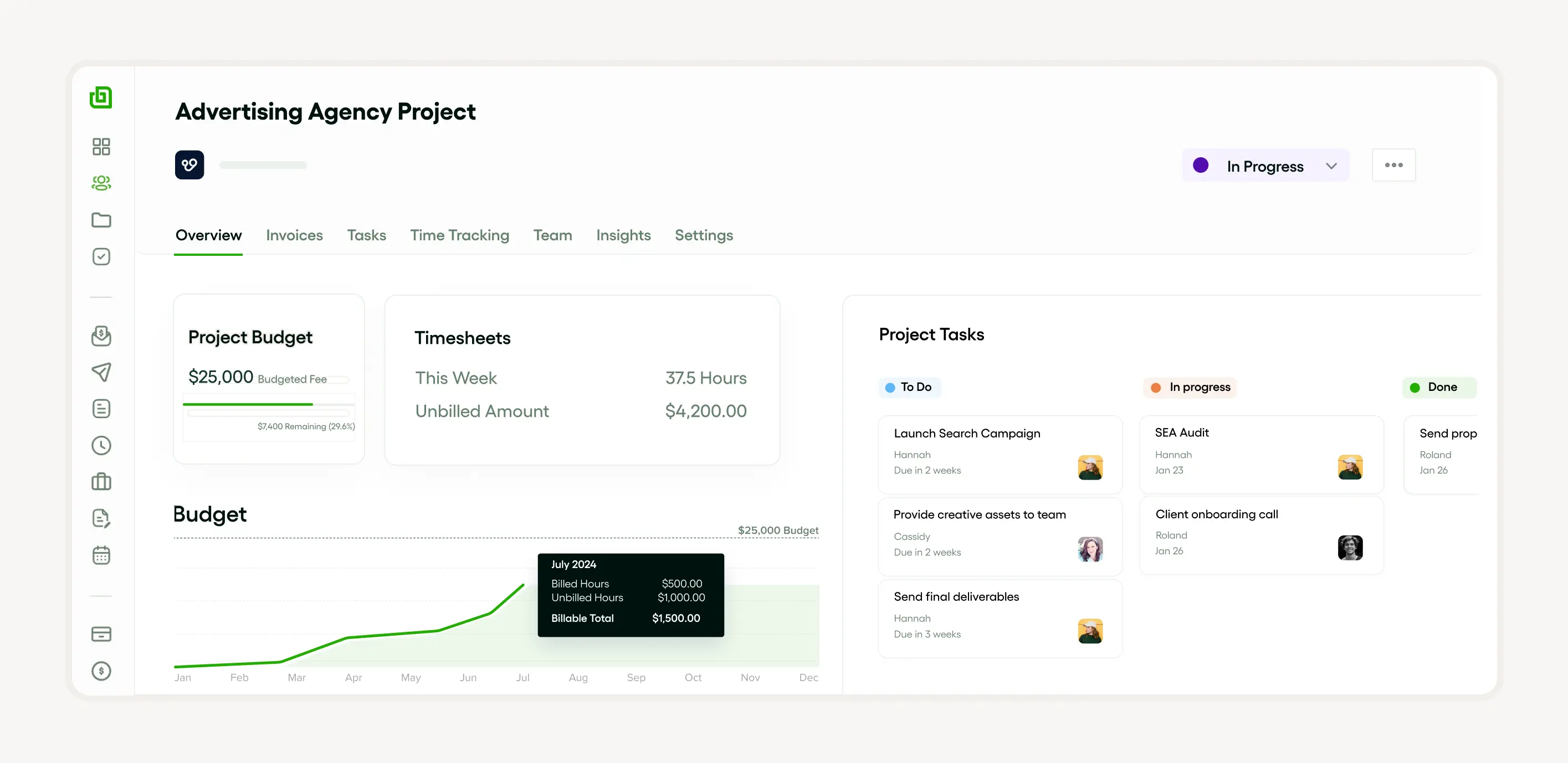

Bonsai's Excel expense report templates are a fantastic resource for businesses looking to track all costs associated with their expenses. These templates are designed to be intuitive and user-friendly, allowing even those with minimal accounting experience to keep accurate records of their financial transactions.

Bonsai offers over 500+ ready-to-use templates, including contracts, briefs, proposals, and more, to streamline your business operations. Whether you're an agencies, consultant, or running a professional service, Bonsai has a template that's just right for your needs and industry.

These templates can be customized to fit the specific needs of your business. You can add or remove categories, set up formulas to calculate totals automatically, and even integrate them with other financial tools to create a comprehensive financial management system.

Bonsai's Excel expense report templates are more than just spreadsheets; they are a complete solution for expense tracking that helps businesses stay organized, make strategic decisions, and ultimately save time and money.

Microsoft Excel expense report templates

It's well known that Microsoft Excel offers a variety of expense report templates such as: business expense report templates, monthly expense report templates and more.

Inarguably, these templates help users track their business-related expenses quite efficiently by organizing all expense categories neatly.

It is a fact that features like expense tracking, and expense types make managing total expenses, along with creating expense reports simple and swift.

The remarkable thing is an employee expense report with a mileage template is available that specifically handles travel and mileage expenses within a company.

Google Sheets expense report templates

It is beneficial to understand that Google Sheets offers a range of expense report templates to help manage business finances. Importantly, this includes monthly and weekly expense report templates, which are perfect for tracking recurring costs.

It is noteworthy that these templates offer features such as receipt tracking, and automatic calculation of total expenses.

One thing is clear: The templates allow for the categorization of expenses into various expense types and sub-categories for more detailed expense reporting. The best thing about using Google Sheets expense report templates is they can simplify and enhance the process of managing business expenses.

Smartsheet expense report templates

Consequently, Smartsheet offers a variety of expense report templates to streamline your expense tracking and reporting process. What’s notable is these range from a basic expense report template to more specific ones.

It is beyond question that this smart tool enables businesses to do the following things:

- Effortlessly keep track of different expense types

- Conducting of receipt tracking for optimal accuracy

- Make sure that all business-related expenses are recorded

By automating these often meticulous tasks, it’s astounding how organizations can spend less time on administrative work!

Vertex42 expense report templates

It's a well-documented fact that Vertex42 provides a range of expense report templates that have been designed to simplify expense tracking and reimbursement.

It is important to highlight that these templates make it easy to calculate total expenses and keep track of various expense types.

To add on, special attention is given to employee expense reports featuring a mileage template. What’s remarkable is they can be invaluable for enterprises looking to streamline their expense reporting and ensure accurate reimbursement.

It's proven that Vertex42 templates are designed to be user-friendly, and comprehensive that cater to all business expense needs.

How to choose the right expense report template for your agency

One thing is for sure: Choosing the right expense report template for your agency requires consideration of the frequency and types of business expenses.

If your agency usually tracks costs on a weekly basis, please consider a weekly expense report template.

However it is reasonable to conclude that if the expenses are tracked monthly; one should opt for a monthly expense report template. Obviously, don’t forget to evaluate the types of expense categories your agency often encounters.

It's crucial to realize that it is also essential to ensure that the chosen template allows for receipt tracking to ease the reimbursement process.

What's worth highlighting is “Consider the expense reporting method and the ease of calculating total expenses that the template provides.” As a result, this will help in smooth expense tracking and management of business-related expenses.

Understanding your agency's expense reporting needs

One notable thing is understanding your agency's expense reporting needs begins with identifying the key expense categories and their matching expense types.

Definitely, this could include business-related expenses like travel or office necessities. It is vital to note that tools like receipt tracking and expense tracking can greatly simplify the process and lead to accurate expense totals.

It's surprising when properly set up, a comprehensive business expense report template can also facilitate streamlined reimbursement protocols!

What’s worth mentioning is your template should allow the inclusion of varying types of expenditure.

Comparing different expense report templates

There are no two opinions when it comes to expense reporting– choosing the right expense report template is crucial. Three common ones are as follows:

- Expense report template of business

- Weekly expense report template

- Expense report template for the month

Predictably the business template is useful for categorizing business-related expenses, whereas the weekly one is fitting for detailed expense tracking, and note that the monthly one is ideal for overviewing total expenses.

What’s obvious is each template differs in expense types, but they all simplify receipt tracking and present organized expense totals. Depending on the complexity of your business expenses, one may set up a more fitting system for expense reporting. Remember, evaluate the type and frequency of your expenses before deciding the template that suits your requirement.

Customizing your chosen expense report template

There is no denying that choosing the right expense report template is crucial for your business.

Usually, the business expense report template is great for tracking business-related expenses, or even a weekly expense report template for shorter-term tracking.

What’s worth noticing is your chosen template should primarily serve your needs and make expense reporting as convenient as possible.

One notable thing is you can consider a template offering features for total expense calculations as well as expense categories for a more comprehensive view of your spending.

It's significant to note that some templates also offer more specialized features. The noticeable thing is you should make sure that your expense report template supports receipt tracking for better accuracy of your business expenses.

Adding your agency's branding

What’s remarkable about our agency is it provides comprehensive solutions for managing your expenses that include a dynamic expense report template tailored to your business needs.

Mainly we offer tools for weekly and monthly expense report templates.

It is beyond dispute that these tools help optimize expense tracking, ensuring no business expenses go unnoticed or unreimbursed.

Moreover, the best thing about our program is it also includes advanced features for receipt tracking. Through generating real-time expense totals, it is imperative to note that we streamline their approach to handling business-related expenses.

Modifying fields to suit your needs

The remarkable thing is that if you require a weekly expense report template or an employee expense report with a mileage template, you can modify these forms to better suit your needs!

It is crucial to highlight that adjusting expense categories and types to align with specific business-related expenses can enhance the utility of these templates. Evidently, one can also add fields for more detailed expense tracking, such as:

- Tracking of the receipt tracking

- Expense totals

It's crucial to be aware that using an expense report template ensures consistency in capturing business expenses. The cool thing is this can provide a clearer picture of total expenses. It’s astonishing how templates make expense reporting much more efficient!

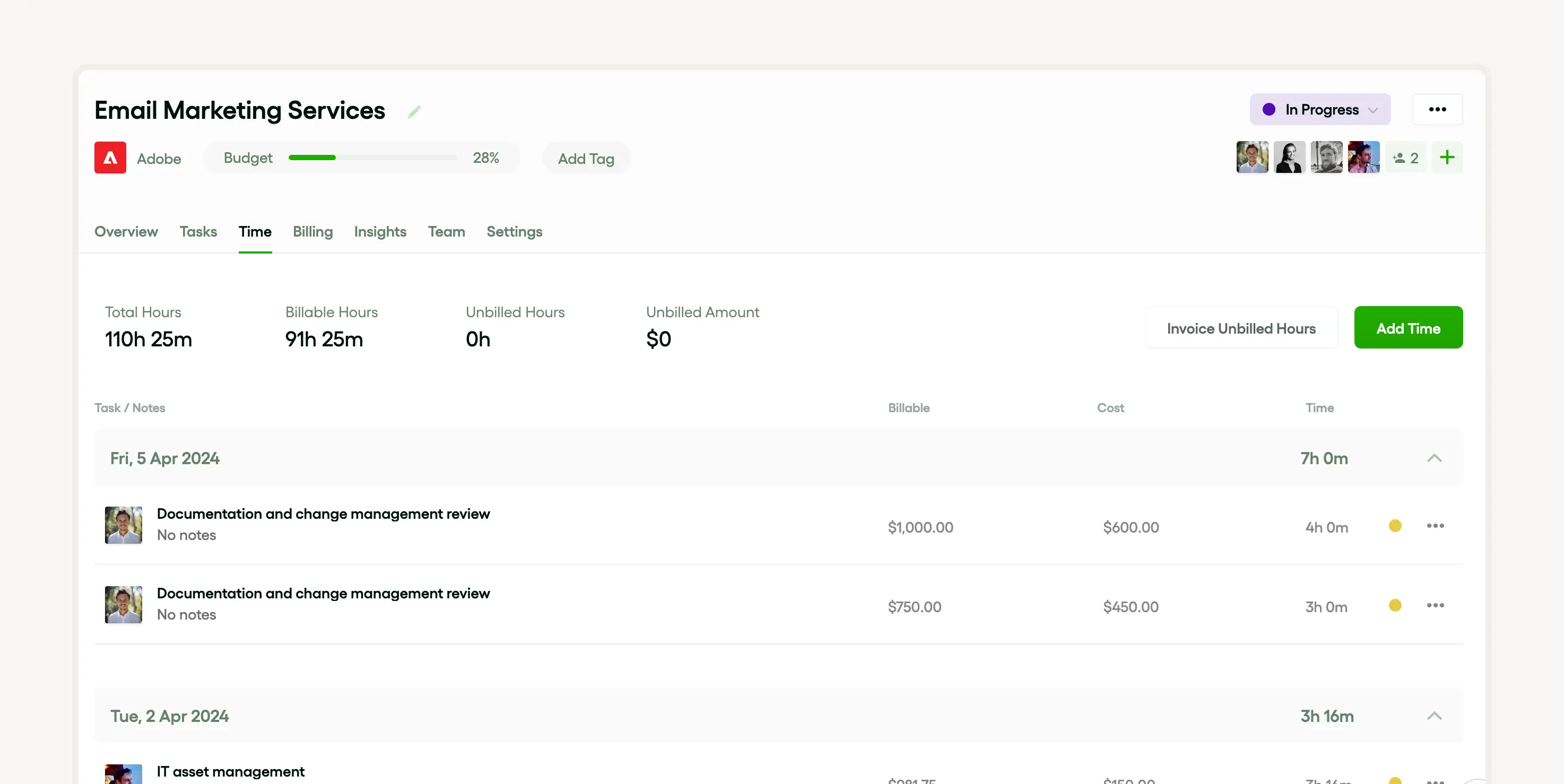

Integrating expense report templates with other tools

It is well known that integrating an expense report template with other tools can streamline your business expense management process.

What’s worth mentioning is business expenses can vary in frequency. It is widely acknowledged that an employee expense report with mileage template can further sort expense types according to trips made and make the process of auditing and reporting like a walk in the park!

Linking your expense report template with accounting software

It is essential to acknowledge that linking your expense report template with your accounting software can significantly simplify expense tracking and reimbursement processes.

If you have been using a monthly expense report template, or an employee expense report with mileage template; the remarkable thing is integrating it into your financial system can help you efficiently monitor business-related expenses in different expense categories.

It goes without saying that with this integration, one can streamline receipt tracking, and handle different expense types without hassle.

As a result, one can ensure up-to-date total expenses information and faster reimbursements – making managing your business expenses like a piece of cake!

Syncing your expense report template with project management tools

One thing is clear: Syncing your expense report template with project management tools can simplify the process of tracking business expenses.

The cool thing about reimbursement processes is they also become straightforward with real-time expense tracking. What's worth highlighting is all these features ultimately help in the seamless management of business-related expenses, and, certainly, make it a boon for finance and project management teams.

Training your team to use the expense report template

It's an undeniable truth that training one’s team to use an expense report template is crucial in tracking business expenses and ensuring accurate reimbursement.

To streamline expense reporting, teach the team to appropriately classify expenses using the following guidelines:

- One can use the business expense report template for day-to-day business-related expenses, and interestingly, the weekly expense report template for weekly outgoings

- It’s obvious that the monthly expense report template can be used for a broader overview

- Don’t forget to focus on correctly identifying expense categories

It’s staggering how the employee expense report with mileage template is particularly useful for those incurring travel expenses!

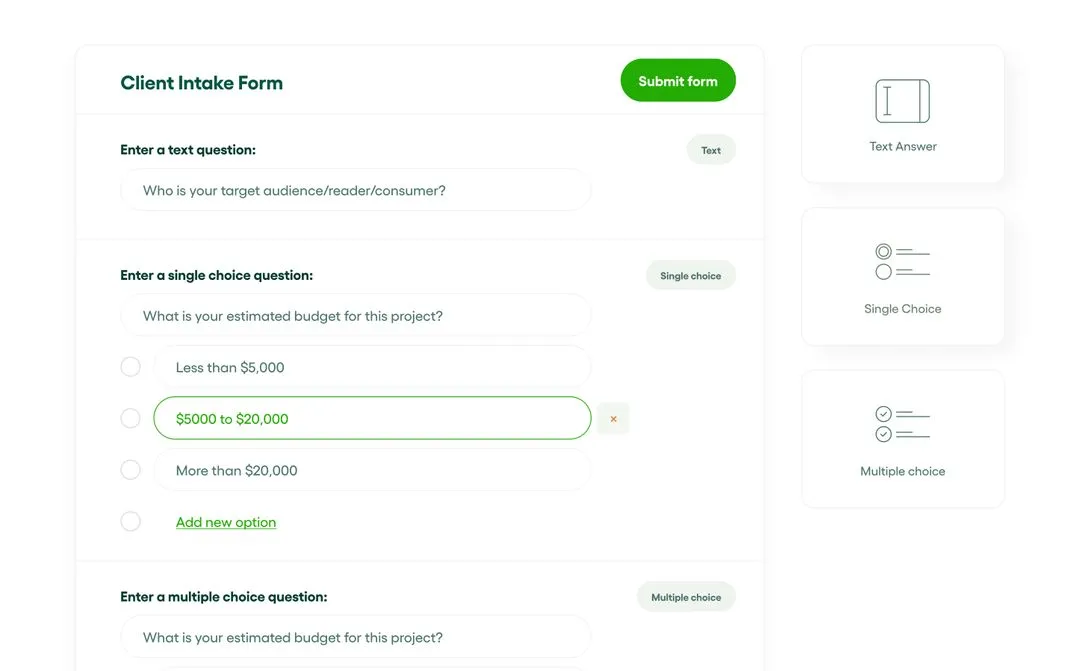

Creating a user guide for your expense report template

Generally, to use your expense report template, first input all pertinent data in their respective fields.

This includes your total expenses, individual expense categories, and receipt tracking.

The astounding thing about the template is it will automatically calculate your expense totals.

Next, input the type of business expense in the 'expense types' field. Remember that if the expenditure involves a vehicle, use the 'employee expense report with mileage template'.

What’s noticeable is this information will greatly influence not only the reimbursement procedures but also the expense tracking for the business.

Never forget to ensure that you keep a systematic record to maintain a transparent account of your business expenses.

Organizing training sessions for your team

It is commonly accepted that organizing training sessions for your team can significantly enhance their understanding of the company's expense reporting system.

Commonly, this includes learning how to effectively use a business expense report template, track receipts, etc.

What’s notable is the training should cover topics such as:

- Differentiating between expense types and determining their expense categories.

- The correct usage of various templates

- The Processing of reimbursement requirements for business-related expenses.

With proper training, the great thing is your team will be able to manage and control total expenses which will pave the way for a more efficient business operation.

Conclusion: Streamlining your agency's expense reporting process

It's a well-documented fact that streamlining your agency's expense reporting process is key to efficient financial management.

One thing is for certain: An easy way to achieve this is through the use of tools such as an expense report template, or even an employee expense report with a mileage template.

Inarguably, these help simplify expense tracking. What's worth highlighting is keeping a clear record of expense types, total expenses, and receipt tracking facilitates an all-rounded view of your business-related expenses. The remarkable thing about this is it will allow one to make data-driven decisions leading to the growth and profitability of their agency.