To file taxes with both a 1099 and W-2, start by reporting your W-2 income on Form 1040. Next, report your 1099 income on Schedule C, and calculate any self-employment tax using Schedule SE. This ensures all income is accurately reported. Understand that W-2 income has taxes withheld, while 1099 income requires you to pay self-employment tax. Use tax software to track expenses and deductions, potentially saving you significant amounts. It's crucial to differentiate between employee and contractor roles to avoid misclassification. Filing both forms correctly helps avoid penalties and ensures compliance with IRS regulations.

There are several situations where an employer or independent contractor may have to deal with both a 1099 and Form W2 in the same year. This can result in questions for both the employer and the employee/contractor.

Fortunately, the IRS rules regarding a 1099 and Form W-2 in the same year are clear and easy to follow. We'll go over how to file your freelancer taxes along with employee income. First, it is important to identify when you receive each form. Second, it is important to identify how this impacts self-employment tax obligations.

Note: if you would like a tax software to help you organize your business expenses and file your freelancer wages, then try Bonsai Tax. Our app will send you filing reminders, estimate your taxes, and help you track all your freelance tax deductions. Users who try our software save an average of $5,600. Claim your 7-day free trial today.

Employers - Issuing A Form 1099 and W-2 in the Same Year

As an employer (this includes independent contractors that hire employees and/or sub-contractors) there are two scenarios in which this could potentially be an issue.

Employers Issue Form 1099 and W-2 - One Form Per Person

This is the most likely scenario most employers will face. They will need to issue form 1099s and W2s for the tax season but no one receives more than one tax form. For the sake of simplicity, anyone receiving a W2 has had the employer portion of payroll taxes paid by the employer.

The employee portion of payroll taxes has also been withheld (based on the employee withholding direction).

Employers Issuing a Form 1099 and Form W-2 - Both Forms to a Single Person

A trickier situation for employers is when they want to issue a form 1099-NEC and Form W-2 to a single person. There are three factors to consider if you are faced with this situation as per the IRS guidelines.

- The worker was treated as an employee for part of the year and an independent contractor for a separate part of the year (i.e., payments reported on Form W-2 and Form 1099-MISC were for the same services but distinct periods of time during the year).

- The worker was performing two or more distinct services and the taxpayer considered the worker to be an employee for one service and an independent contractor for the other service (i.e., dual-status worker).

- The payment reported on Form 1099-MISC represented additional compensation to the worker in his capacity as an employee for which he received compensation reported on Form W-2 (e.g., a bonus payment).

It is not uncommon for IRS examiners to review this situation. The linchpin of the examination is determining if the worker should have been treated as an employee for the period they were treated as self-employed.

Employees/Independent Contractors - Receiving W-2 and 1099

If you receive Form 1099-NECs and Form W-2 wages there is one question to answer before getting into the tax implications. The question is whether you should really be receiving a form 1099-NEC.

If you are classified as a 1099 contractor then you are responsible for all the self-employment tax responsibilities (Social Security and Medicare). If you are looking at prior-year tax situations, it would be a 1099-MISC instead of a 1099-NEC. That change for independent contractors was made for the 2020 tax year.

The reason it is important to consider your employment status is it will have a significant impact on your net income. As a W2 employee, the employer pays a portion of the payroll taxes (Medicare and social security).

As a self-employed person, you are responsible for both the employer and employee side of those taxes which effectively doubles the amount of taxes you pay - excluding your self-employment income tax responsibility.

Understanding the W2 and 1099-NEC Forms

The first step of filing your employment taxes correctly is understanding the Form W2 and Form 1099-NEC. These forms provide similar, but not identical, information.

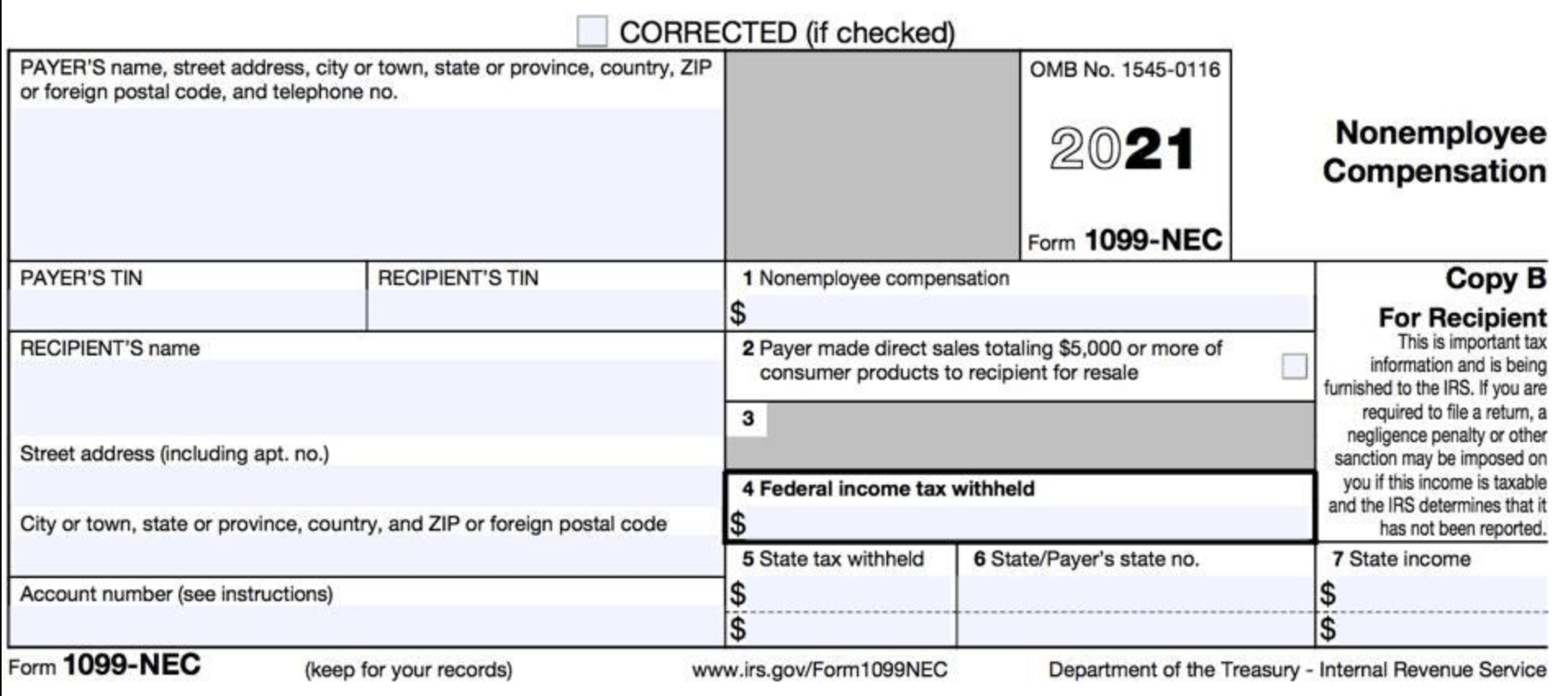

What Is A 1099 Form?

The 1099-NEC is the informational form provided by "employers" to self-employed independent contractors. It indicates the total amount paid to the contractor. Employers will issue this form because it helps justify their expenses which reduces their taxable income.

It serves as evidence that additional income has been paid to an individual taxpayer. You will likely receive this income as an independent contractor or as a self-employed individual in a sole proprietorship or single-person limited liability company.

If you own your business or if you're a freelancer, you'll likely receive a 1099-NEC form for each project that you complete. If an "employer" has sent you $600 or more for that year, they are legally required to provide you with a 1099-NEC. Taxes will not be deducted from your payments, except in specific circumstances, so the 1099-NEC is essential for accurate tax reporting.

What is a W2 Form?

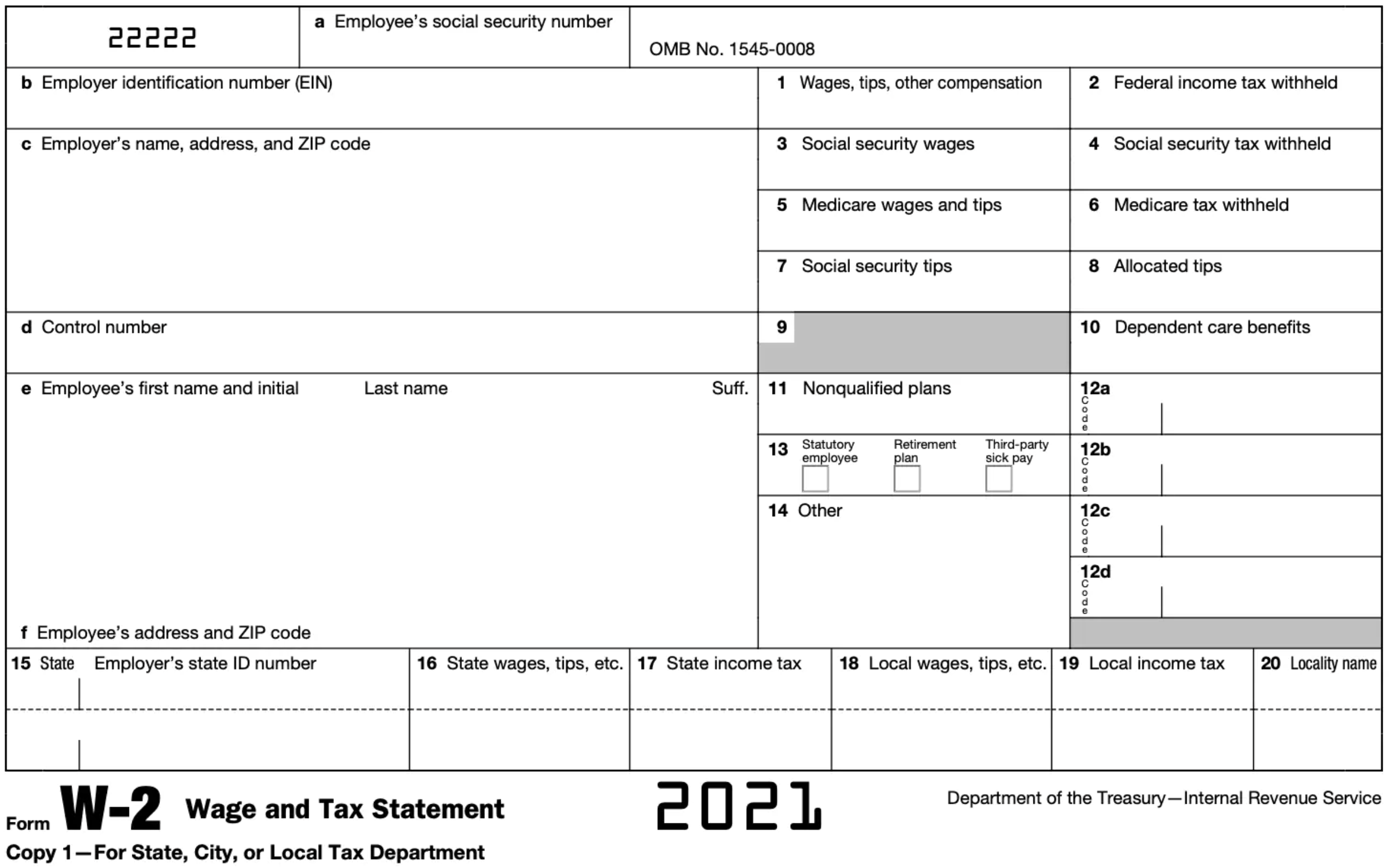

A W2 form is an Internal Revenue Form that is used to report income. It is used to both report wages paid to an employee and the taxes that were withheld from them.

It also indicates the amount of taxes paid by the employer. Depending on the benefits provided by the employer, it also includes a variety of potential deduction codes.

Similar to Form 1099 any employer who paid you $600 or more during a given year, is required to send you a W2 for that year. Form W2 is provided to what most people refer to as "traditional employees".

Is a W2 or 1099-NEC the Right Form?

Before we get into how to file a 1099-NEC and W2 in the same year, let's first clearly define freelancers and employees.

Difference Between Contractors and Employees

The default position of the IRS is that a worker is an employee unless there is evidence to the contrary. This is largely because the required tax withholding from an employee's paycheck is the primary way the IRS enforces the collection of income taxes from individuals and payroll taxes from employers.

To be considered a freelancer there is a certain set of criteria that must be met based on evidential facts. The keys are to look at the entire relationship and consider the extent of the right to direct and control the worker. They all relate to the amount of independence a freelancer has.

Facts that provide evidence of the degree of control and independence fall into three categories:

- Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the payer? (these include things like how a worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of Relationship: Are there written contracts or employee-type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

The Concurrent or Separate Tax Form Decision

There are two situations in which an independent contractor can receive both Forms 1099 and W2 from the same employer. The first is if the worker performed duties as an employee and independent contractor or freelancer concurrently for the same employer.

This situation tends to arise when employees to work or provide services outside of their normal job description. For example, if you are employee and your employer says they will pay you $1,000 to design a website outside of your normal working hours. The $1,000 payment would require a 1099-NEC.

The other situation is where the worker held these two jobs at separate times during the same tax year for the same employer. From an employee/contractor perspective, the key is making sure the amounts on each tax form are accurate.

If you are switching from contractor to employee then you should complete a W4 and the employer must treat you like any other new employee. Converting an employee to an independent contractor requires firing the employee and then having them fill out a W9.

If you switch roles for the same company, clear distinctions must remain to uphold either the employee or independent contractor categorization.

FAQs - Filing W-2 and 1099-NEC (or Form 1099-MISC) on the Same Tax Return

Here are some frequently asked questions to file form 1099-NEC for non-employee compensation on top of your W-2 income.

How Do You Approach Your Personal Tax Return if You Receive a W-2 and 1099-NEC?

If you have both W-2 income and 1099 income to report on your annual tax return there are some variables to consider but it doesn't need to be overly complicated.

The first step is filling out your tax return with your W-2 information - just like you would if you only have W-2 income. Your W-2 tells the IRS how much you earned from your and how much you have already paid in taxes throughout the year. This is important because when you receive W-2 income, your employer is paying half of the Medicare and Social Security payroll taxes.

Once your W-2 information has been entered, you will enter your 1099 income. This is often referred to as your self-employment income. Since your worker classification for 1099 income is as an independent contractor/self-employed individual you will be responsible for both sides of the payroll tax equation. Once your income has been input into your annual tax return you will add in any applicable deductions.

You can always file a 1099 extension before the deadline if you need more time.

Do Your Independent Contractor Tax Deductions Change if You Receive both W-2 and 1099 Income?

The short answer is - No. Annual tax returns are designed to provide a holistic picture of your tax profile. This means that, at the end of the day, it doesn't matter what your income sources are or what tax deductions are - the goal is for the IRS to get the full picture the amount of income you earn and allowable deductions/expenses since these two variables determine the amount of taxes you must pay.

Note: Freelancers with business expenses can lower their taxable income substantially if they provide the IRS with proper records. A tax software like Bonsai Tax can help with that. Our app scans your bank/credit card expenses to discover potential tax write-offs automatically. Users generally save $5,600 from their tax bill. Claim your 7-day free trial here.

Can You Avoid Filing Quarterly Estimated Tax Payments if You Have 1099 and W-2 Income?

Taxes are "paid" as you earn or receive income. The IRS accomplished this in two way: payroll withholdings and estimated quarterly tax payments. Estimated taxes can be used to pay self-employment tax and the alternative minimum tax in addition to income taxes. If you do not pay enough in estimated taxes then a penalty will be due when you file your annual tax return.

Individuals, including sole proprietors or freelancers, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

You don’t have to pay estimated tax for the current year if you meet all three of the following conditions.

- You had no tax liability for the prior year

- You were a U.S. citizen or resident for the whole year

- Your prior tax year covered a 12-month period

How Do I File A Form 1040?

If you have both W-2 and non-employee income, you'll need to file IRS form 1040. Typically, as an independent contractor, you'll need to file Form 1040-A or 1040-EZ. You'll be able to deduct one-half of the self-employment tax on your Form 1040 or personal tax return.

Adjusting your W-2 Withholdings to Eliminated Estimated Tax Payments

If you receive both W-2 and 1099 income you can increase your W-2 withholdings to cover all of your tax obligations. Quarterly estimated taxes are typically paid to cover any estimated unpaid taxes but it is not a requirement. The requirement is simply to pay taxes as your earn income.

Instead of filing quarterly tax payments, you can cover this obligation by adjusting how much is withheld from your paycheck. It is important to keep in mind that while this is an option, it does require some calculated tax estimates to ensure you withhold enough from your W-2 wages.