The year 2020 was a rollercoaster of changes for everyone. Along with these changes came new laws and legislations, including the 1099-NEC due date and other important aspects of the form.

Before 2020 hit, if your company had contract work or was into freelancing, you would either receive or issue a 1099-MISC. Now, a new form was made to report income from independent contractors.

Form 1099-NEC is the new bad boy in town. Also referred to as non-employee compensation, this form caters to everyone who is self-employed. In this article, we'll go over when you need to file the 1099-NEC.

What Is Form 1099-NEC?

Form 1099-NEC is a tax form specifically made to report non-employee compensation. This compensation is made for people who are not on the payroll and only receive their compensation upon finishing a project.

Here, we are talking about gig workers and independent contractors. It also includes self-employed people who previously used to file Form 1099-MISC to report their income.

This form cannot be downloaded online. You'd either have to file it through the Filing Information Forms Electronically (FIRE) system, or you'd have to order through the website of the IRS.

The Deadline for Form 1099-NEC

What's the due date for 1099s? The 1099-NEC due date is at the end of every tax year, on January 31. In this case, you must have the tax papers filed to the IRS by January 31, 2022.

In the event that this day does not fall on a business day, when 1099s are due moves to the next business day. For instance, if January 31 falls on a bank holiday, then you may make that payment on February 1.

This applies to Copy B of the form as well. For you to make the due date, you will be required to file it by January 31, at the end of the tax year.

What Does Form 1099-NEC Report?

For those who are filing non-employee compensation, form 1099-NEC reports the following:

- Payments made to another individual that is not an employee. This includes materials and parts for the project.

- Payments made for services following their trade or business. This includes nonprofit organizations and government agencies.

- Payments made to the payee of more than $600 per individual, throughout the year.

If these conditions are met, the client may calculate self-employment taxes and file for non-employee compensation.

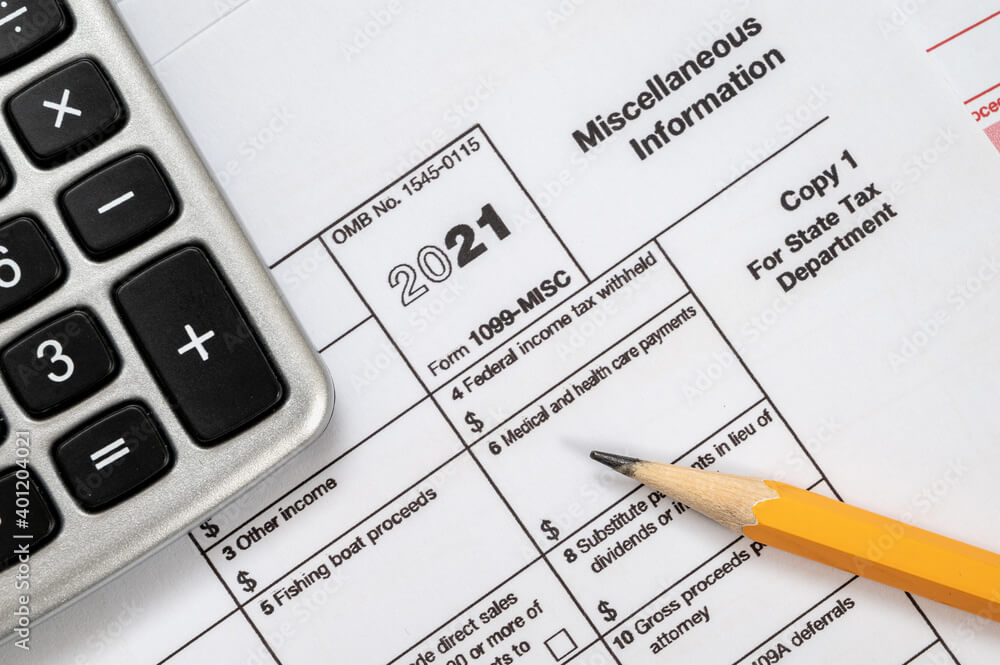

Differences Between Form 1099-NEC and Form 1099-MISC

1099-MISC and 1099-NEC are highly connected. Before the 1099-NEC came around, form 1099-MISC was the one used for non-employee compensation. Now, form 1099-NEC is used for that instead.

This does not mean that form 1099-MISC is no longer used. Contractor payments are indeed reported with 1099-NEC, but there are other reports made with 1099-MISC as well.

The main use of form 1099-MISC now is to make reports for miscellaneous income. For example, if you have to make payments to an attorney or rent, then you will have to use 1099-MISC form.

Previously, while form 1099-MISC was used, the information would be reported in box 7 of the form. Form 1099-MISC and 1099-NEC are similar - but the latter has its own separate boxes now (form 1099 for rent, attorney payments, or other payment types).

Who Needs Form 1099-NEC?

There are certain circumstances in which you may need to send out or file form 1099-NEC, but mostly, it depends on the circumstances of the work.

As a starting point, if you have a business and you hired a contractor, you might have to turn in form 1099-NEC. If their pay is more than $600 within the year, it is your job as the payer to file these forms.

That being said, as the payer, you will have to submit two copies: one to the IRS, and one to the contractor you needed for your trade or business.

If you are the one receiving the second copy from a variety of business owners that you work with, then you don't have to file form 1099-NEC.

With that in mind, if you are self-employed, you should still ask for a copy of the form from the businesses you work for. You may need the paperwork to add it to your own records.

Bear in mind that if the contractors are marked as S or C corporations, then you won't need form 1099-NEC. In that case, Form W-9 is the one to go for.

If the recipients are employees, you won't need to submit the new form to the IRS. Instead, the employee will have to submit Form W-2 themselves. These forms are necessary to report tips, wages, and other compensations received throughout the tax year. Since, the Internal Revenue Service receives the tax information, the IRS will catch a missing a 1099 if you don't file.

What Do You Need to File Form 1099-NEC?

If you are the one making the payment, you need to obtain form W-9. With this, you need the following information:

- Business name or legal name, if applicable

- Current address

- A business entity (partnership, sole proprietor, corporation)

- Taxpayer identification number

Technically, you can still file your taxes without 1099 forms.

The payer is responsible for filing Form 1099-NEC, and they will find that all the information necessary to fill the form is already there.

If you are collaborating with a payroll service to pay the contractors, they will be the ones to file and mail form 1099-NEC. Your only input there would be filing form W-9 upfront.

The total paid amount should be found on the bookkeeping records. See how much every independent contractor was paid by the end of the tax year, and use that information to file 1099-NEC. Don't forget about your tax deductions. We recommend you use an app track receipts for taxes to do it for you.

All types of payments, including the cash money for fish or payments for attorneys, have to be submitted in Box 1 of the form.

With that settled, two copies of the form need to be submitted: one to the IRS and the other to the contractor. Those are referred to as copy A and copy B.

Submission of Copy A

The first copy of the 1099-NEC form, namely Copy A, needs to be submitted to the IRS by the end of the tax year. This can be done either by traditional mail or by e-filing.

You may ask for a physical version of form 1099-NEC from the IRS website. If you wish to file through a paper copy, bear in mind that its cover sheet needs to be the 1096 form. Once you gathered and completed them, all that is left is for you to have them delivered to the IRS.

E-Filing Copy A

On the other hand, if you wish to do it electronically, you'll have to use the FIRE System.

Remember that you'll need a service provider or software that can create the document in its proper format. PDF or scanned copies will not be taken into consideration.

If you're using FIRE, you'll also require a Transmitter Control Code (TCC). You may do so by completing Form 4419 and faxing or mailing the IRS.

This should be done at least one month before your form 1099-NEC tax deadline. Then, you will be contacted by the IRS, which will provide you with the TCC. With this done, you may create your FIRE account.

Submission of Copy B

While Copy A needs to go to the IRS, Copy B should be given to the independent contractor. With that in mind, you will need their consent first.

You need to obtain consent in the same way that you would send the copy. For example, if you are emailing the form, then you'll have to email when asking for consent as well. If you cannot get consent that way, then you'll need to use traditional mail.

Requesting Consent

For the request for consent to be IRS-compliant, you'll need to include the following:

- Confirmation that, in the event, your recipient doesn't consent to get an electronic copy, they will get a paper version.

- Duration and scope of the consent. For example, this can specify whether they only agree with an electronic copy this year, or every calendar year to follow.

- Methods of requesting for a paper copy from the sender (you), even if they already agreed to the fact that they will receive an electronic copy.

- Instructions on how to withdraw their consent, if needed.

- Conditions under which the consent may no longer be necessary. For instance, this might happen if the contract is canceled or if you pay them at least $600 for their services.

- The procedure one needs to go through in order to update any potential information.

- A software or hardware description of what the recipient will need to print out the form.

- The date on which the form may be unavailable. For example, if it can only be downloaded from the website of your company, then you'll also need to specify the date on which it may become unavailable.

Once consent has been received, you are free to send them an electronic version of Copy B.

What Are the Penalties for Missing the 1099-NEC Deadline?

Filing for 1099-NEC forms can still be made after the due date, but remember that there will be a penalty for that. The 1099 late filing penalty that you will owe will depend on how late you are with the payment. The penalties break down as follows:

- $50 if you file the form within 30 days past the due date

- $100 if you are more than 30 days late, but still make it before the 1st of August

- $260 if you file after the 1st of August

There are serious penalties if you don't file a 1099. Late filing of required 1099s can result in fines ranging from $50 to $280 every 1099, with a maximum penalty of $1,130,500 per year for your small business.

The final amount will be set depending on when you file the right information. If you know for a fact that you will be unable to pay by January 31, then you may submit Form 8809 to request a 30-day 1099 extension.

Keep in mind that even under these circumstances, you'll still need to supply these forms 1099 to your independent contractors by January 31. If you need to make any changes to a submitted form, you'll need to file a 1099 amendment.

The Bottom Line

The new 2020 form 1099-NEC is an updated form of the 1099-MISC. By the end of the tax year 2020, people no longer had to use the old form to report contract income. Now, everything could easily be done with the 1099-NEC form. We hope our article has helped business owners understand how it works.