Selecting the best financial advisor tools for 2025 demands a clear understanding of what boosts efficiency and productivity. Top-tier financial planning software, cutting-edge automation tech tools, and advanced client management strategies will lead the way.

Advisory businesses must prioritize software that integrates customer relationship management, portfolio management, and risk analysis. This not only helps achieve financial goals but also secures client data and enhances overall financial management processes. Investment in the right fintech and digital tools is invaluable.

Understanding the importance of financial advisor tools

Financial advisor tools critically aid advisory businesses by automating tedious tasks, allowing advisors to focus more on core duties. Financial planning software enables effective client data management, efficient portfolio management, and expedited financial processes. Some tools also feature scheduling, risk analysis, and client management.

Increasingly, fintech and automation tech tools are integrated into software to manage financial advisory services seamlessly. These digital tools let advisors craft strategies to help clients meet their financial goals. Customer relationship management systems play a crucial role in enhancing client engagement processes.

The role of financial advisor tools in modern agencies

In today's financial advisory landscape, various tools have become essential for efficient operations. Client management and portfolio management rely heavily on financial planning software and fintech. These digital tools help advisors manage customer relationships, monitor investment risks, and create strategies for clients' financial goals.

Automation tech tools streamline administrative tasks like scheduling and client data management. Consequently, these resources significantly improve financial management, leading to more efficient and timely service delivery.

How financial advisor tools enhance efficiency and productivity

Financial advisor tools such as financial planning software, automation tech tools, and customer relationship management systems significantly boost efficiency and productivity. They streamline portfolio management, risk analysis, and client data, optimizing investment decisions. These digital fintech tools are essential for managing client processes, automating scheduling, tracking financial goals, and other critical financial tasks.

Their usage reduces manual labor, improves accuracy, and ensures smooth workflow. By cutting down on administrative tasks, financial advisors can focus more on strategizing and achieving clients' financial goals.

Achieving success through team capacity management

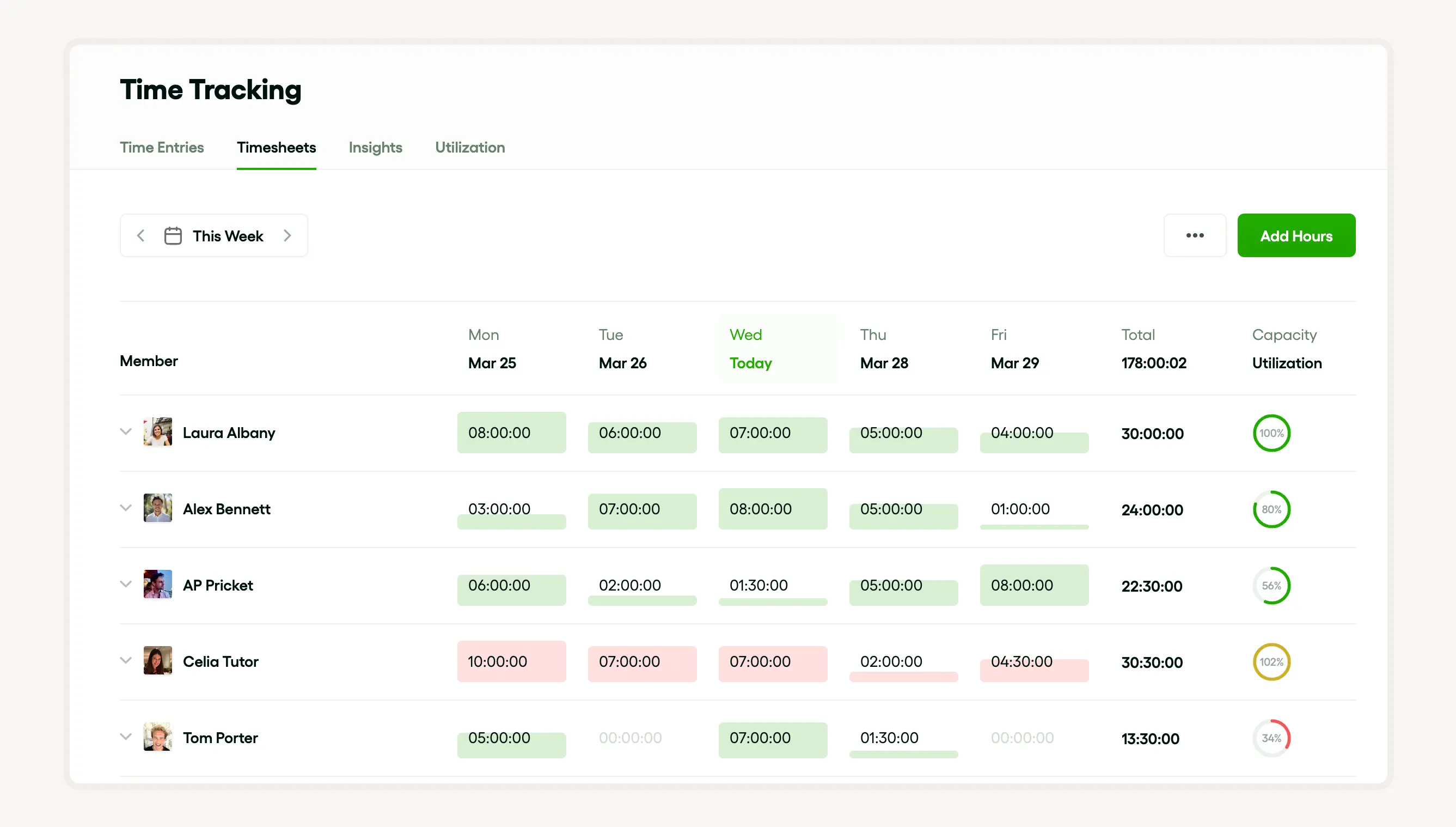

Successfully managing team capacity in Bonsai requires a strategic approach to balancing workloads in order to optimize efficiency and productivity. Bonsai's capacity management tools enable you to establish and track capacity limits for each team member, ensuring that no one is overwhelmed or underutilized.

By offering real-time insights into team performance and resource allocation, Bonsai empowers you to make well-informed decisions that keep projects on schedule and teams motivated. This proactive strategy not only improves project results but also cultivates a healthier, more productive work environment.

1. Set up team capacity

Bonsai's capacity management features allow you to set daily or weekly capacity limits for each team member, helping to prevent overwork and underutilization.

- Simply go to the "Team page."

- Click on a member to open their settings.

- Adjust their capacity in the "Capacity section."

Please note that only team members with the owner or partner roles have the ability to edit a member's capacity.

2. Tracking capacity utilization

You can easily check if a team member has exceeded their weekly capacity by looking at the "Timesheets" page. If their capacity is set on a weekly basis, the entire week will be highlighted in red if they have gone over their limit. However, if the capacity is set daily, only the specific days that exceed the limit will be highlighted in red.

Additionally, you have the option to monitor a team member's capacity utilization over a period of time through the utilization report. The Total Utilization and Billable Utilization bars in the report are color-coded to indicate the level of capacity utilization.

- 0% - 49%: Red

- 50% - 100%: Green

- Over 100%: Yellow

Additionally, Bonsai provides insights into team performance, enabling you to make informed decisions about resource allocation and project planning. This proactive approach ensures that your team remains productive and engaged, ultimately leading to higher project success rates and client satisfaction.

3. Track utilization reports & efficiency

Utilization reports in Bonsai are crucial for optimizing resource management and improving team productivity. These reports offer in-depth insights into how efficiently your team is using their time and resources. By differentiating between billable and non-billable hours, utilization reports assist in understanding where your team's efforts are focused and in identifying areas for enhancement.

- Track the ratio of billable hours to total hours worked, helping you gauge the financial efficiency of your projects.

- Access up-to-date information on team performance, allowing for timely adjustments and better decision-making.

- Utilize group utilization charts to visually represent data, making it easier to understand and communicate utilization levels across the organization.

By regularly reviewing utilization reports, you can ensure balanced workloads, prevent burnout, and optimize resource allocation. This proactive approach leads to more efficient project execution and higher overall productivity.

Key features to look for in financial advisor tools

When choosing financial advisor tools, look for functionalities like financial planning software to devise robust strategies to meet financial goals. Efficient portfolio management is crucial for client data organization and investment distributions. Automation tech tools lighten administrative tasks, update in real-time, and boost business efficiency.

Client management tools, such as scheduling software and customer relationship management systems, improve responsiveness, client engagement, and streamline processes. Top-tier fintech solutions should offer risk analysis for informed financial decisions and digital tools that enhance accessibility and client interaction.

Integration capabilities

Financial advisory firms can significantly increase efficiency by integrating automation tech tools. Digital tools like financial planning software are essential for managing portfolio tasks and risk analysis, handling large amounts of client data, and providing advisory services that help clients meet financial goals.

Furthermore, integrating customer relationship management (CRM) systems can streamline client management processes. Adding scheduling software can make appointment handling easier and more efficient. These fintech advancements improve financial management at each client lifecycle stage, making integration capabilities indispensable for a company's financial plan.

Client relationship management

Client relationship management is vital for any advisory business, relying on automation tech tools and digital tools like financial planning and scheduling software. These tools ensure efficient portfolio and client data management.

Through customer relationship management, advisory services help clients plan and achieve financial goals. Fintech advances have also enhanced financial management and risk analysis, providing a better understanding for both client and advisor. This allows for more accurate investment decisions and increased trust in the advisory relationship.

Portfolio management and reporting

Portfolio management and reporting are crucial for financial advisory services, involving digital tools and fintech like financial planning software to monitor, control, and report client data. This data is vital for both the business and the client.

Modern portfolio management uses automation tech tools, such as customer relationship management and scheduling software, to enhance client management. These tools help in realizing financial goals, guiding investment decisions, and providing risk analysis, ultimately elevating financial management efficiency and productivity.

Compliance and security features

Our financial planning software ensures robust security and compliance measures for advisory businesses. It prioritizes client data protection, incorporating advanced encryption to secure sensitive information. Besides data security, the software includes compliance features to ensure operations align with regulatory requirements.

Key functionalities include portfolio management, automation tech tools for scheduling and client management, and risk analysis. The software aids in achieving financial goals by streamlining financial management processes and interactions via integrated customer relationship management (CRM) capabilities.

Leveraging such digital tools is imperative for sustaining competitiveness and delivering high-quality advisory services in an evolving fintech environment.

Top Financial advisor tools for 2025

In 2025, for financial advisors, nabbing the right tools can make or break your advisory game. Some hot picks include full-scope financial planning software to streamline portfolio handling and risk analysis, boosting investment savvy with some snazzy tech features.

Keep an eye out for tech tools that put client management in the spotlight, packing a punch with top-tier customer relationship management for slick and accessible client data handling. Digital doodads and fintech are also in the limelight.

Don't sleep on automation tech tools—they're gearing up to be big players, alongside user-friendly scheduling software, smoothing out financial advisory operations and helping track those big financial dreams.

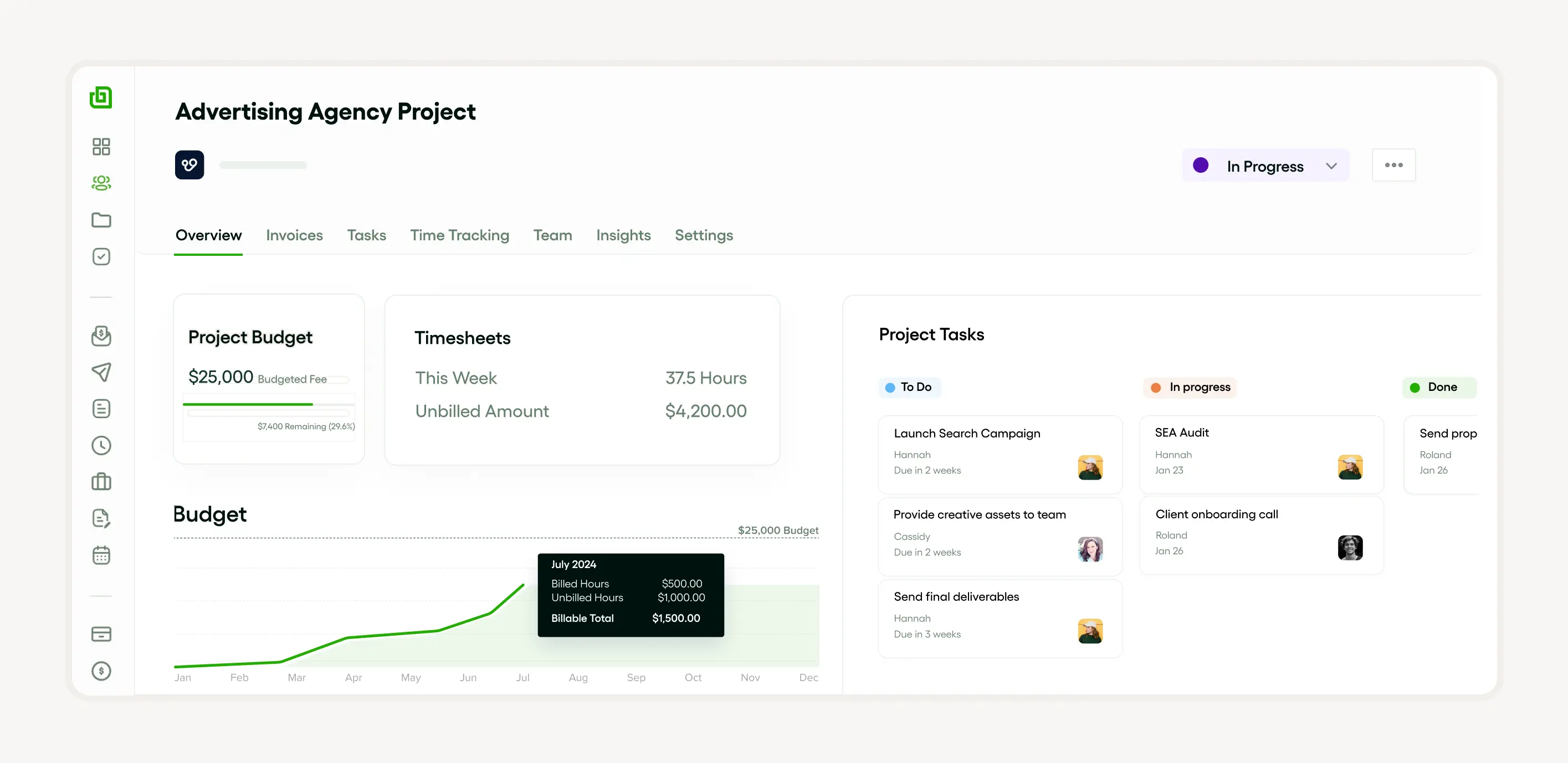

Try Bonsai’s powerful features

Bonsai’s toolkit is a game-changer for service providers, small outfits, and agencies, making invoicing a breeze with customizable templates and nifty automated reminders to keep those payments on time.

- Tracking expenses? No sweat—categorize, upload, and watch your spending like a hawk.

- Get the lowdown on your financial health with detailed reports on profit and loss, cash flow, and balance sheets, sharpening your decision-making chops.

- Bonsai’s also got your back come tax time, tracking deductible expenses and dishing out tax estimates to ease the tax season jitters.

With solid client management tools and integrated time tracking, Bonsai beefs up billing accuracy and productivity, while its automated workflows let you zero in on growing your business. Bonsai is all about keeping your financials in check and your business stability solid.

Overview of eMoney advisor

eMoney Advisor dishes out a slew of digital tools for the advisory hustle. It’s all about cutting-edge fintech for managing portfolios, sizing up risks, and keeping client data neat and tidy.

Automation’s the name of the game here, making scheduling and client management slick as a whistle, boosting investment strategies, and helping clients reach those financial peaks. Globally recognized, eMoney Advisor stands tall in the financial advisory arena, empowering pros to master financial management.

Features and benefits of MoneyGuidePro

MoneyGuidePro throws down some serious features to streamline your advisory business. This software’s a triple threat with client data integration, portfolio management, and risk analysis to optimize your financial wizardry. Scheduling software kicks productivity up a notch by ensuring smooth client management operations.

Focused on client financial ambitions, MoneyGuidePro is decked out with automation tech tools and top-notch customer relationship management, making it a fintech gem for bolstering investment strategies and securing clients’ financial futures.

Why choose Morningstar Direct?

Opting for Morningstar Direct? You’re looking at top-tier financial planning software that melds fintech with client management to elevate portfolio management with advanced digital tools.

Decked out with features like customer relationship management and risk analysis, Morningstar Direct zeros in on client data, fine-tuning the investment process to match clients’ financial objectives.

The best part? Its automation tech tools and scheduling software are all about streamlining financial management to boost your advisory service efficiency.

Exploring the capabilities of Advyzon

Advyzon digitalizes the works—acting as a financial planning powerhouse, portfolio manager, client data handler, and more, excelling in automating the nitty-gritty for slick operations. Its customer relationship management keeps client relations on point, while risk analysis tools help you make sharp investment calls.

Offering comprehensive advisory services and aiding in financial goal attainment, Advyzon is your go-to for a well-rounded financial management tool in today’s market.

Understanding the power of Envestnet Tamarac

Envestnet Tamarac is a powerhouse, blending financial planning software with portfolio management and client data savvy, empowering advisory businesses with the best in fintech and automation tools for top efficiency. This platform is all about upping the ante in financial management, comprehensive risk analysis, and effective scheduling.

With a strong customer relationship management strategy and advanced digital tools, Envestnet Tamarac simplifies financial advisory services, making client management a breeze and investment handling a piece of cake.

Comparing financial advisor tools: A closer look

The world of financial advisory services is buzzing with digital innovation—from financial planning software to portfolio management systems and automation tech tools. These fintech marvels are revolutionizing client data management, cranking up efficiency in advisory businesses.

Tools like scheduling software make day-to-day tasks smoother, while customer relationship management platforms enhance client interactions and help nail those financial goals. With risk analysis features in most financial management software, investment strategies get a shiny polish, pushing productivity and client satisfaction through the roof.

eMoney advisor vs MoneyGuidePro: A comparative analysis

Stacking up eMoney Advisor against MoneyGuidePro, it’s all about sifting through their features. Both stand as titans in the digital realm of financial planning software.

- eMoney Advisor shines with its robust client data aggregation and solid portfolio management—key for any advisory operation. Its interactive client portal is a goldmine for setting and tracking financial goals.

- MoneyGuidePro brings a unique flavor with its goal-based planning, sharp risk analysis, and solid client management features. With its tech tools automating the grunt work, it also boasts strong customer relationship management chops.

Advyzon vs Envestnet Tamarac: Which one fits your needs?

Choosing between Advyzon and Envestnet Tamarac? It boils down to what your advisory business craves.

- Advyzon is a standout for detailed client management, risk analysis, and financial management. It’s the go-to if you’re all about deep-dive customer relationship management and a robust set of fintech tools for crafting sharp investment strategies.

- Envestnet Tamarac, on the other hand, is a juggernaut with its automation tech tools, scheduling software, and financial advisory prowess, ideal for smashing those financial goals with organized, automated processes.

Implementing financial advisor tools in your agency

While managing the financials can be a complex task, it's only a part of the bigger picture. Being able to manage your projects effectively is just as important. Learn more about the best project management tools for startups to keep your business operations running smoothly.

Using financial advisor tools enhances client management and streamlines your advisory business. Financial planning software is crucial for portfolio management, closely tracking investments, and aligning client data with financial goals. It also aids in risk analysis, forming a solid financial management strategy.

Automation tech tools boost efficiency. Advanced scheduling software speeds up meeting arrangements, and customer relationship management platforms ensure smooth interactions. Leveraging these digital tools is key for growth in today's digital age.

Steps to successfully integrate a financial advisor tool

First, identify fintech tools that fit your advisory services like financial planning software for organizing investments and a customer relationship management (CRM) system for effective client management. A portfolio management tool enhances decision-making for efficient financial management.

Ensure the chosen tools support risk analysis and align with your advisory business's financial goals. Lastly, explore automation tech tools and scheduling software to streamline tasks. These steps guarantee successful tool integration.

Training your team on the new tool

Rolling out a new tool requires proper team training. Start with an overview of how the financial planning software supports portfolio management and client data handling. Then, provide detailed walkthroughs of the software's features and their alignment with key advisory services.

Highlight how automation tech tools enhance risk analysis and client management. Explain the integration of scheduling software and CRM systems. This training equips your team to optimize fintech for better financial management.

Future trends in financial advisor tools

Fintech, specifically financial planning software and automation tech tools, will dominate future advisory businesses. These tools enable better portfolio management, efficient client data handling, and improved CRM. Advances in risk analysis tools support advisors in investing while keeping client goals in focus.

Demand for transparency and customization will drive adoption of advanced financial management tools. Automated scheduling software and CRM systems streamline operations, fostering meaningful advisor-client interactions. These advancements will shape the industry's future.

How technology is shaping the future of financial advisor tools

Technology is reshaping financial advisory services with digital tools like financial planning software, automation tech tools, and fintech apps advancing rapidly. These tools improve client data management, portfolio management, and streamline business operations.

Better financial management, risk analysis, and goal setting for clients enhance CRM. Financial advisors can more effectively meet client goals, improving service delivery. The future of financial advising will be shaped by technology through scheduling software, automation, and digital tools.

Preparing your agency for future financial advisor tools

To stay competitive in the changing financial advisory landscape, embrace emerging fintech trends. Leverage tools like financial planning software, portfolio management systems, and automation tech tools.

These digital tools automate various aspects of your business, from scheduling to risk analysis and client management. Secure client data management enhances CRM and supports financial goals. Successful implementation requires a strategic approach to financial management and readiness to embrace these advancements.