Whether you are an independent contractor just starting out or you have been freelancing for a long time, you have to stay on top of expense reports for your business. You should know where all the money is being spent to maintain your small business. You'll need clean records of all your receipts when tax season rolls around.

Listen, hoarding paper receipts is a thing of the past. The IRS has updated its rules for organizing tax receipts. That means they accept digital receipts to track business write-offs for your taxes.

Well, if you're in the market for the best receipt scanner, we've got your answer. In this article, we will review the best receipt apps on the market and tell you what makes them so great.

Let's dig into which receipt app to take care of all your expanse scanning tracking for your business.

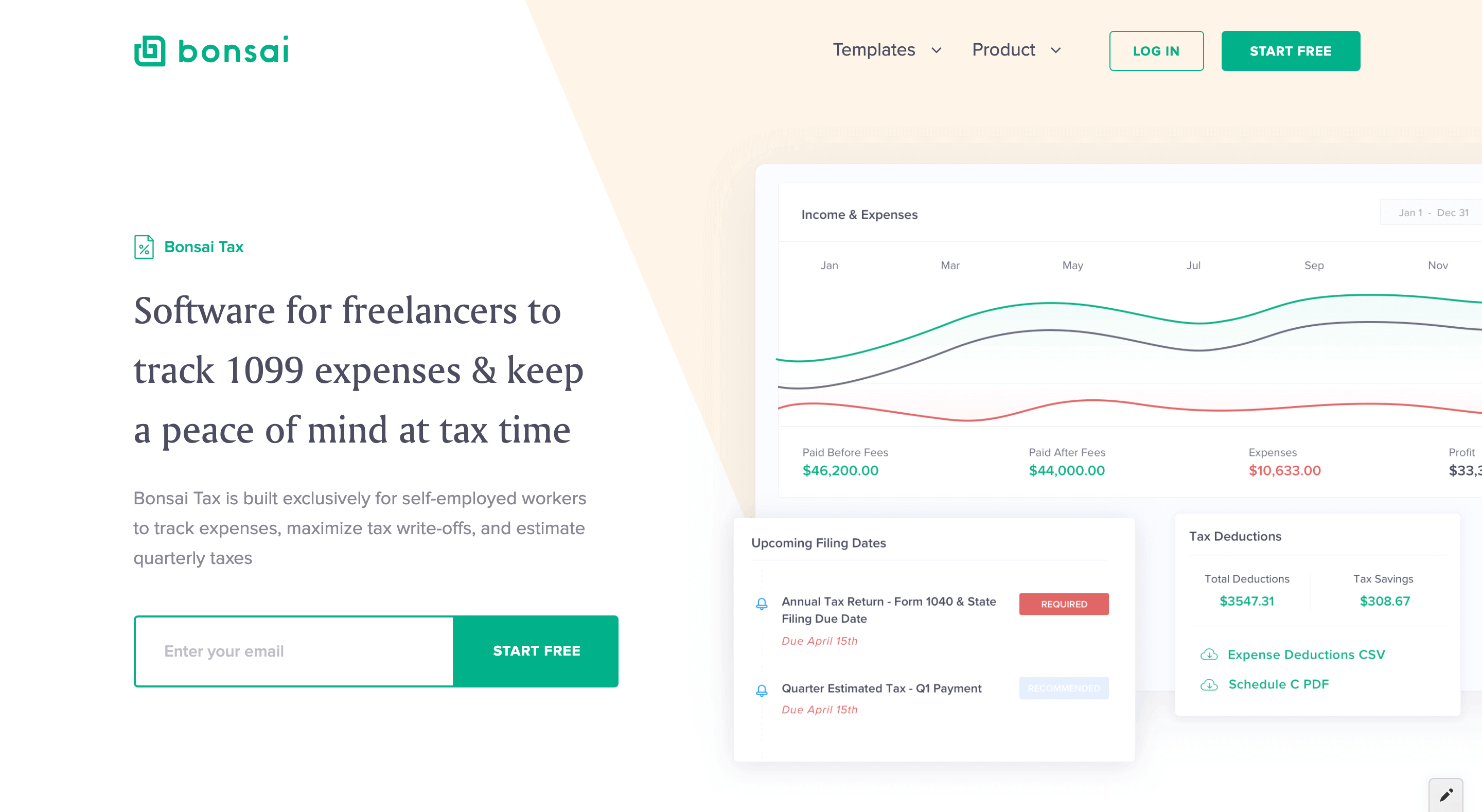

Note: If you want to try the top-rated receipt app (that saves the average user $5,600 from their tax bill), try Bonsai Tax. Our tax software is simple to use and organizes as well as stores all your receipts for your taxes. Claim your 7 day free trial today.

The Benefits Of Using Receipt Scanning Apps

Correctly managing your taxes is absolutely vital for any business. If you mishandle your taxes, you can receive penalties, lose more money and deal with a lot of unnecessary headaches. Let's talk about the benefits of using apps to track receipts for taxes.

It's Portable

As an entrepreneur, you are always occupied and busy. You need a receipt scanner that can complement your lifestyle.

You know, one that is portable and can be used on the go. The beauty of the internet is that you can use a cloud-based tax app from anywhere. You won't worry about carrying a portable receipt scanner to take photos or scan receipts.

Storage Features

Storing your receipts online beats any phone app to scan documents, 1099 excel template, or filing cabinet to store receipts.

With a receipt app, you won't have to worry about losing or misplacing your receipts. So you won't have to worry about the IRS requirements for how long you keep tax receipts because all your documents will all be on the cloud.

It's Fast

Ever heard the expression, at the push of a button? Receipt scanning apps will literally do that. Connect your accounts and the software will organize, categorize and track everything for you instantly.

As an entrepreneur, you know your time is valuable. Scanning and organizing all of your tax receipts on your own is mundane and takes a lot of time. Now, all you need to do is create expense reports, and voila, all your deductions are organized. Receipt scanner apps could free up your time so you can focus on other things like making more money.

Export All Your Documents For Tax Season

Receipt scanning apps organizes and tracks all your business expenses for you. Plus you can easily store your tax records for three years online in case you get audited later. All you need to do is export the files if you ever need them. Maybe you need to send your records to an accountant or a friend. Just download your scanned documents and deliver them wherever you need to.

If you are interested in the best receipt scanner to track business expenses for your small business, continue reading this blog post to find out which one we recommend.

1. Bonsai Tax

Bonsai has always been on a mission to make the lives of freelancers easier. That includes providing contract templates, proposals, invoices, and everything else a freelancer may need to automate their small businesses and manage less work.

Bonsai Tax is our software to help you manage your receipts, stay on top of your deadlines, and pay fewer taxes. It is the go-to business software for self-employed workers on the market to save money on taxes.

We'll review all the reasons why Bonsai Tax is the best receipt app you'll ever need to use.

Bonsai Tax Features

Let's get into the nitty-gritty details of all the features that will be available to you the moment you try our software. In just a moment, we'll go over some reasons why Bonsai Tax stands apart from its competitors in the market as the best tax receipt organizer app.

Automatically Identify All Your Deductions

As we mentioned above, tax rules are always changing. You may know a list of 1099 tax deductions available to you, but I bet some write-offs will slip through the cracks. Our receipt scanner will help you maximize your deductions at the end of the year by identifying and categorizing all your expenses.

All you need to do is swipe left for personal expenses and right for business ones after Bonsai scans your receipts and identifies all the potential write-offs.

If you need to split expenses for both business and personal, the app can do that.

Instead of going through all your receipts, sorting them, and calculating your write-off amount, just use our software to scan your transactions. Seriously, that can save you a lot of time and money. Not to mention you'll receive filing reminders so you never miss a deadline and receive a late filing penalty.

Note: Our app could organize all your tax receipts for you at the push of a button. In fact, the average user of our app to track 1099 expenses saves $5,600 during the tax year. You see, the receipt scanner software pays for itself and more. Try a 7-day free trial today.

The Best Receipt Scanners Automate Everything

Most accounting software and expense tracker templates can be a pain to use. Receipt scanners are supposed to make your life easier! They are not supposed to be complicated to navigate or use.

Bonsai Tax is hands down the easiest receipt scanner to use. All you have to do is sign up for an account, connect your credit card/business accounts, and watch as Bonsai Tax tracks all your tax deductions for you.

Tax accounting can be a fairly complex topic. The laws and regulations for what counts as a business expense are always changing. Our 1099 expense tracker would auto-import potential expenses from your bank and credit card transactions, classify and then display them on your account. You don't have to scan documents yourself, the app will track and store your receipts online or in the cloud.

Note: Try the best receipt scanner on the market, Bonsai Tax, to save thousands of dollars during tax time. Our expense tracker will discover all the tax deductions you qualify for by scanning and organizing your bank/credit card receipts. In fact, users typically save $5,600 from their tax bill. Try a 7-day free trial today.

Estimate Your Quarterly Taxes

Sure, receipt scanning is important. But so is staying on top of all your tax deadlines. Independent contractors have to pay their taxes every quarter because the U.S. operates on a 'pay-as-you-go system'. Bonsai Tax will send reminders for quarterly tax deadlines as well as help you determine how much you should make in estimated tax payments within the app.

Knowing the right amount to send to the IRS every year will help you avoid tax underpayment penalties.

Also, check out our self-employment tax calculator to determine how much you'll owe to Uncle Sam at the end of the year.

Our Software Can Help, No Matter What You Do

Our receipt scanner can track your business expenses no matter what your job is. If you are a GrubHub 1099 worker, Uber or Lyft driver, graphic designer, advertiser, web developer, writer, photographer, you name it. Our scanning software can save you thousands of dollars from your tax bill. Not to mention, you get the full freelancer produce-suite when you try our receipt scanner. See for yourself why Bonsai is the go-to independent contractor app.

Try Our Receipt Scanner Out For Free, On The House

If saving thousands of dollars on your tax bill sounds good to you, then test-drive our software and see for yourself why freelancers consider us the best receipt scanner app on the market. Bonsai Tax is a one-stop solution to manage your deductions no matter what you do. You've got nothing to lose by signing up and getting started! See for yourself why we're voted the best app to track receipts for taxes.

2. Expensify

Expensify is heralded as a simple app to track business expenses. The OneDrive feature allows you to take a picture of your receipt, and they’ll automatically categorize the expense for you.

You'll also have the option to import credit card transactions and combine them with receipts to scan for deductions.

Expensify is great because it saves time from entering information manually. It also makes sure that all the data is captured correctly so there are no mistakes when filing taxes at year-end. It's fairly easy to enter an expense, select a category, type the dollar amount and submit it.

The mileage tracker feature can record how far you've traveled for the Standard Mileage Deduction. All these features can be accessed from your Android or IOS mobile phone as well as a web browser.

However, users complain about how duplicate charges are flagged by the Expensify app. Sometimes folks have multiple expenses for the same dollar amount from the same company. Users have also complained about the mobile app being buggy when they take a picture for receipts and the company being overly promotional for their Expensify card. That is why many folks search for Expensify alternatives.

Overall, the app can help you simplify expense reports and easily help you get reimbursements for expenses.

3. Zoho Expense

If you are looking for a smooth interface to track and record your receipts, Zoho Expense is a useful tool. You'll be able to easily record monthly expenses and mark items for reimbursement.

The app is fairly simple to set up. You can use the tool without heavy training.

Users of this app complain about the reporting functionality. They say it is too clunky. For example, to record an expense, you'll have to attach it to a report which can get tiresome or difficult. The app also does not auto-generate receipts for expenses over $75.

Also, many user reviews have stated they hate having to take a photo with their phone and constantly send them to themself. After they do this, then they will be allowed to download as well as upload them. Constantly having to snap a photo and data entry can be a pain.

The app is not too expensive though. You won't burn a hole through your wallet using it.

This receipt scanner app is a great tool for categorizing and organizing credit card receipts.

4. Freshbooks

If you are looking for cloud-based accounting software, then Freshbooks is best for you. It's best not just because it offers a free trial but also because of its simplicity and ease-of-use which will help any small business to record their expenses without the headache of learning an accounting software package that has hundreds of features.

On top of managing your expenses, you can pay invoices.

While many apps offer scanning capabilities, the best and simplest are often those that do not require any additional software to be installed on your device or computer. This is especially important if you have an older model iPhone or iPad with limited storage space as well as a small battery.

Freshbooks has a:

- Intuitive interface that doesn't require any training or learning curve

- Fast and efficient scanning process without the need for additional software to be installed

- Fantastic customer support that is available via live chat, email or phone

- Tracking of expenses in real-time and the ability to set up recurring transactions with a single tap.

- Fast receipt scanning process without the need for additional software to be installed

Users have stated, however, that the mobile app can be too expensive for what you are allowed to do on the app. Especially if you have a lot of clients or want to use their add-on options. The price can quickly add up.

Put simply, this software can scan receipts, and get the job done. You don't need to be a professional accountant to use it.

5. Wave Accounting

Wave accounting is a great app to track business purchases. People save a lot of time using this app because it is really easy to use.

Since storage is online on the cloud, you can easily access it from any computer. Not to mention, the app easily integrates with other popular accounting tools and apps.

The program can automatically import digital receipts from ridesharing or lodging services for Uber, Lyft 1099 taxes or from Airbnb, HotelTonight, and Booking.

6. Evernote

Evernote is a great receipt scanning app to help you scan receipts and organize your deductions for tax time. Many small business owners love this app's expense tracking feature because it is so easy to use.

The app is great at organizing purchases as well as tracking revenue. It stands out because of how easy it is to use, and its variety of features make this app a great choice for anyone who needs to store receipts or wants an accurate way to track their income.

Evernote is one of those apps with a lot of features.

- Simply snap a photo of your receipt with the in-camera for IOS and android to record any expense.

- WebClip allows you to save emails to send to your tax records whenever you need to

- You can attach files or write notes on your documents to better organize your paperwork.

7. QuickBooks

QuickBooks is a receipt scanner app and more. We'd recommend this app for small business owners that have more medium-sized.

This app can help simplify your accounting. You can easily take a photo of your receipt as well as connect your bank account/credit card statements. QuickBooks will automatically scan your bank account, categorize your deductions and spit out an expense report for you to download.

Not to mention, QuickBooks allows you to track your receipts in real-time and provides good accounting reports.

People who use this receipt management tool, complain about a lack of professional support as well as system crashes. The data is oftentimes not automatically backed up, which can lead to the loss of important receipts. Check out our full list of alternatives to Quickbooks Self-Employed.

Be Prepared During Tax Time!

Seriously, the amount of cash you can save by downloading one of these apps is enormous. Tracking receipts have never been easier.

When tax season rolls around, just create expense reports of all your receipts, fill out your tax form and file your taxes with the IRS. It is really as easy as that. We hope this guide has helped you make an informed decision about which best receipt scanner to purchase.