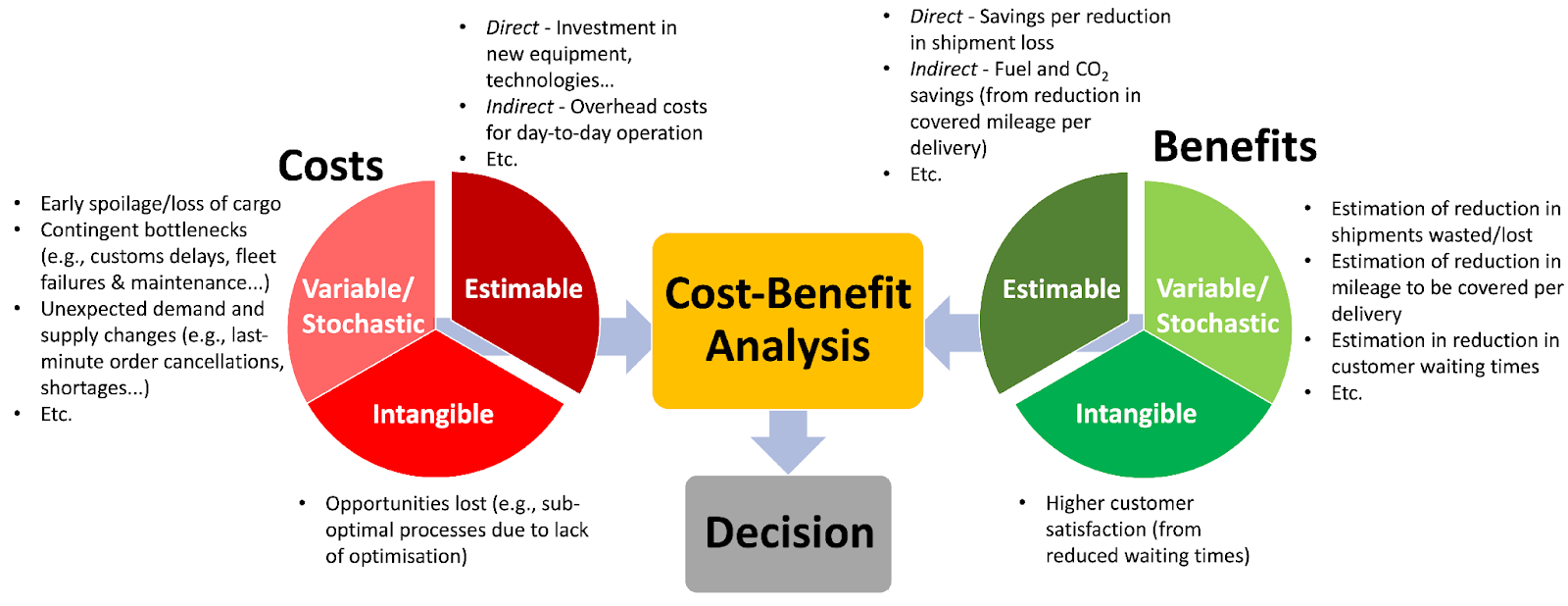

Diving into the nuts and bolts, cost-benefit analysis is a heavyweight in decision-making arenas, balancing the scales of projected costs against the potential benefits of a project. This analytical powerhouse accounts for everything from direct cash outflows to the sneaky intangibles, ensuring a holistic view of a project's feasibility. Core metrics like the benefit-cost ratio and net present value become your north stars in navigating these decisions.

Pros and cons of cost-benefit analysis

On the sunny side, cost-benefit analysis offers a crystal-clear picture of project expenses and the economic perks they might bring. However, it’s not all smooth sailing. The method might skip over the hidden costs of missed opportunities and stumble when pinning down intangible costs.

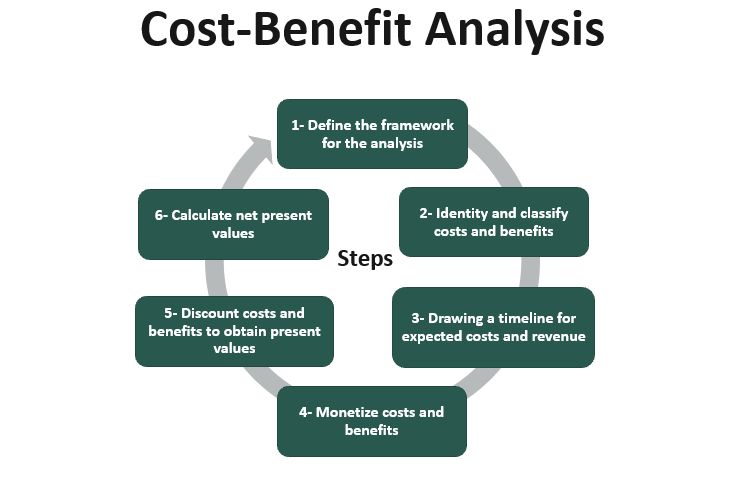

Steps in cost-benefit analysis

Embarking on a cost-benefit analysis journey involves:

- Pinning down both costs and benefits,

- Applying a discount rate to future gains,

- Crunching numbers to find the net present value,

- Conducting a sensitivity analysis to test assumptions,

- Drawing conclusions and making informed recommendations.

Introduction to cost-benefit analysis

Cost-benefit analysis stands as a cornerstone in decision-making, assessing project viability by weighing monetary benefits against projected costs. This method shines a light on direct, indirect, and even intangible benefits, providing a thorough economic evaluation with tools like the benefit-cost ratio and net present value to guide decisions.

Definition of cost-benefit analysis

Cost-benefit analysis is the strategic balancing act in decision-making, comparing a project's potential costs with its expected benefits. This method not only covers direct and indirect costs but also tunes into the subtler tunes of intangible costs and potential savings, offering a full economic sketch with metrics like net present value and benefit-cost ratio at its core.

Importance of cost-benefit analysis in decision making

In the decision-making sphere, cost-benefit analysis is indispensable, offering a meticulous economic breakdown that helps pinpoint the net present value of a project. It’s a tool that not only highlights potential cost savings but also puts the spotlight on the benefit-cost ratio, making it a cornerstone for strategic and cost-effective decision-making.

Understanding the use of cost-benefit analysis

Cost-benefit analysis is pivotal in project decision-making, examining projected costs against possible benefits. It calculates key elements like direct, indirect, and even intangible costs, with the benefit-cost ratio and net present value helping to gauge economic benefits relative to costs. When used effectively, it leads to decisions that are both financially sound and strategically savvy.

A guide to using cost-benefit analysis in project management

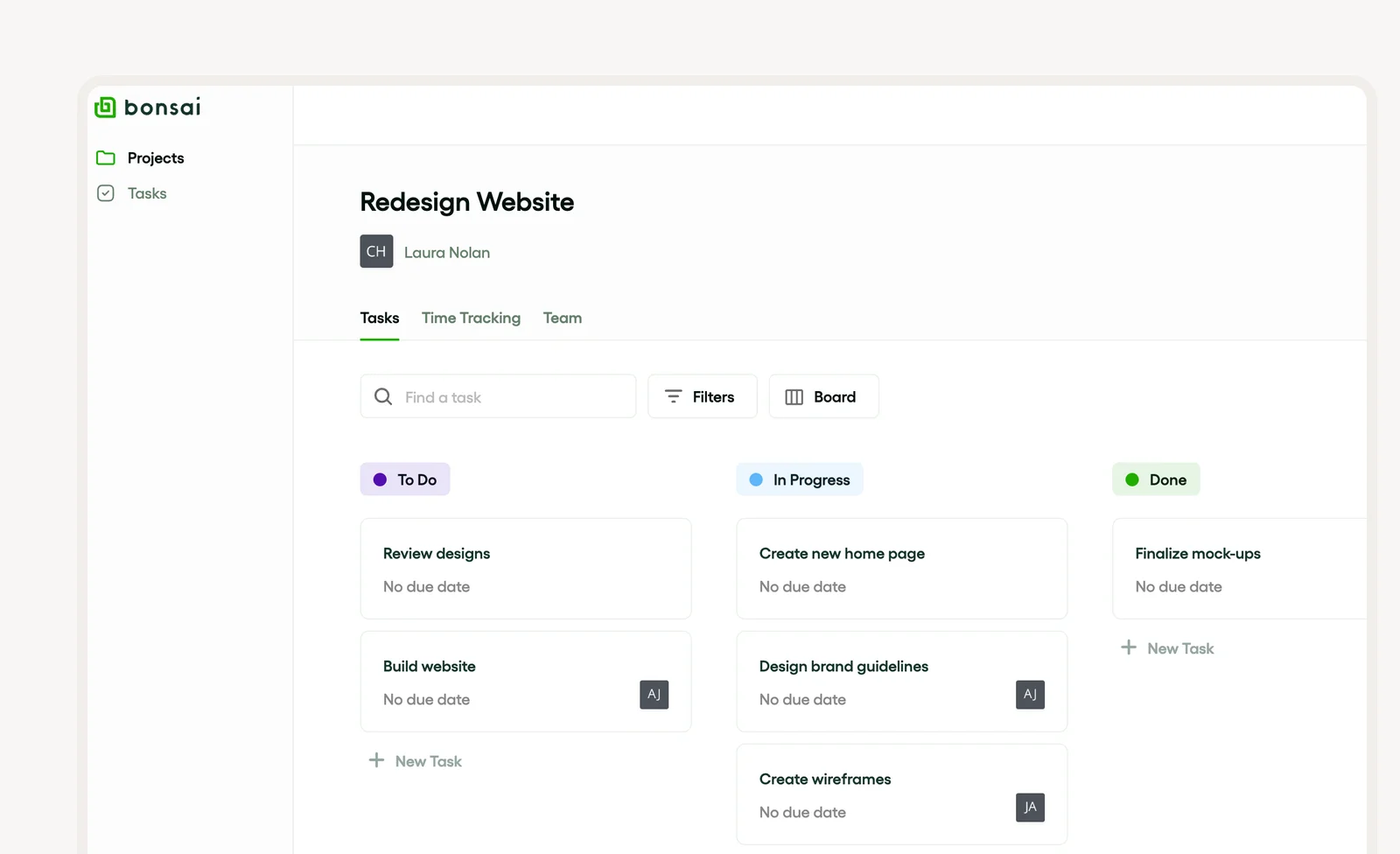

Using cost-benefit analysis in Bonsai for project management is a smart strategy that improves planning, budgeting, and cost control. This guide will assist you in using Bonsai's features to enhance your cost-benefit analysis.

Begin by identifying all potential costs and benefits related to your project. This includes direct costs like labor and materials, as well as indirect costs such as overhead. It's essential to assign monetary values to these elements for a clear comparison. Bonsai's user-friendly interface makes this process easy, allowing you to input and track these values without hassle.

- Assign tasks to team members

- Easily track task progress with Kanban and list views.

- Use integrated timers to manage time effectively.

- Invite collaborators to your projects to assign tasks.

As the project progresses, continuously monitor the costs and benefits. Bonsai's real-time updates and notifications ensure you stay informed about any changes. If necessary, adjust your plans to keep the project on track.

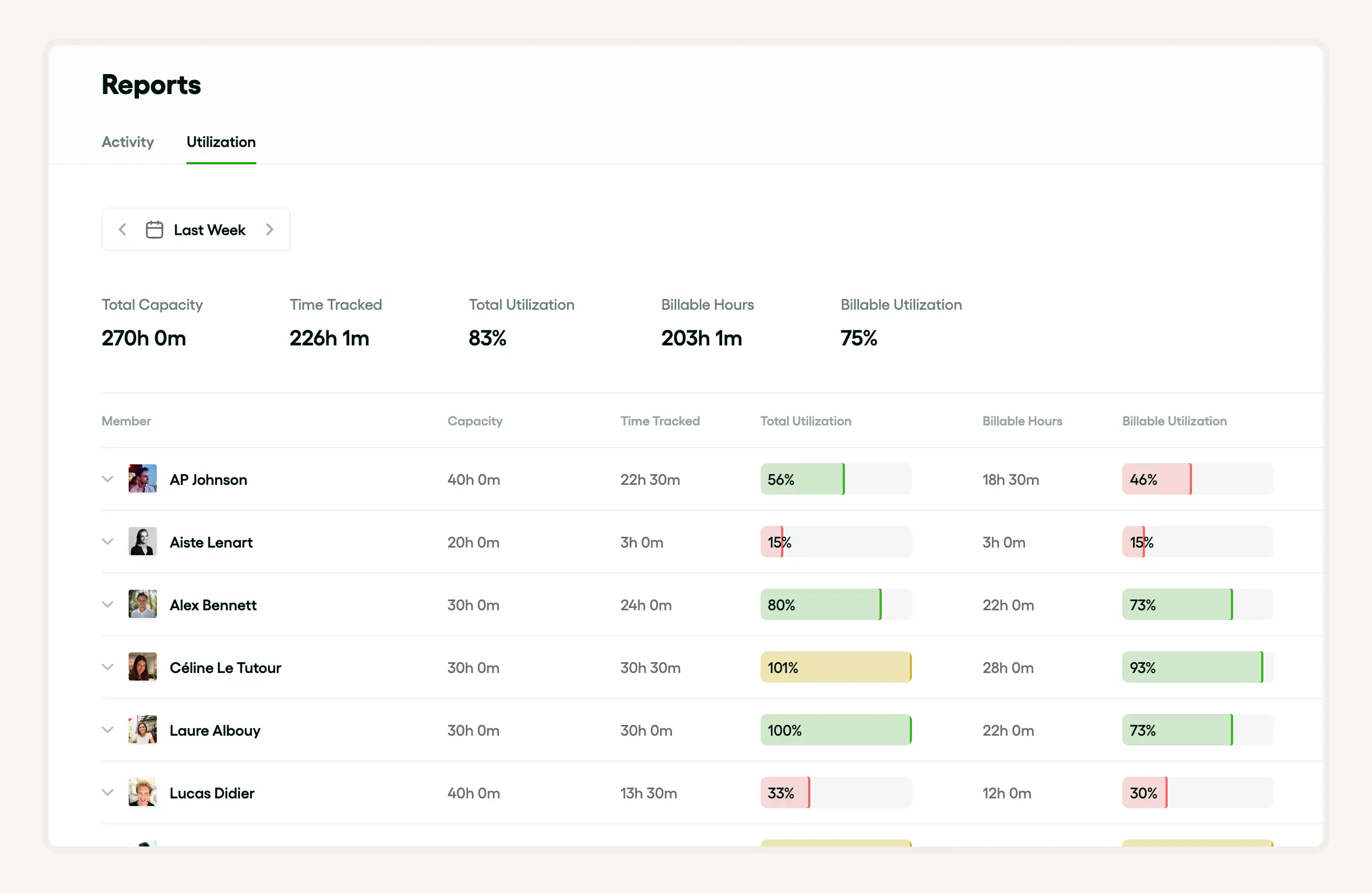

Use Bonsai's comprehensive reporting tools to create detailed reports. These reports offer valuable insights into the cost-benefit analysis, highlighting key successes and areas for improvement. Sharing these reports with stakeholders promotes informed decision-making and enhances transparency.

You can track a team member's capacity utilization over time using the utilization report. The report features color-coded bars for Total Utilization and Billable Utilization to show capacity levels:

- 0% - 49%: Red

- 50% - 100%: Green

- Over 100%: Yellow

Effective budgeting is another important aspect of cost-benefit analysis. Bonsai enables you to set and manage project budgets effectively. By combining cost-benefit analysis with budget tracking, you can ensure that your project remains financially viable. Bonsai's real-time updates and notifications keep you informed about any changes, helping you stay on top of your budget.

Resource planning and forecasting are also critical components of cost-benefit analysis. Bonsai's resource forecasting tools allow you to anticipate future resource needs based on your analysis. This proactive approach aids in efficient resource allocation, preventing bottlenecks and ensuring that the right resources are available when necessary.

Role of cost-benefit analysis in project management

In project management, cost-benefit analysis is crucial, offering a systematic approach to evaluate the economic feasibility of projects. It assesses direct, indirect, and intangible costs, alongside net present value and opportunity cost, ensuring that the economic benefits justify the expenditures. This analysis is vital for identifying cost reductions and calculating the economic efficiency of projects.

Cost-benefit analysis in financial planning

In financial planning, cost-benefit analysis is key, providing an economic evaluation to determine the viability of projects by weighing both tangible and intangible costs against potential benefits. Important factors like the benefit-cost ratio, net present value, and opportunity cost play significant roles in identifying viable cost reductions and ensuring informed investment decisions.

Use of cost-benefit analysis in policy making

Cost-benefit analysis (CBA) is fundamental in policy-making, offering a critical lens through which projected costs and benefits are examined. This economic tool evaluates policies by comparing costs with anticipated economic returns, factoring in both tangible and intangible elements to assess net present value and opportunity costs. CBA is essential for crafting policies that promise high returns and low risks.

Pros of cost-benefit analysis

Cost-benefit analysis simplifies decision-making. By comparing projected costs—direct, indirect, and intangible—with expected benefits, businesses can gauge project feasibility. This economic analysis helps identify cost reductions and maximize benefits. Techniques like benefit-cost ratio, net present value, and opportunity cost quantify economic benefits, aiding informed decisions on project costs and ROI.

Quantitative approach to decision making

A quantitative approach uses techniques like cost-benefit analysis, economic analysis, and net present value. These methods help managers understand projected costs and benefits, including direct, indirect, and intangible costs. This approach also considers opportunity cost, benefit-cost ratio, and feasibility, providing a clearer perspective on project costs and potential savings. It enables organizations to maximize economic benefits during decision-making.

Comparative analysis of alternatives

Cost-benefit analysis evaluates direct, indirect, and intangible costs for each alternative. This detailed economic analysis weighs projected costs, opportunity cost, and potential savings against possible benefits.

Economic benefits are compared to project costs to compute the benefit-cost ratio. Net present value is also considered, accounting for the time value of money. This comprehensive evaluation method accurately determines feasibility, guiding key business decisions.

Long-term financial planning

Long-term financial planning involves strategic decision-making, weighing projected costs, benefits, and feasible strategies. Cost-benefit analysis determines direct and indirect costs relative to potential economic benefits. Intangible costs, net present value, and opportunity cost are considered. The goal is a favorable benefit-cost ratio, signifying a viable investment.

Economic analysis reveals potential cost reductions, making project costs sustainable long-term.

Cons of cost-benefit analysis

Cost-benefit analysis has limitations. Predicting projected costs and benefits is challenging, relying on data availability and reliability. Unforeseen circumstances impact outcomes. Quantifying intangible costs and benefits is difficult, affecting analysis validity.

The decision-making process can be oversimplified, neglecting complexity and underlying factors. Feasibility of cost reductions or shifts in economic benefits may be overlooked. The benefit-cost ratio might miss opportunity costs, indirect costs, and project cost fluctuations over time.

Limitations in quantifying benefits

Quantifying benefits in cost-benefit analysis faces limitations. Indirect and intangible costs are hard to estimate accurately. Changing market conditions affect projected costs and benefits, making net present value and benefit-cost ratio uncertain. Measuring non-economic benefits and integrating sustainability and feasibility considerations complicate cost reductions and opportunity cost assessments.

Challenges in predicting future costs and benefits

Predicting future costs and benefits is tough due to uncertainty and a dynamic economic environment. Calculating projected, indirect, and intangible costs accurately is difficult in cost-benefit analysis. Determining benefit-cost ratio and net present value is intricate as assumptions change, impacting decisions.

Assessing economic benefits, understanding opportunity cost, and estimating cost reductions require thorough knowledge and forecasting, which isn’t always feasible. Unpredicted project costs add hurdles.

Subjectivity in assigning monetary value

Assigning monetary value to project components like projected, direct, and indirect costs is subjective.

Accurate economic analysis, including cost-benefit analysis and net present value, needs objectivity. Intangible costs and benefits introduce subjectivity, potentially biasing feasibility and opportunity cost assessments. This subjectivity can influence the benefit-cost ratio, affecting perceived economic benefits and potential cost reductions, impacting project costs.

Steps in conducting a cost-benefit analysis

Starting with the basics, conducting a cost-benefit analysis kicks off with identifying all project costs. This includes direct and indirect costs and even those elusive intangible ones.

- You'll need to factor in the cost of all necessary resources and the opportunity cost.

- Next up, quantify the projected benefits—think economic perks, cost reductions, and other potential gains.

- Finally, stack up the total costs against the benefits using the benefit-cost ratio. This method provides a crystal-clear overview of the project's feasibility and net present value.

Identifying costs and benefits

Performing a cost-benefit analysis is a key step in management’s decision-making process. It encompasses all project costs—direct, indirect, and intangible. This helps spot potential cost reductions and validates the project's feasibility.

Presenting a benefit-cost ratio, this analysis measures economic benefits, smoothing business operations. Projected costs and opportunity costs are significant in determining the project’s net present value, offering insights into potential returns and overall financial health.

Assigning monetary value

In the decision-making process, assigning monetary value is crucial. This involves pinpointing and calculating both direct and indirect costs, such as project expenses and intangible costs, along with potential cost reductions.

Consider the benefits, from economic advantages to other potential gains. Tools like the benefit-cost ratio and net present value merge these elements, revealing project feasibility and opportunity cost. This ensures a comprehensive grasp of financial implications for any strategic decision.

Comparing costs and benefits

When taking on a project, comparing costs and benefits through a cost-benefit analysis is essential. Weigh the projected costs—direct, indirect, intangible, and opportunity—against the anticipated benefits, such as economic gains and cost reductions. The benefit-cost ratio and net present value are key metrics in this economic analysis, predicting project profitability and ensuring financial planning justifies the project costs with solid returns.

Conducting sensitivity analysis

A sensitivity analysis delves deeper into the cost-benefit analysis. It assesses projected costs—direct, indirect, and intangible—against expected benefits, including economic ones.

Key considerations include the benefit-cost ratio, net present value, and opportunity cost, along with potential cost reductions. This robust economic analysis factors in variations in project costs, determining economic viability and supporting informed decision-making by highlighting necessary adjustments and critical success factors.

Real-world applications of cost-benefit analysis

Cost-benefit analysis finds its footing in evaluating decisions across various sectors. In business, it aids in comparing projected costs to potential benefits, performing economic analysis to determine net present value and enable cost reductions. In government policy-making, it evaluates economic benefits and costs—direct, indirect, and intangible.

For project management, it assesses project costs, understanding opportunity costs and deciding on the worthiness of investments based on expected returns.

Cost-benefit analysis in Bonsai

Cost-benefit analysis in Bonsai serves as an important tool for project management, enabling teams to make well-informed decisions by comparing the anticipated costs and benefits of a project. This process includes identifying all potential expenses, such as labor, materials, and overhead, and evaluating them against the expected advantages, like increased revenue or enhanced efficiency.

In practical scenarios, cost-benefit analysis is employed to assess the viability of new projects, optimize resource distribution, and confirm that investments are justified.

For example, a company may use this analysis to determine whether to upgrade its software systems or invest in new machinery. By quantifying both costs and benefits, Bonsai assists project managers in prioritizing projects that promise the highest return on investment.

This structured approach not only supports improved decision-making but also bolsters financial planning and resource management, ensuring that projects are completed within budget and provide maximum value.

Cost-benefit analysis in Microsoft Project

In Microsoft Project, cost-benefit analysis is a cornerstone for project managers. It considers direct, indirect, and intangible costs, along with projected expenses.

Evaluating economic benefits, the benefit-cost ratio, and net present value helps in understanding project feasibility. Microsoft Project indexes project costs, envisions cost reductions, and calculates opportunity costs, making it an effective tool for comprehensive economic analysis in project management.

Cost-benefit analysis in Oracle Primavera

Oracle Primavera offers a robust platform for conducting cost-benefit analysis, streamlining decision-making by capturing projected costs. It estimates direct and indirect costs, calculates the benefit-cost ratio, and determines the net present value. This platform identifies opportunity and intangible costs, aiding in economic analysis and feasibility assessments, leading to significant cost reductions and enhanced project viability.

Conclusion: The value of cost-benefit analysis for agencies

Cost-benefit analysis is a vital tool in agency decision-making. It provides a comprehensive view of projected costs, benefits, and intangible costs, enabling informed choices. This method evaluates economic benefits, direct and indirect costs, and the benefit-cost ratio, considering feasibility, project costs, cost reductions, net present value, and opportunity cost. Ultimately, it helps in selecting projects that offer the highest return on investment.