Customer profitability analysis is a key responsibility of finance managers and plays a major role alongside customer valuation. It is a type of segmentation based on metrics like lifetime value and demographics. This analysis divides customers into two groups:

- Deserving

- Undeserving

Customer profitability analysis evaluates the relationship between a business and its customers to reveal customer acquisition cost and profit per customer. This relationship guides the calculation of customer lifetime value. Therefore, focusing on customer welfare can increase profit potential. In short, customer profitability analysis aids in making firm business decisions and shaping effective strategies.

Customer profitability analysis introduction

Customer Profitability Analysis (CPA) is an important metric that determines how businesses generate profits through customer selection. It includes factors like customer acquisition cost, customer lifetime value, and customer behavior. Some customers are accepted after analysis because, despite higher costs to serve, they bring more lifetime profit.

The objective of CPA is to differentiate customers based on the profit they generate. It provides valuable insights into customer interactions and improves relationships. This analysis considers factors like profit per customer, customer segment, and demographics.

Definition of customer profitability analysis

To improve customer acquisition cost efficiency, firms use Customer Profitability Analysis to separate high-value customers from lower-value ones. It details the costs and revenues involved in serving these customers. The assessment helps companies determine profitability for specific individuals or customer groups. This includes considering the customer’s lifetime value and the expected duration of their contribution.

To effectively use this analysis, businesses must gather customer information such as age, gender, income level, and interaction frequency. Advertisers can then devise strategies to increase profit per customer and overall company profitability.

Why customer profitability analysis matters

Analyzing customer profitability helps decide which types of customers are worth retaining and acquiring. Key factors include customer lifetime value, acquisition cost, and profit per account. Additionally, knowledge of customer behavior enables businesses to improve relations through social and demographic segmentation.

In addition, this analysis helps in relationship marketing by providing information on the profitability of specific customers versus their servicing costs. In this way, businesses can plan their strategies in such a way as to increase the lifetime value of customers and the total profit.

Why customer profitability analysis matters

Customer profitability analysis is a key tactic that helps companies assess profit generated from specific customer segments. Lifetime value and customer acquisition cost distinguish profitable customers from unprofitable ones.

This analysis expands on customer demographics and behavior by studying the profitability of individual customers or groups. It enhances how customers and businesses relate, thereby improving customer relationships.

Profit per customer analysis highlights the costs of doing business with specific customers and provides a broader view of customer lifetime value.

Identifying profitable and non-profitable customers

Customer Profitability Analysis defines the criteria for high-value and low-value customers. Understanding which customers are valuable over time helps businesses decide which customers to attract.

Some customers prove more profitable long term due to purchasing patterns, socio-economic status, and cost to serve. Customer segments with strong profit potential should be supported by appealing relationship strategies. Customers with low anticipated profit may require resource realignment.

By balancing risk and analyzing value over the lifetime of the customer, a business can budget better and add value as well as increase profits.

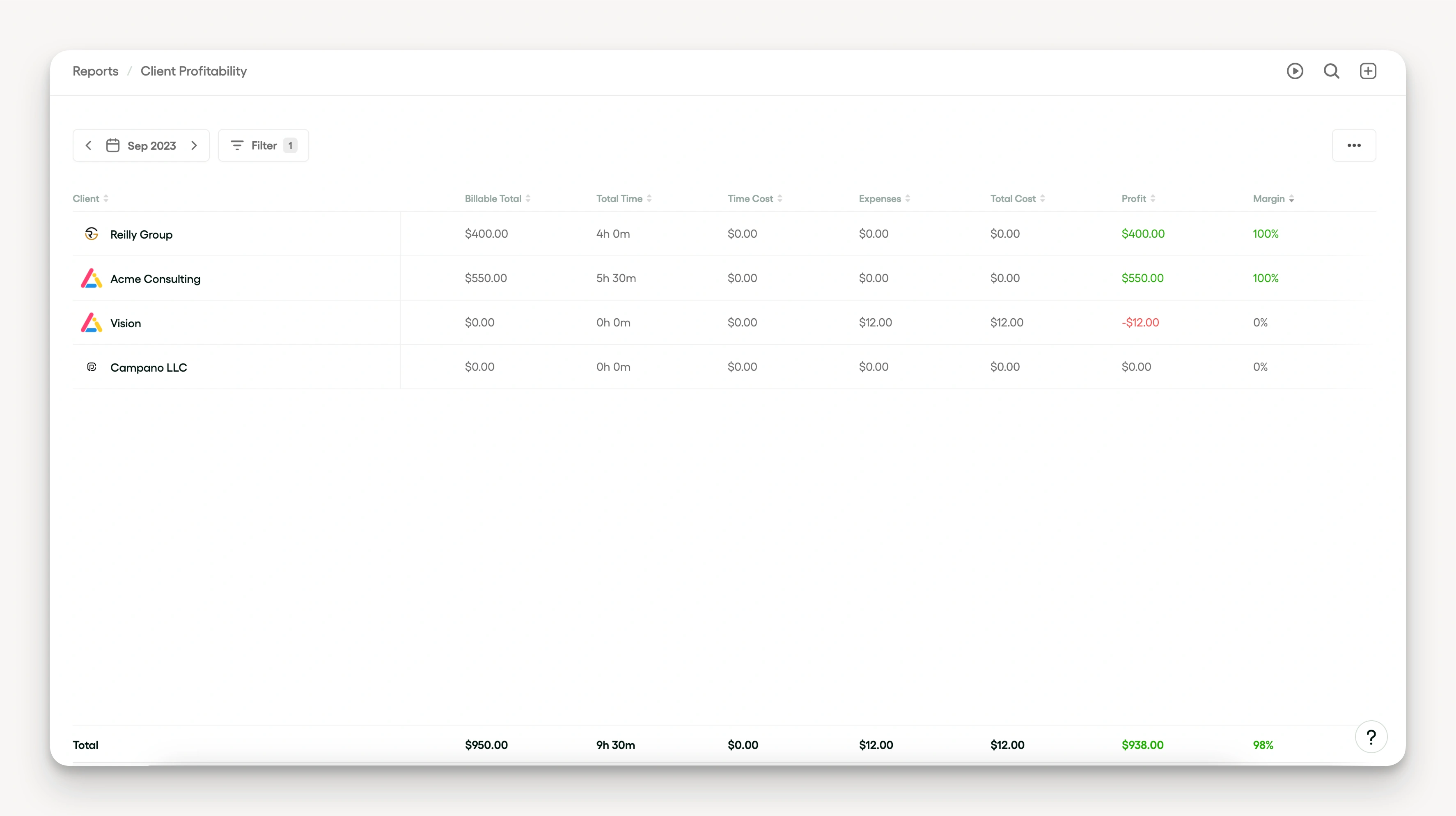

With Bonsai’s Client Profitability Report, agencies can quickly assess the profitability of individual clients through a clean, intuitive dashboard. For each client, Bonsai provides a detailed breakdown of billable time, expenses, and total profit, allowing businesses to make informed decisions about where to invest their time and resources. Whether identifying high-profit clients or understanding where certain clients may be costing the business more than they bring in, Bonsai simplifies the customer profitability analysis process.

Building better customer relationships

Polishing Customer Relationship Management (CRM) involves various activities aimed at creating outstanding resources. One of the most critical is conducting an extensive customer profitability analysis. Social, cultural, psychographic, or behavioural segmentation aspects classify customers based on their profitability index.

In addition, the word “customer segmentation strategies” drastically changes standard approaches used regarding the customer segmentation process. This more practical way of performing customer segmentation can lower the customer acquisition cost and maximize customer lifetime value at the same time.

Bonsai’s Client Management dashboard is an essential tool for enhancing customer relationship management. It allows agencies to organize and track all client information in one centralized location, including contact details, communication history, and custom tags. This makes it easier to manage both active clients and leads, helping agencies tailor their interactions based on the client’s current status. By efficiently tracking and categorizing clients, Bonsai enables businesses to maintain stronger relationships with high-value clients, while also identifying opportunities for nurturing leads into profitable customers.

As a final point, it is important to note that the third principle of effective CRM paints a picture of the organization having gained ample experience in dealing with customers. This does not only entail offering services to a certain category of customers but also customising services in order to satisfy customers’ needs, promote loyalty and enhance business growth as a whole.

Improving pricing strategies

Strong pricing tactics improve through customer profitability analysis. This involves understanding customer profiles and behaviours, allowing the business to classify customers as profitable or not. Such differentiation helps apportion efforts and resources optimally.

Determining the lifetime value of a customer helps establish the merits of spending on acquiring more customers. Additionally, it strengthens productive relationships by ensuring effective interaction between the business and its customers.

As a consequence of the said practices, pricing strategies can be developed that can address each of the market segments thus providing services to the right customers and making profits.

Customer profitability analysis formula unpacked

Customer profitability analysis is a key metric describing the benefits a company gains from customers within certain subscribed profiles throughout their relationship with the firm. To better understand this concept, focus on three elements:

- Customer acquisition cost

- Customer lifetime value

- Profit per customer

- the cost of acquisition of the customer,

- the lifetime of the customer, and

- the type of customers the business has.

Customer acquisition cost is the total expense incurred to acquire new customers. Customer lifetime value is the total revenue reasonably expected from one customer account, specifying both revenue value and expected duration of the customer relationship. These metrics allow segmentation of customers into high-value and low-value groups within the firm.

These patterns of behaviour are an essential aspect of customer relationship management and per-customer profit maximization; this includes the understanding of the customer’s purchasing patterns and relationship with the business. Profits from serving a particular customer can thus be improved by the observation and modification of the customer behaviour.

Components of the formula

The customer profitability analysis formula includes many factors. One is the customer acquisition cost, which determines the total spent to win new customers. It also emphasizes customer lifetime value, the total profit realized from a customer over the period of business interaction.

The formula also evaluates purchasing patterns and business interactions. The objective is to distinguish between high-value and low-value customers. High-value customers generate more profit per customer, while strategies for low-value customers focus on relationship building and improving customer lifetime value.

Analysis of findings

Customer profitability analysis divides customers into high-value and low-value segments. Loyal customers have high lifetime value and generate high profit due to favorable interactions and good customer management. In contrast, low-value customers add little value and may incur very high acquisition costs. Companies use segmentation by variables such as ethnicity, income, or location to serve these market segments effectively.

Attribution of revenue and costs to customers or segments

How to assign revenue to individual customers or segments

Assign revenue to customers or segments by tracking sales data accurately. Use your invoicing or CRM system, like QuickBooks or HubSpot, to record each transaction linked to a specific customer or group. This direct linkage ensures you know exactly how much revenue each customer generates over a given period.

For example, if a freelancer sells graphic design services, they can categorize clients by industry or project type in their invoicing software. This segmentation helps identify which client groups contribute the most revenue. Additionally, recurring revenue from subscription clients should be tracked separately to understand long-term value.

To take action, set up reports in your accounting software that summarize revenue by customer or segment monthly. This practice helps you spot trends and prioritize high-value customers for marketing or service improvements.

Methods to allocate costs accurately to customers or segments

Allocating costs to customers requires identifying both direct and indirect expenses related to serving them. Direct costs include materials, labor, or subcontractor fees tied to specific projects. Indirect costs include software subscriptions and office rent, which need to be apportioned based on usage or time spent.

For instance, a small marketing agency might track hours spent on each client using time-tracking tools like Toggl or Harvest. These hours can then be multiplied by hourly rates to assign labor costs. Overhead expenses can be divided proportionally based on revenue share or project complexity.

To implement this, maintain detailed records of all expenses and regularly review them to refine your allocation methods. This approach ensures your profitability analysis reflects true costs, enabling better pricing and resource decisions.

Using customer profitability analysis to improve business decisions

Customer profitability analysis reveals which clients or segments generate the most profit after accounting for associated costs. This insight helps freelancers and small business owners decide where to focus efforts, whether by increasing prices, reducing service costs, or targeting marketing.

For example, if a segment generates high revenue but also high costs, you might negotiate better supplier rates or streamline processes to improve margins. Conversely, low-profit or loss-making customers may require renegotiated terms or could be phased out to free resources.

Start by creating a simple profitability report using spreadsheet software like Excel or Google Sheets, combining your revenue and cost data per customer. Regularly update this report in 2024 to guide smarter decisions that boost your overall business health.

Customer segmentation in profitability analysis

Why segment customers for profitability analysis

Segmenting customers is essential for accurate profitability analysis because it groups clients with similar behaviors and value to your business. This approach helps freelancers and small business owners identify which customer types generate the most profit and which may be costing more than they bring in.

For example, a graphic designer might find that repeat clients ordering large projects contribute significantly more profit than one-time clients requesting small jobs. By segmenting customers into categories like frequency, order size, or service type, you can tailor your strategies to focus on the most profitable groups.

To start segmenting, gather data from your invoicing software or CRM, such as HelloBonsai or HubSpot, and classify customers based on measurable traits. This foundation allows you to make informed decisions about marketing, pricing, and service prioritization to boost overall profitability.

How to create customer segments for profitability

Creating customer segments begins by analyzing key metrics like revenue, frequency of purchases, and cost to serve each client. Use your accounting or invoicing tool to export customer data for the current 2024 tax year, focusing on total sales and associated expenses per customer.

Next, group customers based on shared characteristics. For example, segment by:

- High-value clients who generate over $5,000 annually

- Occasional clients with fewer than three purchases

- Clients requiring extensive support that increases service costs

Tools like Excel or Google Sheets can help you organize and visualize this data effectively.

Once segments are defined, calculate the profitability for each by subtracting the direct costs and time invested from the revenue generated. This step reveals which groups contribute positively to your bottom line and which may need reevaluation or different handling to improve margins.

Using segmentation insights to improve profitability

After identifying profitable and less profitable customer segments, tailor your business strategies to maximize returns. For example, you can offer loyalty discounts or premium services to high-profit segments to encourage repeat business and increase revenue.

Conversely, for less profitable segments, consider adjusting pricing, streamlining service delivery, or setting minimum order requirements to reduce costs. A freelance writer might limit low-paying clients who demand extensive revisions, focusing instead on clients who value and pay for premium content.

Regularly revisit your customer segments throughout 2024 and beyond, updating your analysis with new data to adapt to changing client behaviors. This ongoing process ensures your business remains focused on the most profitable opportunities and avoids wasting resources on unprofitable customers.

Strategies to improve customer profitability

Segment customers based on profitability

Segmenting customers by profitability helps you focus resources on those who bring the most value. Start by categorizing customers into groups such as:

- High profitability

- Medium profitability

- Low profitability

This segmentation uses recent sales and cost data from 2024. Tools like QuickBooks or FreshBooks can track revenue and associated expenses per client to make this process easier.

Once segmented, tailor your marketing and service efforts accordingly. For example, offer loyalty programs or premium support to high-profit customers to encourage retention. Conversely, evaluate if low-profit customers require adjusted pricing or reduced service levels to improve margins. This targeted approach ensures your time and money generate better returns.

Regularly updating these segments every quarter helps you respond to changes in customer behavior or costs. Use this data-driven method to prioritize your best clients and optimize your business strategy for 2024 and beyond.

Increase customer lifetime value through upselling and cross-selling

Increasing customer lifetime value (CLV) boosts profitability by encouraging repeat business and higher spending. Focus on upselling higher-tier services or cross-selling complementary products tailored to each customer's needs. For instance, a freelance graphic designer might offer brand strategy consulting alongside design work.

Leverage customer data from CRM tools like HubSpot or Zoho CRM to identify buying patterns and preferences. Personalized email campaigns or follow-up calls can introduce relevant offers that add value without appearing pushy. In 2024, automation features in these platforms make it easier to scale such efforts efficiently.

Track the success of upselling and cross-selling campaigns by monitoring changes in average order value and repeat purchase rates. Adjust your approach based on what resonates most with your customer segments to steadily enhance profitability.

Optimize pricing strategies based on customer insights

Optimizing pricing is crucial for improving customer profitability. Use insights from your profitability analysis to identify customers who are sensitive to price changes versus those willing to pay for premium services. For example, small business clients might respond well to bundled service discounts, while enterprise clients may prefer customized pricing.

Consider implementing tiered pricing or value-based pricing models that reflect the benefits customers receive. Tools like Price Intelligently or ProfitWell can help analyze pricing data and recommend adjustments. In 2024, dynamic pricing software also allows real-time price optimization based on demand and competition.

Test pricing changes with a subset of customers before full rollout to minimize risk. Communicate clearly about the value behind price adjustments to maintain trust. This strategic approach ensures your pricing supports profitability without alienating customers.

Reduce costs through process improvements and automation

Lowering the cost to serve customers directly increases profitability. Identify repetitive or time-consuming tasks in your workflows that can be automated or streamlined. For example, using invoicing software like HelloBonsai or QuickBooks can reduce manual billing errors and speed up payments.

Automate customer communication with tools such as Mailchimp or ActiveCampaign to nurture leads and handle routine inquiries. This frees up time for personalized interactions with high-value clients. Additionally, review supplier contracts or service delivery methods to cut unnecessary expenses without sacrificing quality.

Regularly measure the impact of these improvements by comparing operational costs before and after implementation. Continuous process optimization ensures your business remains lean and profitable in 2024’s competitive environment.

Benefits of customer profitability analysis

Customer profitability analysis identifies high-value and low-value customers. Focusing on high-profit customers minimizes resources spent on less profitable ones while maximizing profits from concentrated customer segments. This targeted approach improves communication by enhancing understanding of customer needs.

This approach also reduces costs of acquiring new customers and maintains positive customer relationships. By focusing on customer lifetime value and attributes, analysts can optimize servicing at the individual customer level to enhance overall firm profits.

Improved decision making

Customer profitability analysis enhances decision-making. Analyzing customer purchase patterns and behavior enables businesses to tag customers as high value or low value. This makes it easier to manage costs, reduce customer acquisition expenses, and improve the interaction between customers and the business.

Customer profitability analysis estimates customer lifetime value, which influences business decisions about which customer relationships to pursue. By servicing customer segments based on profitability, businesses can increase profit per customer. This improves overall business performance.

Enhanced revenue and profitability

Customer profitability analysis is crucial for increasing revenues and profits by segmenting customers into highly profitable and less profitable groups. Firms must focus efforts on high-value customers due to their high lifetime value. Building loyalty through understanding customer behavior and enhancing customer-business interactions is essential.

Businesses should adopt strategies that generate high profit per customer while keeping customer acquisition costs low. This requires thorough market research and customer segmentation. Implementing these strategies ensures effective servicing of selected customers and increases average customer lifetime value.

Automate your billing process with Bonsai's recurring invoices – set it once and ensure timely payments for ongoing projects

One way to ensure consistent revenue streams is by using Bonsai’s recurring invoice feature. This tool allows agencies to automate billing for ongoing projects, retainers, or long-term clients. This helps make sure that invoices are sent on time without any manual effort. With customizable billing cycles and payment methods, agencies can set up recurring invoices that align with their clients' payment schedules.

This not only helps in maintaining a steady cash flow but also reduces administrative work, allowing businesses to focus on maximizing profitability while keeping client payments seamless and organized.

Increased customer retention

Focusing customer retention on optimizing lifetime value and strengthening customer-business relationships is most effective. An efficient retention strategy requires careful analysis of customer profitability. This helps identify clients who deliver strong returns and those who need servicing despite lower profitability.

Customer analysis is key to building and enhancing relationships. Adapting services to market segment needs not only increases customer satisfaction but also reduces marketing costs for new customer acquisition.

Retaining customers generates more profit and supports further company growth and development.

How to apply customer profitability analysis in your agency?

Customer profitability analysis is a critical step to improve growth trends and profit levels in your agency. This approach identifies important versus less important customers by assessing the profitability of servicing each one. It involves evaluating factors such as customer acquisition cost, lifetime value, and customer nature.

Common techniques for assessment include recording and monitoring customer-business interactions, analyzing customer background, and evaluating these interactions. Integrating these methods enables advanced segmentation and precise allocation of resources to reach the most productive customers.

Steps to implement customer profitability analysis

Customer profitability analysis categorizes customers based on their profitability and characteristics. It identifies those who generate substantial revenue, those who provide limited profit, and those in the middle range.

The customer acquisition cost, service costs, and relationship maintenance costs per segment are determined. Calculating customer lifetime value reveals the profit generated by a customer over a specified period. Evaluating purchase patterns helps identify measures to improve profit per customer.

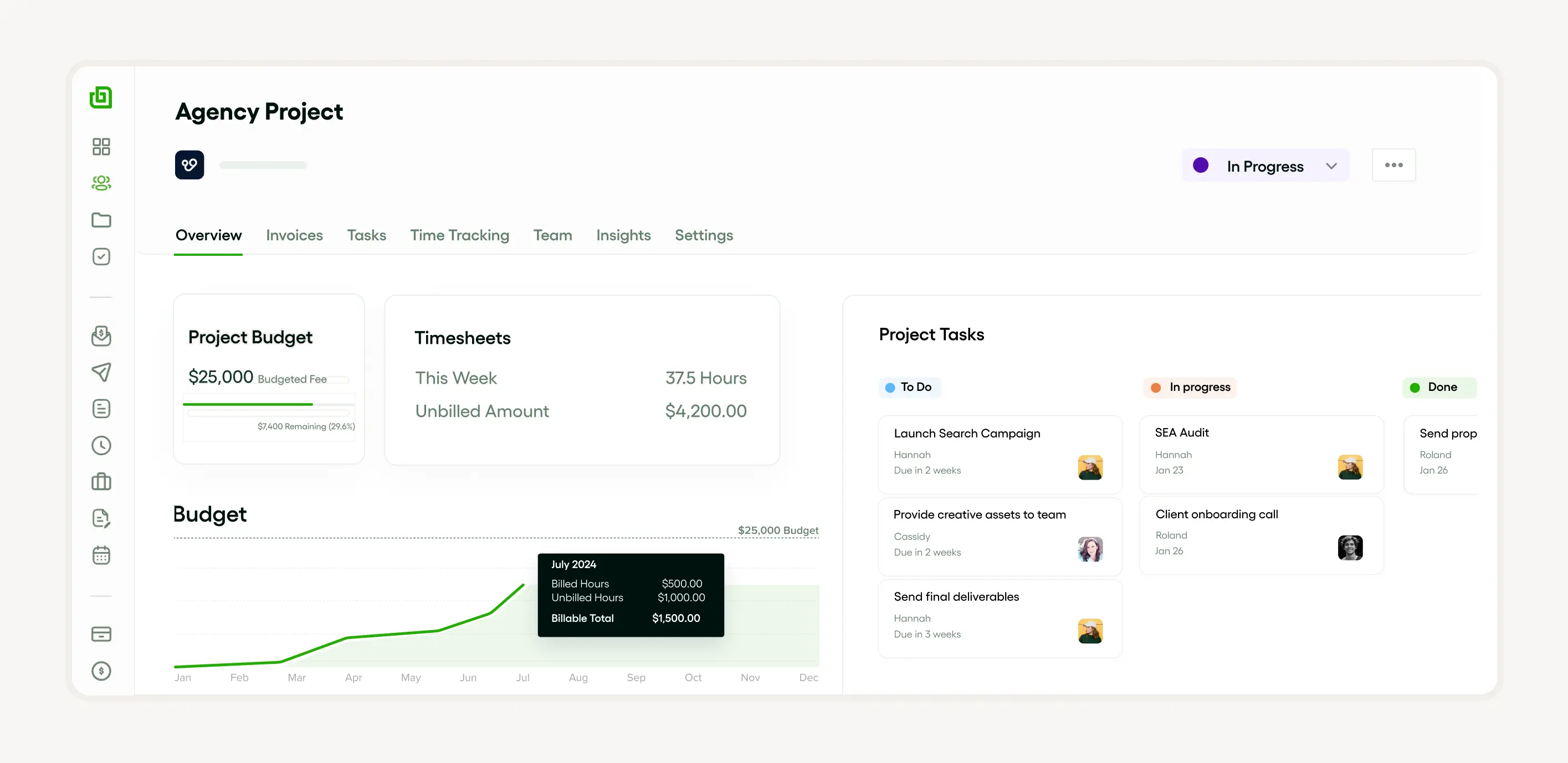

How to use Bonsai to generate profitability reports

Step 1: Set up team members' billable and cost rates

If you would like to monitor the budget of a project, then you need to first enter the billable amount and cost rate of the team members in Bonsai. These rates will decide how much you will be charging the clients concerning their work as well as costing them internally for their time. Getting these rates accurately set is key to making sure that the profitability of the projects is monitored at all times.

Step 2: Create a project budget

Having completed the above step, prepare the project budget and create a new project within Bonsai. There are various methods you can use to make a budget:

- Based on billable time

- Based on expenses

- Based on both billable time and expenses

- Fee-based budget: Enter an amount representing the total fee that you will charge the client for the entire project.

- Time-based budget: State how long the project will take by providing a certain number of hours.

- Recurring budgets: Perfect for continuous projects or retainers whereby you can create a budget which replaces itself over a set duration.

You can further customize your budget by choosing whether to base it on billable time, expenses, or both.

Step 3: Set budget notifications

You may also enable budget notifications in Bonsai, and get notifications when you feel like you are reaching your budget limits. This helps to guarantee that you are performing within agreed limits and are not spending more than you should. The budget alerts allow you to take corrective action before making expenses beyond the limit you had budgeted.

Step 4: Establish project billable rates

Bonsai allows flexibility with billable rates. There is a billable rate tied to every project for every team member. You can also further break it down and assign billable rates on a per-project basis, if applicable. This allows for more flexibility and is dependent on the nature of the project or the client.

Step 5: Monitor budget status in real-time

Bonsai’s Insights will help you watch the real-time status of the project budget. See how much of your budget has gone to waste at what point and if other activities expected at a later date are predicted to breach the budget line. This permits timely changes and prevents situations that require extreme measures.

Step 6: Track project expenses

Bonsai will easily allow capturing all expenditures incurred in the course of project implementation and include labour costs as well as additional expenditures that may arise. By capturing both billable time and expenditure, you will have a better understanding of the source of expenditure in the execution of a particular project hence determining the profitability of the client’s project.

Step 7: Analyze profitability reports

Bonsai’s Client Profitability Report provides a detailed view of the financial performance of each client by comparing the billable totals against total costs. You can also use the report to analyze profitability per project and per team member, helping to pinpoint the areas where your business generates or loses revenue. Hence, it helps you evaluate which clients and projects bring the maximum profit to the agency.

Step 8: Forecast future profitability

The Bonsai profitability forecast feature enables you to plan for the future and make necessary strategies. Using the information as the basis for their decision, you are able to change the course of the business in order to improve profitability in the coming times. Detailed insights and forecasts serve to keep you on top of your financials.

Challenges and how to overcome them

An obstacle in customer-business relationships exists in the proper resource distribution among high-value and low-value customers. Customer profitability analysis is essential in addressing this. It helps decide on resource and effort inputs required to maintain customer relationships and operational ones.

A subsequent challenge is in the willingness and capacity of the buyers which serves as a basis for calculating the customer’s lifetime value. This is best handled by using a technique of profiling consumer characteristics and behaviour patterns.

Also, what most companies have to wrangle with is the high customer acquisition cost. This can be countered by concentrating more on the expansion of the customer’s profit per capita and better targeting a certain type of customer.

Tools and software for customer profitability analysis

Different tools and software are available for customer profitability analysis. For example:

- Customer relationship management (CRM) tools

- Business intelligence tools

- Predictive analytics software

These key software assist in segmenting high-value and low-value customers, customer analysis, and tracking business and customer relations. They provide better knowledge of the cost of customer acquisition and customer lifetime value, aiding strategic planning.

Likewise, these tools assist in measuring the profit per customer, enhancing customer relationships, and more efficient servicing of a particular customer or customer group. They also provide information regarding the characteristics of their customers and their lifetime value, which helps companies to optimize their profits.

One of the most effective ways for agencies to implement customer profitability analysis is by using Bonsai. This streamlines the process of evaluating client value, offering clear metrics on billable time, total costs, and profit margins. Bonsai allows agencies to easily segment clients and adjust their strategies based on real-time data, making the implementation of customer profitability analysis both simple and effective.

Summary of customer profitability analysis usefulness

Customer profitability analysis segments customers into high-value and low-value groups. It provides insights into customer behavior and customer-business cooperation, helping increase revenue per customer. Understanding customer acquisition costs and lifetime value is essential for building a customer portfolio and managing customer services, especially for focused customer segments.

Such a type of analysis also considers the demographics of the consumers providing a more nuanced view of the customer relationship. In the end, it assists organizations in achieving their profit maximization objectives and improves customer relations.

Future trends in customer profitability analysis

How artificial intelligence is transforming profitability insights

Artificial intelligence (AI) is revolutionizing customer profitability analysis by automating data processing and uncovering deeper insights. AI-powered tools like Microsoft Power BI, Tableau, and Google Looker now integrate machine learning models that predict customer lifetime value and identify high-risk accounts with greater accuracy.

For example, AI algorithms can analyze purchasing patterns and segment customers based on profitability potential, allowing freelancers and small businesses to tailor marketing efforts more effectively. This reduces wasted spending and improves return on investment (ROI) by focusing resources on the most valuable clients.

To leverage AI in your customer profitability analysis, start by adopting analytics platforms with built-in AI features. Regularly update your customer data and use predictive insights to adjust pricing, promotions, and service offerings. This proactive approach will help you stay competitive in 2024 and beyond.

Integrating real-time data for dynamic profitability tracking

Real-time data integration is becoming essential for accurate customer profitability analysis. Instead of relying on monthly or quarterly reports, businesses can now monitor profitability metrics continuously using tools like QuickBooks Online, Zoho Analytics, and Domo.

This approach allows freelancers and small business owners to respond immediately to changes in customer behavior, such as sudden drops in purchase frequency or increased service costs. For instance, if a client’s profitability declines due to frequent returns, you can quickly adjust contract terms or offer incentives to improve retention.

To implement real-time tracking, connect your sales, accounting, and customer service platforms through APIs or automation tools like Zapier. This will create a unified dashboard that updates key profitability indicators instantly, enabling agile decision-making throughout 2024.

Emphasizing customer experience as a profitability driver

Customer experience (CX) is increasingly recognized as a critical factor in profitability analysis. Happy customers tend to spend more and stay loyal, boosting long-term profits. Tools such as SurveyMonkey and Medallia help gather real-time feedback to link CX metrics directly with profitability outcomes.

For example, a freelancer might track how response time to client inquiries correlates with repeat business and profitability. Improving CX in targeted areas can lead to measurable profit increases by reducing churn and encouraging referrals.

To capitalize on this trend, incorporate CX data into your profitability models. Regularly survey customers, analyze feedback alongside financial data, and prioritize improvements that enhance satisfaction. This strategy will help you build stronger, more profitable relationships in 2024.

Criticism of customer profitability analysis

Challenges in accurately allocating costs

Customer profitability analysis often struggles with accurately assigning costs to individual customers. Many expenses, such as overhead, marketing, and customer service, are shared across multiple clients and require allocation methods that can be subjective or imprecise. For example, a freelancer might find it difficult to determine how much time spent on general administrative tasks should be charged to each client.

Using tools like QuickBooks or FreshBooks can help track billable hours and direct expenses, but indirect costs remain challenging to assign. This can lead to distorted profitability figures, where some customers appear more or less profitable than they truly are. Without precise cost allocation, decisions based on this analysis might be misleading.

To improve accuracy, freelancers and small business owners should regularly review their cost allocation methods and consider time-tracking software like Toggl or Harvest. These tools provide data to better estimate indirect costs, making customer profitability analysis more reliable and actionable.

Overlooking long-term customer value

Customer profitability analysis often focuses on short-term profits, which can lead to undervaluing customers who generate less immediate revenue but offer long-term potential. For instance, a new client might require significant upfront work with low initial returns but could become highly profitable over time through repeat business or referrals.

Small business owners should complement profitability analysis with metrics like customer lifetime value (CLV) to capture the full value of each relationship. Tools such as HubSpot CRM or Zoho CRM can help track customer interactions and forecast future revenue, providing a more balanced view.

By integrating long-term value considerations, freelancers can avoid prematurely dropping clients who might be strategic for growth. This approach encourages investment in nurturing relationships that pay off beyond immediate profits.

Data quality and complexity limitations

Customer profitability analysis requires accurate and comprehensive data, which can be difficult for freelancers and small businesses to maintain. Incomplete invoices, inconsistent time tracking, or missing expense records can all skew results. For example, a missed expense entry in 2026 could falsely inflate a customer's profitability.

Additionally, the complexity of gathering and analyzing data can overwhelm small business owners who lack dedicated accounting resources. While software like Xero or Wave offers user-friendly interfaces, the initial setup and ongoing data entry demand discipline and time.

To mitigate these issues, it’s important to establish routine data management practices, such as weekly reconciliation of expenses and invoices. Outsourcing bookkeeping or using integrated platforms that sync bank transactions automatically can also reduce errors and improve the quality of profitability insights.

Risk of damaging customer relationships

Relying heavily on customer profitability analysis may lead some freelancers or small businesses to cut ties with clients deemed unprofitable, which can harm long-term relationships and reputation. For example, a client who generates low profits but provides valuable referrals or strategic opportunities might be dropped prematurely.

It’s crucial to balance profitability data with qualitative factors such as customer loyalty, market positioning, and potential for growth. Communicating transparently with clients about pricing or service adjustments can help maintain trust while improving profitability.

Ultimately, customer profitability analysis should inform, not dictate, client management decisions. Using it as one of several tools ensures that business owners maintain strong relationships while optimizing their financial health.