Wenn Sie als Freiberufler Ihr Zuhause als Hauptgeschäftssitz nutzen und alle Ihre Rechnungsvorlagen von zu Hause aus erstellen und versenden, haben Sie wahrscheinlich das Formular 8829 für Ihre Selbstständigensteuer ausgefüllt (oder werden dies tun). Dieses Dokument der US-Steuerbehörde IRS trägt den Titel „Ausgaben für die geschäftliche Nutzung Ihres Eigenheims“ und wird von Selbstständigen üblicherweise jedes Steuerjahr ausgefüllt. Auch wenn Sie das Formular wahrscheinlich nicht erkennen, wenn Sie gängige Software-Dienste nutzen, füllen Sie es dennoch aus; diese Dienste automatisieren den Prozess lediglich durch eine Reihe von Fragen und Antworten.

Entdecken Sie unsere Anleitung zur Verwendung des Formulars 8829 für Ihr Heimgeschäft!

Sind Sie berechtigt, das Formular 8829 einzureichen?

Bevor Sie davon ausgehen, dass das Formular auf Sie zutrifft, gibt es einige Dinge, die die Steuerbehörde IRS sicherstellen möchte, bevor Sie einen Raum in Ihrem Zuhause als „Heimbüro” geltend machen können. Die vollständigen Details des Formulars sind auf der IRS-Website aufgeführt, aber hier sind die Grundlagen.

Sie müssen eine der folgenden Fragen mit „Ja“ beantworten, um die Steuervorteile des Formulars in Anspruch nehmen zu können:

- Nutzen Sie Ihr Zuhause als Hauptgeschäftssitz für eines Ihrer Unternehmen?

- Nutzen Sie Ihr Zuhause als Geschäftsraum, in dem Patienten, Klienten oder Kunden Sie regelmäßig aufsuchen?

- Nutzen Sie eine separate Struktur (Schuppen, Garage oder Gebäude) in Verbindung mit Ihrem Unternehmen?

Wenn Sie jedoch eine Kindertagesstätte besitzen oder Ihre Geschäftsräume zur Lagerung von Produktbeständen nutzen, gelten Ausnahmen.

Es ist auch wichtig, Ihr Zuhause für ein Unternehmen zu qualifizieren, indem Sie angeben, wie viel Platz Sie nutzen. Denken Sie daran, dass Sie Bonsai Tax zur Ermittlung von Steuerabzügen nutzen können.

Die US-Steuerbehörde IRS möchte sicherstellen, dass Sie diesen Raum „ausschließlich und regelmäßig für Verwaltungs- oder Managementtätigkeiten“ im Zusammenhang mit Ihrem Unternehmen nutzen und dass Sie keinen anderen Ort haben, an dem Sie einen wesentlichen Teil Ihrer Arbeit verrichten.

Ein Beispiel hierfür wäre, wenn Sie 40 Stunden pro Woche oder mehr mit Projektarbeit bei Starbucks verbringen, weil Ihr Haus zu klein ist. Die Steuerbehörde würde dann Starbucks als Ihren Hauptgeschäftssitz betrachten und Ihr Zuhause als solchen disqualifizieren. (Die Nutzung eines Hotelzimmers oder eines temporären Büroraums während einer Geschäftsreise führt jedoch nicht zum Ausschluss, da Sie dort nicht den Großteil Ihrer Arbeit verrichten.)

So berechnen Sie Ihren Homeoffice-Abzug

Da der Hauptzweck des Formulars 8829 darin besteht, einen Geschäftsabzug zu erhalten, den Sie von Ihrem Gesamteinkommen abziehen können – und damit Ihr zu versteuerndes Einkommen zu verringern –, ist es wichtig, dass Sie das Formular nach bestem Wissen und Gewissen ausfüllen, damit Sie den größtmöglichen Vorteil erzielen. Das Formular enthält viele Felder, in denen Sie ehrliche Angaben zu Ihrer Arbeitssituation machen müssen, darunter:

- Die Gesamtfläche Ihres Hauses

- Die Quadratmeterzahl der Fläche, die Sie ausschließlich als Homeoffice nutzen

- Ausgaben im Zusammenhang mit dem Besitz und der Instandhaltung Ihres Eigenheims, darunter: Reparaturen am Haus, abzugsfähige Hypothekenzinsen, Grundsteuern, Versicherungen, Nebenkosten und Gebühren für Wohneigentum/Instandhaltung

(Beachten Sie, dass „Büroausgaben” und „Ausgaben für den Haushalt” nicht dasselbe sind. Sie können die Kosten für Dinge wie Büromaterial und Möbel auf einem anderen Formular in Ihrer Steuererklärung geltend machen, aber diese gehören nicht auf das Formular 8829. Die Ausgaben für das Homeoffice sind auf die Kosten beschränkt, die mit der Struktur und Instandhaltung Ihres Hauses verbunden sind.

Das Formular enthält auch ein Feld für komplexere Zahlenangaben, darunter die Abschreibung Ihres Eigenheims und den Übertrag nicht abzugsfähiger Ausgaben aus früheren Jahren. Ihr Steuerberater sollte Ihnen bei diesen Fragen weiterhelfen können, aber auch die meisten Anbieter von Software für Heimunternehmen haben entsprechende Fragen dazu. Beachten Sie beim Ausfüllen des Formulars unbedingt die Anweisungen des IRS-Formulars 8829.

Wussten Sie, dass Sie Bonsai für die Buchhaltung verwenden können? Oder dass Bonsai Ihnen dabei helfen kann, sich auf die Selbstständigensteuer vorzubereiten, indem es Steuerschätzungen bereitstellt, Sie an Abgabetermine erinnert und Ihre Steuerabzüge ermittelt?

Mal sehen, wie das funktioniert. Gehen Sie zunächst zu Ihrem Bonsai-Hauptdashboard und schauen Sie sich die linke Seite genau an – wir werden mit den Bereichen Buchhaltung und Steuern arbeiten. Klicken Sie zunächst auf „Buchhaltung“.

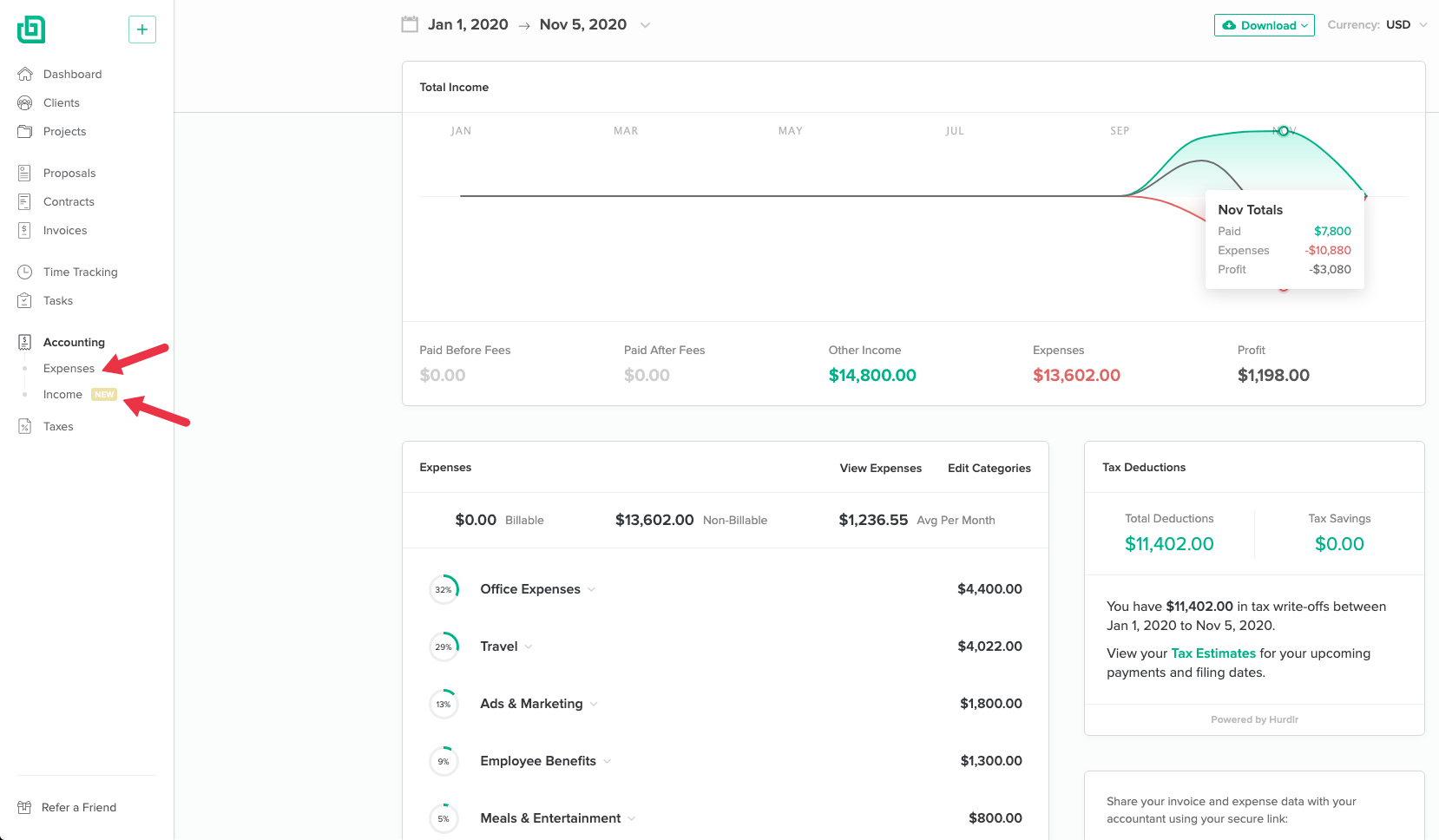

Im Abschnitt „Buchhaltung“ finden Sie eine Aufschlüsselung Ihrer Einnahmen und Ausgaben. Beide können entweder automatisch von Ihrem Bankkonto importiert oder manuell hinzugefügt werden. Auch Arbeiten, für die Sie über Bonsai bezahlt wurden, werden hier registriert.

Stellen Sie sicher, dass dieser Abschnitt ordnungsgemäß ausgefüllt ist, und klicken Sie anschließend auf „Steuern“.

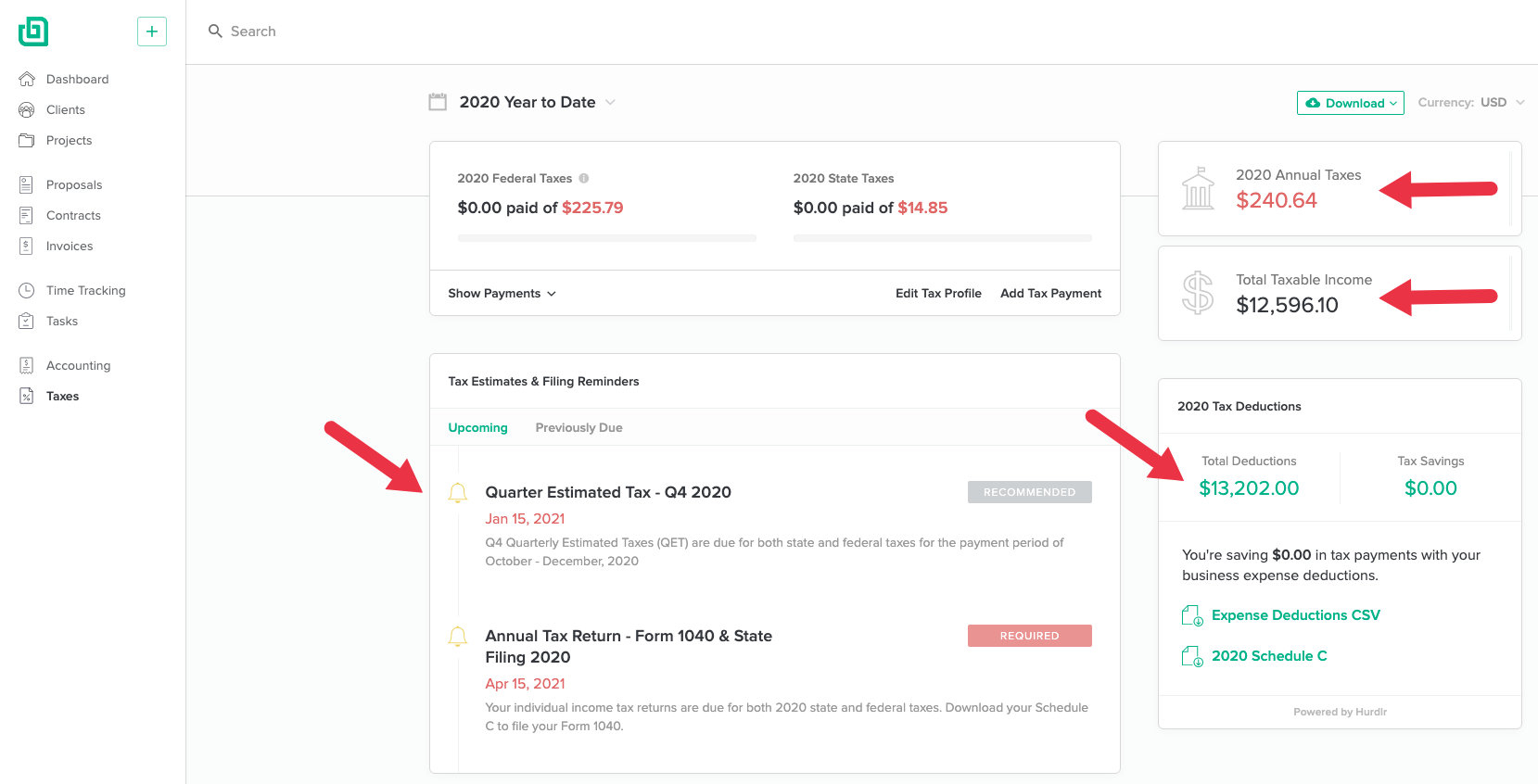

Hier geschieht das Wunder: Bonsai übernimmt alle Berechnungen für Sie und wir versorgen Sie mit einer Übersicht Ihrer geschätzten Steuern, einer Liste der Steuerabzüge, die Sie für die kommende Steuersaison nutzen können, sowie Erinnerungen an alle anstehenden Abgabetermine.

Einfach, oder? Wenn Sie bereit sind, Bonsai auszuprobieren und alle Funktionen zu erkunden, melden Sie sich für die kostenlose Testversion an!

Die vereinfachte Homeoffice-Abzugsmöglichkeit in Anspruch nehmen

Wenn Ihnen bei einem der oben genannten Punkte der Kopf schwirrt, sind Sie nicht allein. Tatsächlich hat die US-Steuerbehörde IRS 2013 einen überraschenden Schritt unternommen und eine einfachere Methode zur Geltendmachung von Homeoffice-Kosten eingeführt. Durch diese Maßnahme wurde eine sehr unkomplizierte Möglichkeit geschaffen, schnell eine Nummer für die Steuererklärung zu erhalten, wodurch den Steuerzahlern jedes Jahr schätzungsweise 1,6 Millionen Stunden Verwaltungsaufwand erspart bleiben. Daher eignet es sich für eine ganze Reihe von Freiberuflern, die von zu Hause aus arbeiten und über eine bescheidene Bürofläche (weniger als 300 Quadratfuß) verfügen.

Diese vereinfachte Methode für das Home Office wird nicht auf dem Formular 8829, sondern auf sechs Zeilen des Anhangs C ausgefüllt (weitere Informationen zum Ausfüllen dieses Formulars finden Sie hier). Diese Methode ändert nichts daran, wer Anspruch auf den Abzug hat. Es gelten dieselben Regeln wie zuvor hinsichtlich Ihrer ausschließlichen Nutzung der Räumlichkeiten und der Tatsache, dass Sie den Großteil Ihrer geschäftlichen Aktivitäten dort ausüben. Die wichtigsten Highlights dieser vereinfachten Methode sind wie folgt:

- Unternehmer können einen einfachen Standardabzug von 5 Dollar pro Quadratfuß für ihr Heimbüro geltend machen – bis zu einer Höchstgrenze von 300 Quadratfuß (oder 1500 Dollar).

- Diese haushaltsbezogenen Einzelabzüge (wie z. B. Grundsteuern) können weiterhin vollständig in Anhang A geltend gemacht werden.

- Es gibt keinen zusätzlichen Abschreibungsabzug für Wohnimmobilien und keine Möglichkeit, später verlorene Abschreibungen nachzuholen.

Da diese Methode ein ganzes Arbeitsblatt und Formular überflüssig macht, ist sie bei Freiberuflern und Personen, die ihre Steuern selbst erstellen, sehr beliebt. Weitere Informationen zu dieser Strategie finden Sie auf der FAQ-Seite der IRS.

Welche Methode soll verwendet werden?

Gibt es einen Grund, sich die Mühe zu machen, den komplizierteren Homeoffice-Abzug in Anspruch zu nehmen? Für manche lautet die Antwort ja. Für diejenigen mit einem sehr großen Heimbüro, das mehr als 300 Quadratfuß groß ist, können Sie möglicherweise mehr erreichen, indem Sie die Kosten einzeln aufführen. Tagesmütter könnten in diese Kategorie fallen, da sie in der Regel einen sehr großen Teil ihres Hauses für diesen Zweck nutzen und dieser nicht ausschließlich dafür bestimmt ist. Wer in einer separaten Struktur – beispielsweise einer Werkstatt – kreativ tätig ist, kann ebenfalls in diese Kategorie der „großen“ Homeoffices fallen.

Natürlich müssen Sie für die kompliziertere Steuerermäßigung jede einzelne Ausgabe nachverfolgen und dokumentieren. Der vereinfachte Abzug bietet Ihnen einen Pauschalbetrag, unabhängig davon, wie hoch Ihre Ausgaben sind. Wenn Sie es schaffen, nicht viel für Ihre Bürofläche zu bezahlen, können Sie mit einem großen Büro, das unter die 300-Quadratfuß-Grenze fällt und relativ günstig zu unterhalten ist, einen Vorteil erzielen. Bei der vereinfachten Methode müssen Sie keine detaillierten Beispiele für Ihre Kosten angeben, sodass auch der Verwaltungsaufwand deutlich geringer ist.

Probieren Sie unser kostenloses Arbeitsblatt aus, um den Steuerabzugsbetrag für Ihr Homeoffice manuell zu berechnen.

Hilfe ist da

Die gute Nachricht ist, dass Sie die Dinge nicht alleine herausfinden müssen. Unabhängig davon, ob Sie die Hilfe eines zertifizierten Steuerberaters in Anspruch nehmen oder eines der vielen seriösen Online-Steuerprodukte nutzen, gibt es den Home-Office-Abzug schon lange genug, sodass die Berechnungen zuverlässig sind. Da es sich um ein gängiges Formular handelt, das häufig verwendet wird und Fachleute daran gewöhnt sind, entfällt ein Großteil des Rätselratens. Sie sollten beide Methoden ausprobieren können und Ihnen mitteilen, welche Ihnen den größten Steuerabzug einbringt. Wenn Sie Ihre Steuern falsch angeben, könnte dies eine Prüfung der Homeoffice-Abzüge nach sich ziehen.

Wenn Sie Ihrem Fachmann jedoch helfen möchten (oder Ihre Zeit am Computer weniger mühsam gestalten möchten), sollten Sie vor der Einreichung die folgenden Informationen zusammenstellen:

- Quadratmeterzahl Ihres Zuhauses und Ihres Heimbüros

- Belege für Ausgaben im Zusammenhang mit dem Eigenheim, wie z. B. Nebenkosten, Reparaturen, Steuern und Hypothekenzinsen

- Antworten auf die Fragen, wie viel Prozent Ihres Geschäfts Sie von zu Hause aus erledigen und ob Ihr Zuhause ausschließlich für diesen Zweck genutzt wird.

Können Sie Ihre Meinung ändern?

Sie können zwar frei wählen, welche Methode für Sie am besten geeignet ist und Ihnen die meisten Einsparungen bringt, jedoch können Sie innerhalb desselben Steuerjahres nicht von einer Methode zur anderen wechseln. Wie sieht es von einem Jahr zum nächsten aus? Die US-Steuerbehörde IRS erklärt dies wie folgt:

„Wenn Sie die vereinfachte Methode für ein Jahr anwenden und in jedem folgenden Jahr die reguläre Methode verwenden, müssen Sie den Abschreibungsabzug für das folgende Jahr anhand der entsprechenden optionalen Abschreibungstabelle berechnen. Dies gilt unabhängig davon, ob Sie für das erste Jahr, in dem die Immobilie geschäftlich genutzt wurde, eine optionale Abschreibungstabelle verwendet haben.

Der Homeoffice-Abzug ist nur eines von vielen Instrumenten, mit denen Sie Geld sparen, einen größeren Teil Ihres Einkommens behalten und zu hohe Steuerzahlungen vermeiden können. Wenn Sie sich rechtzeitig vor der Steuererklärung vorbereiten, können Sie kostspielige Fehler vermeiden. Beginnen Sie jetzt mit der Planung der Details, die den 15. April zu einem Kinderspiel machen werden!

Verwenden Sie Bonsai, um Ihre freiberufliche Tätigkeit zu verwalten, Ausgaben zu importieren, Steuerabzüge zu ermitteln und vierteljährliche Steuern zu schätzen – melden Sie sich für eine kostenlose Testversion an.