If you're an independent contractor, you know the value of every mile. You can save a load of money on your taxes if you properly track your miles. Understanding tax laws may sound confusing but that's why we're here to help. We've created a free mileage tracker template that will make it easy for you to keep track of your business mileage.

In this article, we'll walk you through how to properly track miles for taxes and use our free template. Keep reading if you need help with calculating your actual expenses instead—our app can help get things rolling.

Note: The majority of freelancers save more money on their tax bill by recording their actual expenses instead of mileage tracking and claiming the Standard Mileage deduction. Only one method can be claimed for the business use of your vehicle. If you want an automatic way to track your vehicle expenses and other tax deductions, try Bonsai Tax. Our app scans your bank/credit card receipts to discover tax write-offs and maximize your write-offs. In fact, users typically save $5,600 on their tax bill. Try a 7-day free trial here.

Make a copy of this document and download it to get started today!

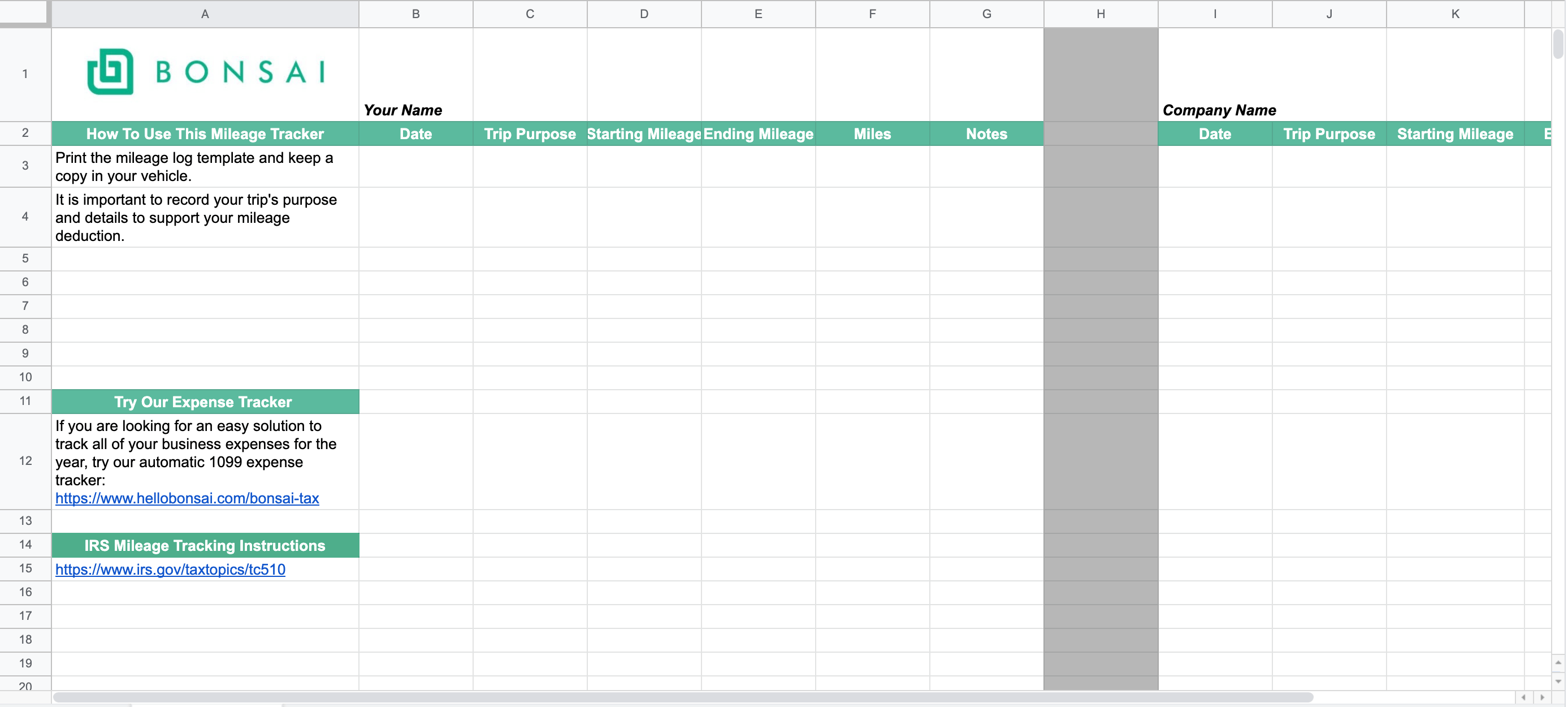

How To Use This Free Mileage Log Template

It is very important to track your mileage consistently. Every trip, every time. Many folks record their miles monthly or weekly but that is not recommended because the IRS would not accept those if there is an audit.

You don't necessarily need to send in the exact mileage log or documentation for mileage you claim along with your 1099 every time you file. However, if you get audited without receipts or documentation to justify your tax deductions, you'll be in trouble. After all, the IRS will want to see proof of your business mileage. You know what they say, it's better to be safe than sorry.

For a given trip, you'll need the date of the trip, starting miles, miles driven, the destination, and the reason it qualifies as a business expense in the mileage log sheet template. Keeping accurate records of your business travel is important to verify your claim. In 2021, the mileage rates are 56 cents per mile. So, the IRS will allow you to deduct 56 cents per business mile and the spreadsheet will help you calculate the value of your business travel.

Using The Mileage Log Form

To fill out the mileage log form, simply enter the purpose for your trip as well as collect odometer readings at the start and end of the trip. The IRS does not require you to include odometer readings for each trip. You just need to include the mileage and reason for each trip. The reason sent to the IRS must have an accompanying name, business, or purpose in the mileage log. Next, let's discuss when a trip actually accounts as business miles.

A Side Note For Tracking Miles

Remember to keep records in the mileage log of your odometer at the beginning of the year or January 1st of every year. You'll need this figure to calculate the total mileage for your tax return.

Note: If you want to skip out on the hassle of keeping a mileage log and instead keep records of your expenses, try Bonsai Tax. Contractors usually save much more money going this route. As a matter of fact, the average user saves $5,600 from their tax bill by using our app. We'll scan your bank/credit card receipts to discover vehicle and other tax write-offs. We do all the hard work for you. See for yourself. Try a 7-day free trial here.

What Counts as Business Mileage For Self-Employed Folks

Before you use our free mileage log, you'll need to know exactly what counts as "business miles". Commuting miles from home to work do NOT count as business miles. It's only when you drive for a business-related task would the IRS considers the mileage to be deductible. However, if you need to drive from one work location to another, those miles would count as an expense.

A general rule of thumb is if you drove miles by your choice, it is likely a personal expense and you won't be able to deduct the mileage. Remember to print our mileage log template and leave it in your car. The IRS recommends you keep mileage records for at least three years. Three years is when the statute of limitations is up for an audit.

Now, let's get into when a business trip would qualify for a mileage deduction.

Travel To The Airport

The miles traveled to and from the airport for business trips count as business miles.

Trips For Errands/Supplies

If you drive for a business-related errand, the mile traveled for the business trip is deductible. Examples of this would include going to the bank, post office, or a store for supplies. Although these business trips may seem small, these miles can add up.

Trips To See Clients

If you have a client meeting or trip to see a customer, those miles would count as business expenses.

Home Ofice Exception

If you have a home office, that is considered her "work place", then all business-related mileage is deductible. The trip could qualify as long as you meet the principal-place-of-business qualification.

A Note For Gig App Drivers

If you drive for gig apps as a freelance Uber, Lyft, Shipt, or Grubhub 1099 driver, you won't need to use the mileage log sheet template. The apps will automatically do the mileage tracking for you.

You can easily find the mileage log form record in the app. Simply download the report in excel to get your mileage records and reimbursement at the end of the year.

Using The Actual Expenses Method Instead of Mileage Tracking

Remember, if you select the Standard Mileage method, you cannot deduct car operating expenses like maintenance and repairs, gas, insurance, oil, and vehicle registration fees. All of these items are factored into the mileage rate set by the IRS.

As we mentioned before, the mileage reimbursement you get from claiming the Standard Mileage Rate for small business owners tends to equal the lower deduction.

Let me show you an example of if you keep track of your actual expenses versus miles.

If your mileage log shows you drove 4,000 total mileage for business-related purposes during the year, you would only be able to deduct $2,160 in 2021. Since the business mileage log form tracks your business mileage, you can subtract the number from your total mileage to get a good idea of your personal miles.

The only other expenses you can deduct that aren't included when you calculate the Standard Mileage rates are:

- the interest on your car loan

- parking expenses and tolls for business trips

- the personal property tax paid when the vehicle was purchased.

There are many mileage tracking apps you can use instead of a mileage log sheet to record your tax miles. All you have to do is categorize records for personal or business when you drive, and the app will track your mileage deductions/reimbursement for you.

Now, let's break down expenses like tires, gas, maintenance, depreciation, and insurance and multiply that total by the time driving for business ratio for the alternative method.

Using The Alternative Method

We'll use national averages as the alternative to claiming a Standard Mileage deduction...

- Tire costs - ~$637 (average cost to replace 4 tires)

- Fuel costs - 600 gallons x $3.36 (average cost of gas) = $1938

- Depreciation - $25,000 car depreciated by 3 years = $2,334

- Insurance costs - $1,674/ year for full coverage

- Maintenance - $792 a year

- MISC - $160 for AAA or other miscellaneous expenses

Now, if we add up all of these expenses, it would total $7,525. Let's say you used your vehicle for business 50% of the time. So your total deduction would be $3767. You see, tracking expenses instead of total miles were driven for business on a spreadsheet may be worthwhile for your tax return.

Note: If you don't want to waste your time mileage tracking and instead use track your other expense to claim the business use of your vehicle for taxes, Bonsai Tax could help. Claim your 7-day free trial here. Again, users save on average of $5,600.

Try Our Mileage Log Template...

If you want to save time and money on your taxes this year, then it is important that you know how much of a deduction can be claimed for business mileage. Business miles are the distance traveled by a business owner in the course of their work. They include travel for business-related tasks you may take care of during the day (such as running errands or picking up supplies).

The IRS has specific guidelines about what counts as “business” miles, so make sure to double-check before getting started! We hope our mileage log template helps you stay on top of your mileage tracking. Don't forget to print out the spreadsheet and store it in your vehicle. Track your mileage for every trip to maintain an accurate record.

If You Have Any Questions About Qualifying Mileage Or Filing Your Taxes...

The team at Bonsai always recommends you consult with a tax professional to receive accurate mileage tax advice. IRS tax laws are always changing and it is your responsibility to properly file your taxes. If you have any questions about your specific circumstances or what trips count as deductions, talk with a CPA.