If you didn't receive a 1099 form, you can still report your income to the IRS by using your own records. Start by gathering all payment documentation, such as bank statements and invoices, to accurately calculate your total earnings. It's crucial to report all income, even if it's below $600, to avoid penalties. Use Form 1040 and Schedule C to report self-employment income. If you lack the company's Federal Tax ID, contact them directly or check previous correspondence. Remember, the IRS requires accurate reporting regardless of 1099 issuance. This ensures compliance and avoids potential audits.

Why Didn't I Get a 1099 Form?

There are various reasons why you may not receive a 1099 form. In some cases, there might be a good reason for it - and in others, it might simply be a misunderstanding. Here are the main reasons why you may not have received your 1099 state tax form.

You Earned Less than $600

If you earned less than $600 within the tax year, the chances are high that you will not receive a 1099 form. Sure, some employers might just decide to send Form 1099-MISC or 1099-NEC to you anyway, but overall, the tax law does not require it of them.

With that in mind, even if you earn less than $600, it's still considered a form of earning - therefore, you are required to file it as income. For that, you will use Schedule C from the personal tax return, reporting it as miscellaneous income.

The process should be fairly straightforward. However, if you are not completely certain about what you are supposed to do, you might want to get some tax advice from a professional.

Your Employer or Client Forgot

Clients and employers are also human - and if neither you nor the IRS got the forms, you are not responsible for their mistake. Sure, you can remind them - but even if you don't, this won't come back to you. All the responsibility lies with them.

If they forget, simply report your income by using the information reported on your records. You did your job and paid your taxes, so there won't be any punishment for you even if the forms didn't come from your employer or client. They are the ones that are more likely to be penalized.

You Were Paid By a Third Party

If you were paid through a third-party payment processor, then you will have different forms to file. Processors such as Upwork, PayPal, or other payments cards and wallets won't work with form 1099-MISC or 1099-NEC but rather with Form 1099-K.

Moreover, depending on the payment processor, there may also be different thresholds at which you get paid. For instance, with Upwork, you will only get the form 1099-K if you earn more than $20,000 for your articles within the tax year.

Your Address Changed

Sometimes, it might not even be your employer's fault that you did not get the tax bill; it might be yours. If you update your address and fail to mention it in the contact details for the job, then it's obvious the form will not get to you.

Make sure that all your information is there, from your social security number to your address and other information that may be required. Everything needs to be up to date if you want the forms to get to your address as well - and not just to the IRS.

Do I Need the Form 1099?

Not getting the Form 1099 won't pose a problem, provided you already have your own records. As long as you know exactly how much you should report, you shouldn't get into too many problems with the IRS. Usually, you can get this sum from your bank statement.

Tax form 1099 is different from W-2. At the end of the tax year, you will need to include the W-2 along with your tax returns. This is not the case with the 1099 form. As long as you know exactly how much you have to report as your income, there is no need to include the 1099-MISC form.

That being said, even if you don't necessarily need the 1099 form, it also does not mean that you should give up on it entirely. If the IRS does get its copy but yours ends up lost in the mail or you lose your 1099, you might find yourself in a bit of accidental trouble.

Companies are required to send form 1099-MISC or 1099-NEC both to you and the IRS at the end of the tax year. So, if you file an amount that doesn't match what the company also filed, forget the tax return; you can also get flagged for it.

That being said, audits are only flagged for it if the amount you list is lower. They won't care much if you list a higher income and your taxes throughout the year are paid.

However, to prevent any errors, you might want to ensure both 1099 forms match. This will prevent any potential tax issues.

What Should I Do If I Don't Get Form 1099?

You can't really hide from the IRS - and if you don't file, the chances are that they'll find out and penalize you. If you made over $600 and still didn't get the forms for your taxes, here is what you should do:

Keep Your Calm

If you didn't get the form after you were paid, there is no need to panic. You are not responsible for sending the form, nor do you really need to contact them if they forgot to send them. Just look out for your own business and start tracking your payments in a calm manner.

Report the Income

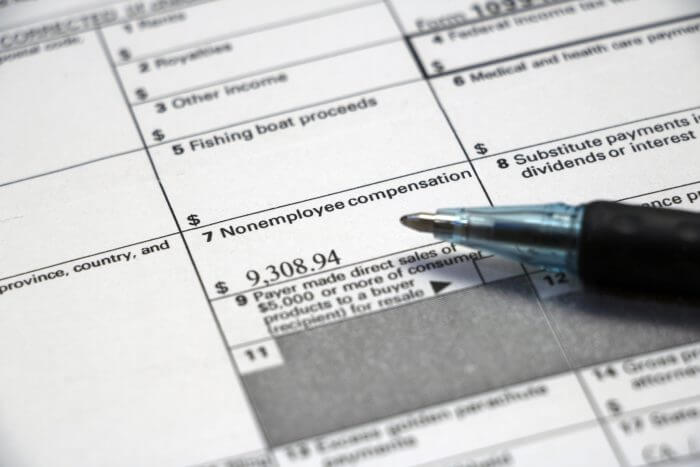

Look, the IRS will catch a missing 1099. So, if the forms are missing, report the income either way. Your business made money, so you'll have to pay your taxes whether you are under or above the $600 threshold. The IRS can't hold anything against you as long as you stuck to your interest and paid your dues. Cash non-employee compensation income information may not technically be sent to the IRS. However, you must also report any cash income without a 1099 form.

Stay Proactive

To prevent any mishaps, you might want to be proactive from the very beginning. Fill in form W-9 and send it to your client or employer, informing them of the missing form 1099. You don't need to send it to the IRS; just the client. It will remind them what their job is.

Changes For Selling Platforms

In 2022, a law has been passed to lower the threshold for receiving a 1099-K if you have a business as an eBay 1099 seller. Instead of 200 transactions and $20,000 in payments, now, anyone who get over $600 on their account, will receive a 1099-K.

How Do I Report Income If I Don't Get a Form 1099?

Technically speaking, if you have not received a form 1099, you may find it difficult to report your income. If you haven't received the form within a few days of finishing the assignment, then you ought to contact a payer or get in contact with the IRS helpline. They should be able to help.

Don't think that if you didn't receive the form, you won't be required to pay; the IRS will know. Simply report it as miscellaneous income under Schedule C of form 1040. Even if your gains are under $600, you will still have to report it as your personal tax income.

What Happens If a Company Doesn't Issue a 1099 Form?

Depending on the scenario and requirements for who doesn't get a 1099, the company may or may not have to issue a 1099 form. If they didn't, don't just think that you are automatically in the clear. With or without the form, your bank statement will be proof that you got the money.

In these circumstances, you'll be responsible for reporting the income that you get and pay your taxes. Usually, form 1099 is used to report income over $600 from your employer. It's mostly between the IRS and the person who hired you. So, if it wasn't their business to issue a 1099 form, then the income reported to the IRS needs to come from you instead.

However, if they SHOULD HAVE issued an IRS, this is a completely different story. You need the form for tax purposes, so if they forgot, you need to contact them with that problem. Sure, you can file it yourself, but you'll have to pay an added tax for that.

If there is no other option and you have no sign of the 1099 form, then you should pay yourself as soon as possible. The last thing you'll want to deal with is a 1099 late filing penalty for each day when you failed to make the payment.

What If I Got Paid But Didn't Receive a 1099-NEC or 1099-K For This Work?

Once more, even if you didn't get a 1099-NEC or 1099-K, it doesn't change the fact that you got money. Your bank statement is proof enough of that.

If your payment wasn't over $600, then even if you got the money, the company will not have to send a form 1099-K or 1099-NEC as well. With that in mind, you'll still have to report your own expenses and income on the tax return. You can track your expenses manually through our 1099 tax excel template or automatically with Bonsai Tax.

Other 1099 Forms You Might Need

Usually, there's no problem if you file without the 1099-MISC or 1099-NEC form at the end of the tax year. However, there is an exception - and that exception is in the form of the 1099-R. This form lists distributions coming from annuities, pensions, and retirement accounts.

You should use the 1099-R if you get at least $10 worth of distributions throughout the year. Moreover, if you had any income tax withheld from any payments you may have made, you'll need the 1099-R form in order to prove it.

Final Thoughts

If you get the 1099 forms, it will indeed make it easier for you to get your tax return. They are used to report a specific amount of money, and they can spare you trouble with the IRS in the long run.

That being said, if you do not receive a 1099 form, you should not panic. You can easily file the tax return for that income with only the information that you know.

As long as you know the amount you need to file for and don't file for a lower amount, you should be fine. To be completely sure nothing is missing, you may also try getting some tax advice.