It's that time of year again: tax season. Whether you're a DoorDash deliverer, Instacart, Lyft/Uber, Grubhub driver, Shipt, or Postmates 1099 contractor and have been freelancing, it's likely time to file your taxes. But don't worry! We've got you covered with our easy-to-follow guide for taking care of your taxes as an independent contractor for Postmates.

We'll cover everything from when you'll receive your form 1099, Social Security/Medicare taxes, quarterly taxes, tax deductions, and much more. No matter where you are at in your journey as a Postmates independent contractor, we hope this post will help make the process easier and less overwhelming than ever before!

First, let's talk about the 1099 forms you'll receive as a delivery driver.

Note: If you want tax software to help you remind you of your deadlines, track your deductions and estimate your taxes, try Bonsai Tax. Our app scans your bank account/ credit card statements to discover tax write-offs. In fact, users typically save $5,600 from their tax bills (that's a significant amount of money!). Claim your 7-day free trial of our app today.

IRS Tax Forms For A Postmates Independent Contractor

As a Postmates delivery driver, you'll receive a 1099 form. A 1099 form is an information return that shows how much you were paid from a business or client that was not your employer. There are many IRS 1099 forms but our guide will only review the most relevant ones for your Postmates taxes. The deadline for companies to send out 1099 forms to independent contractors is January 31. Keep a lookout for your 1099 document by February. You'll typically receive your 1099 form for your previous year's earnings in the first week of February.

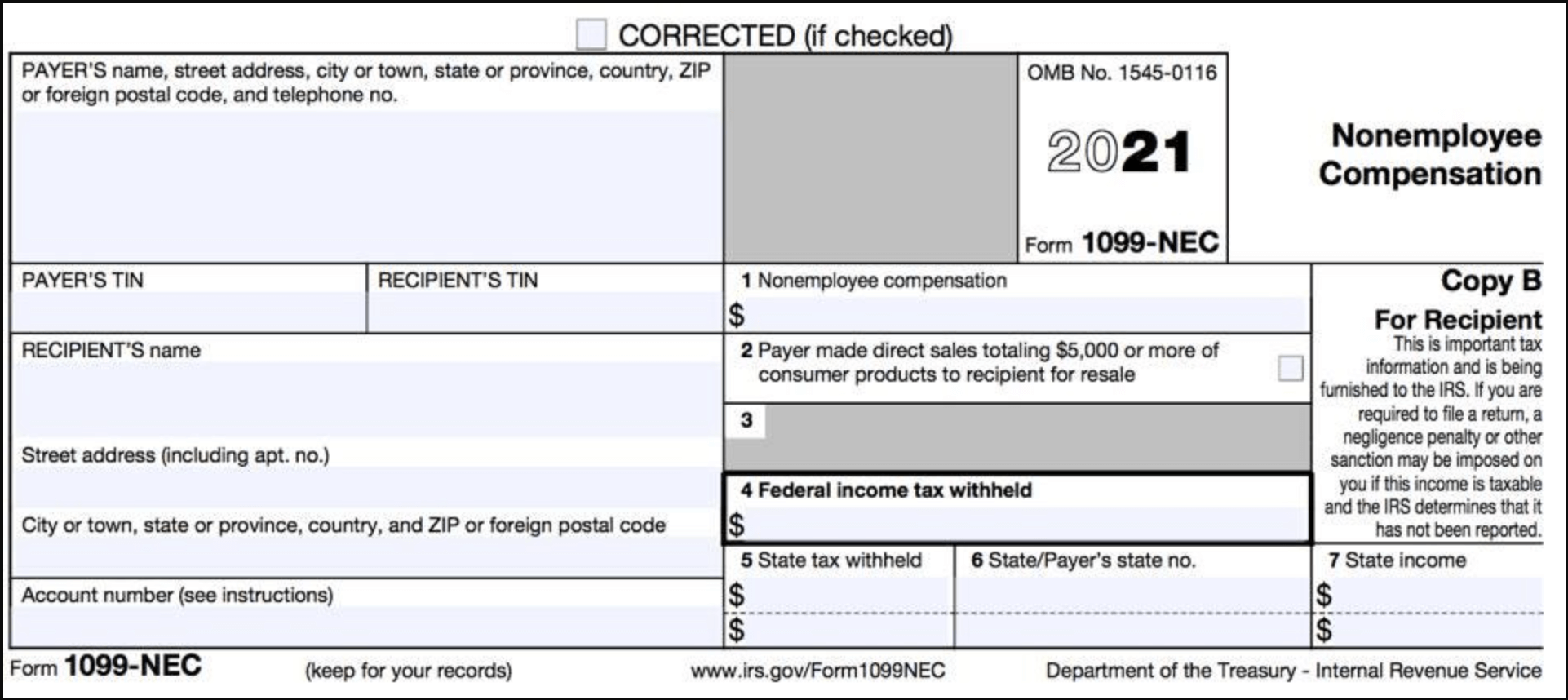

1099- NEC (Previously the Form 1099-MISC)

If you freelanced and reported income prior to 2020, you are pretty familiar with Form 1099-MISC. The 1099-NEC replaced the form 1099-MISC for reporting non-employee compensation. The IRS 1099-MISC form was not replaced entirely, only the non-employee compensation portion was moved over to the 1099-NEC. Postmates will send you this tax form to report the income you earned while working for the company.

In fact, this is the most common form received by independent contractors. The requirement to receive a tax form is if you earned more than $600 from a business that was not your employer.

Businesses are not required to send out 1099s under $600 in payments to freelancers. This means if you earned less than $600, you will not receive a tax form. However, you may still be required to pay taxes on your earnings.

A delivery driver is only off the hook for self-employed taxes if they earned less than $400 (but they'll still need to pay income tax). Pay close attention to Box 7 of the 1099 form. It reports your non-employee compensation or earnings in the last year from Postmates.

Depending on the State in which you reside and its requirements, a company may send you a 1099-K instead.

.png)

Form 1099-K

The 1099-K includes the gross amount of all reportable payment transactions. So, even if you were paid $100, and Postmates subtracts its service fees, the form 1099 will still show you made $100. The requirement to receive a 1099-K is if you had 200 transactions AND received over $20,000 in payments. For instance, if you made 250 transactions but received less than $20,000 in earnings, the Postamates company will not send you a 1099-K.

The 1099-K is also used by third-party payment processors such as PayPal to report if someone sold more than $20,000 in goods or services in a year.

Folks who live in Massachusetts and Vermont will receive a 1099-K if they earn more than $600 a year.

Generally, companies that send out a 1099-K do so to make it look like clients are working directly with you.

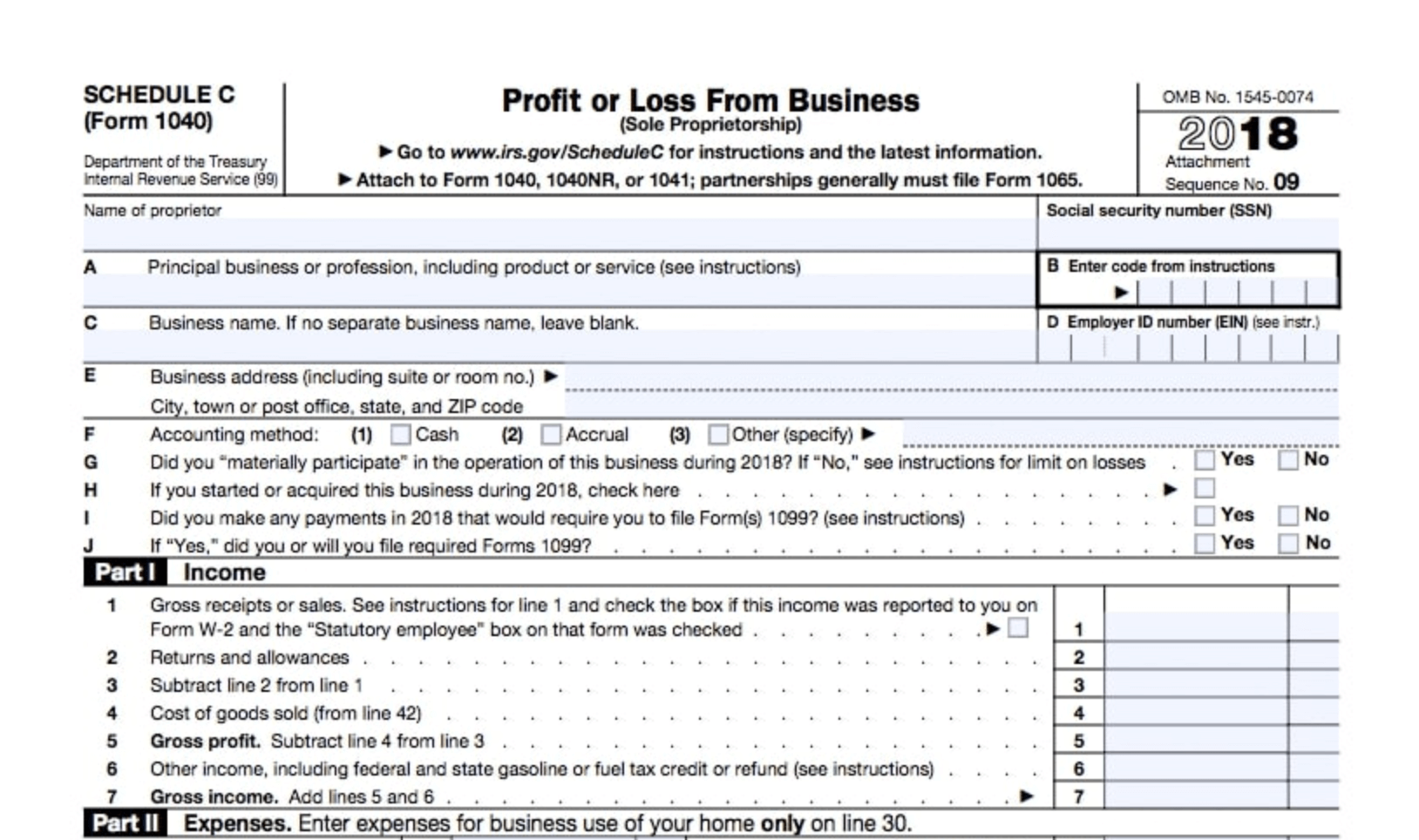

Schedule C

You'll typically use IRS Schedule C to calculate your net earnings from being self-employed. This is where you'll report your profits and losses or include your business deductions when you file your taxes. Form 1040 includes Schedule C. Sole owners utilize it to tell the IRS how much money they gained or lost in the previous year. You'll need to file a Schehdule C along with your 1099.

What To Do If You Don't Receive A 1099 from Postmates...

If you know you met the requirements to receive a form 1099 but you didn't receive one in the mail after January, we'll go over what you need to do. First, check your Postmates account and see if all your information is correct. The information return may have been sent to the wrong address. If your address is wrong, you wanna put in a change of address with the post office. If it is correct, then you need to contact Postmates support for your form.

Remember, if you made less than $600, Postmates does not need to send you 1099 forms. There are some instances where you haven't earned $600 or more but companies will still issue out the form. If you received a tax form, be sure to verify all the information. If you notice some discrepancies or wrong payments information, correct it with their support immediately.

You can always download your tax information directly from your account.

.jpeg)

Self-Employment Taxes (Social Security & Medicare)

Congratulations, you are technically a business owner. As a self-employed worker, you'll have to pay your own Federal Insurance Contributions Act (FICA) or Social Security and Medicare taxes on your earnings. The self-employment tax rate is 12.4% for Social Security and 2.9% for Medicare. So, you'll owe 15.3% in taxes.

If you made less than $400 as a freelancer, you won't have to pay these taxes. You only have to file an income tax return if your net earnings as a freelancer were $400 or more

However, you'll still need to report your earnings on your income taxes.

You use IRS Schedule SE or our free self-employed tax calculator to calculate how much you'll owe. Don't worry if your tax liability appears to be a lot, we'll show you an automatic way to reduce your payment to Uncle Sam later in the article.

If you expect to owe more than $1,000 in self-employment taxes, you'll need to file quarterly payments throughout the year.

Filing Quarterly Taxes

The U.S. uses a "pay-as-you-go" system that requires you to make payments towards your tax liability throughout the year. To calculate your quarterly tax payments, all you have to do is take your total tax liability (income, self-employed, and any other taxes) from the last year and divide that number by four.

It is critical to send the right amount to the IRS. If you send a payment for less than you owe, you can be fined with a tax underpayment penalty.

The penalty is calculated based on:

- The amount of the underpayment

- How long the underpayment was due and underpaid

- The interest rate for underpayments that the IRS publish quarterly

Check out our full guide for more help on how to file estimated taxes.

Estimated Tax Payment Deadlines

Here are the due dates for when estimated quarterly payments are due:

- April 15

- June 15

- September 15

- January 15 of the following year.

Mark your calendars because if you file these quarterly tax payments late, you could face fines of up to 25% of your tax bill.

Note: If you never want to miss a deadline, pay unnecessary fees, and accurately estimate your quarterly payments to the IRS, try Bonsai Tax. Our app will help send important filing reminders so you never miss a deadline and receive unnecessary penalties. Try 7-days on the house.

Business Expenses Postmates 1099 Delivery Drivers Can Claim As Tax Deductions

Now, we are getting to the good stuff. How to save money from your tax bill. It is absolutely vital you track and store your receipts for taxes. After all, the IRS will want proof that your claimed deductions were actually business expenses.

Common Tax Deductions

- Health Insurance (the IRS lets you deduct health insurance premiums)

- Vehicle repairs (read about claiming the Standard Mileage Deduction vs the Actual Vehicle Expense method here).

- Gas (you can't deduct both mileage and gas)

- Toll and parking expenses (parking tickets are not deductible).

- Postmates fees

- Cell phone bill (you can deduct the business-related use of your cell phone bill. Check your phone records!)

- Car insurance expenses

- Costs of hot bags for delivery and blankets

- A bike and helmet

- Depreciation of your car (you can deduct the value loss of your car every year from being a delivery driver).

- Business mileage (be sure to track your mileage and calculate if taking the Standard Mileage Deduction or keeping actual expenses like gas, car repairs or maintenance, etc will lead to a greater deduction)

Remember, you can only deduct the costs/portion related to you making Postmates deliveries. For example, if you use your phone 15% of the time for deliveries, you can only deduct 15% of the expenses from your tax bill. The same goes for mileage. You can only deduct the mileage made on delivery. You can't use your commuting hours or other times you used your vehicle for personal reasons as an expense (the same goes for Uber, DoorDash or Task Rabbit).

Note: If you want an automatic way to discover business expenses or tax write-offs, try Bonsai Tax. Our software will automatically search your bank/credit card receipts to discover potential business expenses and help you maximize your tax savings. Don't leave money on the table. Try a 7-day free trial today and see how much money you'll save.

It's Time To File Your Postmates Taxes!

There you have it. You have everything you need to know to properly file your 1099. We covered the different types of forms you'll receive, the different taxes you'll owe, quarterly tax payments and expenses you can deduct, etc. We hope this guide has helped make filing your 1099 Postmates taxes a cinch.

The word "taxes" can strike fear in the hearts of even the most well-intentioned among us. Remember, as a Postmates driver, you’ll be responsible for taxes that are owed to both your State and Federal government. And while it may seem daunting at first, we have good news! Our online tax software makes handling taxes easy by helping you find all deductions and credits available to you as a business owner or contractor so that no one has an excuse not to do their due diligence when it comes time for making quarterly or yearly returns with Uncle Sam (or Aunt Sally). You don’t want any surprises come April 15th; make sure you get started early this year on taking care of those pesky obligations as soon as possible! Claim your 7-day free trial here and see how much money you save.

For Tax Advice, Consult With A Professional

If you have any questions about filing your Postmates taxes, deductions, or qualifying costs, talk to a tax professional. We always recommend contractors to talk with an accountant or tax advisor for counsel. As a Postamates driver, you are solely responsible for properly keeping track of your income and properly reporting it to the IRS.