One of the essential parts of filing freelancer taxes is a tax return.

An important component of that is filing a Schedule C (Or Form 1040/1040-SR), which is how you report your business income aka reduce 1099 taxes.

Don’t be intimidated by the numbered forms and lettered schedules required by the Internal Revenue Service (IRS). We’re here to help with Schedule C instructions, to make tax time easier.

Note: if you want to easily fill out your net profit or loss statement with an app that automatically records your write-offs, try Bonsai Tax. Our tax software will scan your credit card/bank account statements to discover tax deductions at the push of a button. In fact, the majority of our users save at least $5,600 from their tax bill. Claim your 7-day free trial today.

What is schedule c, form 1040?

A Schedule C form is used to report profit or loss from your sole proprietorship. Your business is considered such if you are engaging in it with the intention of making a profit and you conduct business on a continual and regular basis.

The IRS does not require Schedule C if you’re pursuing a hobby or a not-for-profit activity. But as a freelancer, that likely doesn’t include you. As a sole proprietor operating with the intention of making a profit from your business, you’ll have to file a Schedule C.

The information you submit on Schedule C is used by the IRS to determine how much profit you made for the purposes of assessing whether you owe taxes or will receive a tax refund. If you own more than one business, you must complete a separate Schedule C for each business.

The IRS used to make it even simpler with a Schedule C-EZ, which was just as it’s called: EASY. It was a simpler version intended for smaller businesses, such as those that didn’t claim home office deductions. But beginning with the 2019 tax year, you have to use Schedule C if you have a sole proprietorship.

Where do I download the Schedule C form?

Access the official IRS website for the Schedule C form

You can download the Schedule C form directly from the official IRS website to ensure you have the most current version for the 2024 tax year. The IRS provides Form 1040 Schedule C as a free PDF that you can fill out electronically or print for manual completion.

To find the form, visit IRS.gov and enter "Schedule C" in the search bar, or go directly to the forms and publications section. This guarantees you are using the latest form and instructions, which is crucial for accurate tax filing and avoiding delays.

Downloading from the IRS site is the safest option because third-party sites may have outdated or incorrect versions. Bookmark the IRS page for easy access during tax season.

Use tax software to automatically access Schedule C

Popular tax software like TurboTax, H&R Block, TaxAct, and TaxSlayer include Schedule C as part of their self-employed or small business filing packages. These platforms automatically generate the correct form based on your entered business income and expenses.

Using software not only downloads the form for you but also guides you through the process with step-by-step instructions tailored to your situation. This reduces errors and helps maximize deductions for freelancers and small business owners.

Consider using these tools if you prefer a guided experience and want to file electronically. Most offer free versions for simple returns, with fees applying only if you need advanced features.

Check your state’s tax agency for additional forms

While Schedule C is a federal form, some states require additional or supplementary forms for reporting business income. Visit your state’s department of revenue website to download any necessary state-specific forms alongside Schedule C.

California and New York have separate schedules or worksheets that align with Schedule C reporting. Ensuring you have all required forms prevents delays in state tax filings and potential penalties.

Always verify state requirements early in the tax season to gather all forms needed for your complete tax return.

Who needs to file Schedule C?

Self-employed individuals and sole proprietors

Self-employed individuals and sole proprietors must file Schedule C to report income and expenses from their business activities. This includes freelancers, consultants, and independent contractors who earn money through personal services or sales. The IRS requires Schedule C to calculate net profit or loss, which then flows to your Form 1040.

For example, if you are a freelance graphic designer earning $50,000 in 2024, you need to file Schedule C to report that income and deduct related expenses like software subscriptions or office supplies. Even if your business operates from home or is a side gig, Schedule C is necessary to accurately report your earnings.

To file Schedule C correctly, gather all your business income records and receipts for expenses. Use accounting software like QuickBooks Self-Employed or Bonsai to simplify tracking. Filing Schedule C ensures you pay the right taxes and claim deductions that lower your taxable income.

Business owners without a separate legal entity

Business owners who operate without forming an LLC or corporation typically use Schedule C to report their business income. This includes sole proprietors and single-member LLCs that are disregarded entities for tax purposes. The IRS treats these businesses as part of the owner's personal tax return.

For instance, if you run a landscaping business as a sole proprietor, you must file Schedule C to report your revenue and deduct expenses like equipment purchases or fuel costs. Even if you have a single-member LLC, unless you elect corporate taxation, Schedule C remains your primary form for business income.

Keep detailed records of all business transactions throughout the year. Tools like HelloBonsai’s invoicing and expense tracking help prepare accurate Schedule C filings and avoid costly mistakes during tax season.

When Schedule C is not required

You do not need to file Schedule C if you have no business income or if your income is reported on other tax forms. For example, if you receive only W-2 wages as an employee or if your business is structured as a partnership or corporation, different tax forms apply.

Additionally, hobby income is generally reported on Form 1040 without Schedule C unless the activity qualifies as a business. The IRS uses factors like profit motive and regularity of activity to determine if Schedule C is necessary. For example, occasional sales of handmade crafts may not require Schedule C unless you treat it as a business.

Understanding when Schedule C is not required can save you time and avoid unnecessary filings. If unsure, consult IRS Publication 334 or a tax professional to clarify your filing obligations based on your specific business situation.

What is a sole proprietorship?

There are different types of business entities. Schedule C refers specifically to a sole proprietor.

A sole proprietor is someone who owns an unincorporated business by himself or herself.

Other business entities include partnerships and corporations. Employees do not need to file Schedule C unless they run a business on the side.

Business details

How to provide your business name and address

When filling out Schedule C, you must enter your business name exactly as it appears on your legal documents or registrations. If you operate under your own name without a separate business entity, you can leave the business name blank or write “N/A.” This ensures the IRS can correctly identify your business activities.

Your business address should be the physical location where you conduct your operations. If you work from home, use your home address. Avoid using P.O. boxes unless that is your only mailing address. For example, if you run a freelance graphic design service from your apartment, list that apartment’s address to maintain accuracy.

Double-check your entries before submitting. Inaccurate or missing business name or address information can delay processing or cause confusion with your tax return. Use the same address consistently across all tax forms to avoid discrepancies that trigger IRS inquiries.

What to include for your business type and accounting method

Schedule C requires you to specify your business type by selecting the appropriate code from the IRS’s list of principal business codes. These codes classify your primary business activity, such as 541430 for graphic design services or 722511 for full-service restaurants. You can find the full list of codes in the 2024 Schedule C instructions or on the IRS website.

Choosing the correct accounting method is also essential. Most small businesses use the cash method, which records income when received and expenses when paid. Alternatively, the accrual method records income and expenses when earned or incurred, regardless of payment timing. For example, if you invoice a client in December but receive payment in January, the accrual method counts income in December, while the cash method counts it in January.

Be consistent with your chosen accounting method year over year. Switching methods requires IRS approval and can complicate your tax filings. If you are unsure which method suits your business, consult a tax professional or use IRS Publication 538 for guidance.

How to report your employer identification number (EIN) or Social Security number (SSN)

Schedule C asks for your employer identification number (EIN) if you have one. The EIN is a nine-digit number assigned by the IRS to identify your business for tax purposes. If you do not have an EIN, use your Social Security number (SSN) instead. Most sole proprietors without employees use their SSN.

Obtaining an EIN is free and can be done quickly online through the IRS website. For example, freelancers who hire contractors or plan to open a business bank account often find having an EIN beneficial. It also helps protect your SSN when dealing with clients or vendors.

Make sure the number you provide matches the one on your other tax documents. Using inconsistent identification numbers can cause processing delays or trigger IRS notices. Keep your EIN or SSN confidential to avoid identity theft risks.

Why your business start date matters

Schedule C requires you to enter the month, day, and year your business started. This date helps the IRS determine your eligibility for certain deductions and credits, especially if you began operations during the tax year.

If you started your business partway through the year, your deductible expenses and income will reflect only the period after your start date. For example, if you launched a consulting service on July 1, 2023, only income and expenses from July onward should be reported on that year’s Schedule C.

Keep accurate records of your business start date and related documentation, such as contracts or licenses. This information is useful if you ever need to prove your business’s operational timeline during an audit or when applying for loans or grants.

What does the Schedule C form look like?

Overview of the Schedule C form layout

The Schedule C form is a one-page document used by sole proprietors to report income and expenses from their business. It is divided into several parts, each designed to capture specific financial details. The top section asks for basic information such as your name, Social Security number, and business type.

Below the header, Part I focuses on income, where you report your gross receipts or sales and returns. Part II covers expenses, listing categories like advertising, vehicle expenses, and office supplies. These sections are clearly labeled and include lines for dollar amounts, making it straightforward to enter your numbers.

Understanding this layout helps you navigate the form efficiently, ensuring you don’t miss any important sections when filling out your Schedule C. Keeping your financial records organized by these categories throughout the year simplifies this process.

Details on key sections and their functions

Part III of Schedule C is for cost of goods sold, which applies if your business sells products. This section requires you to detail inventory at the beginning and end of the year, purchases, and labor costs related to production. Accurately completing this part can reduce your taxable income by accounting for the cost of items sold.

Part IV asks for information about your vehicle if you claim car expenses. You’ll need to provide the total miles driven for business and personal use, along with dates of use. Using IRS tools like the standard mileage rate (65.5 cents per mile for 2024, updated annually) can help calculate deductible amounts.

Finally, Part V collects information about your business use of your home, which is important if you qualify for the home office deduction. You must calculate the percentage of your home used exclusively for business to determine the deductible portion of expenses like rent or utilities.

How to use the Schedule C form effectively

To fill out Schedule C accurately, gather all your income records and receipts for business expenses before starting. Using accounting software like QuickBooks or FreshBooks can streamline this by categorizing expenses according to Schedule C sections. This reduces errors and saves time during tax season.

Review the IRS instructions for Schedule C (Form 1040) for 2024, which provide line-by-line guidance and examples. The instructions clarify what qualifies as deductible expenses and how to handle special cases, such as depreciation or business use of your vehicle.

By understanding the form’s structure and using available tools, freelancers and small business owners can confidently complete Schedule C, ensuring compliance and maximizing deductions. Regularly updating your records throughout the year makes this process less stressful and more accurate.

What are the tax obligations of a sole proprietor?

As a sole proprietor, you annually file your personal income tax return, known as a Form 1040, the United States Individual Income Tax Return (or in the case of seniors, a 1040-SR).

Along with it, you file Schedule C (Form 1040 or 1040-SR), Profit or Loss from Business. Self-employed individuals or sole proprietorships are required to file an annual return.

You’re obligated to to file an income tax return if your net earnings from self-employment are $400 or more. To figure out your net earnings, you subtract your expenses for business use from your taxable income. You can do a rough calculation to determine if it’s more than $400.

Then you’re ready to proceed with filing Schedule C.

What schedule c information is needed to file?

Before you get started filling out Schedule C with a 1099, you will need the following information:

- Your social security number

- Your employer identification number

- An income statement for the year

- Receipts and statements for your business expenses (you can easily export your expenses using our business receipt organizer)

- Mileage records (if applicable)

There are also specific areas of the IRS instructions that you’ll need to complete the form, such as the business codes section.

It’s a good idea to walk through our Schedule C instructions in their entirety, and then return and go through the Schedule C instructions as you complete the form.

That’s because there are some sections later in the form (Parts 3 and 5, for instance), which are calculated and then added into the calculations in Parts 1 and 2.

How to file schedule c: introductory sections a-j

Let’s dive into our Schedule C instructions by starting with Sections A-J, the introductory part of the form. Most of these boxes are straightforward, where you include your name, your Social Security Number, and your business activity, business name and other information.

Here are some of the fields in the form for which you may need clarification:

- Name

- Social Security Number

- Business activity

- Business name

- Other identifying information

A and B go together, where you insert your principal business in A and assign it a code in B. The code is based on the IRS schedule c instructions, which provide codes for different businesses defining your principal business or profession, including services or products that you sell. Check the IRS instruction guide and complete the code accordingly.

For instance, a freelance photographer would be found under Professional, Scientific, & Technical Services, and be assigned the code 541920 - Photographic services. A consultant falls in the same category and would be assigned Code 541600 - Management, scientific, & technical consulting services.

D: Employer Identification Number: The EIN is used to identify a business entity, and most businesses need an EIN. There is a long list of EIN benefits for a sole proprietor.

Most of the other fields are straightforward, such as whether you started the business in that tax year and whether you materially participated in the business.

Schedule c instructions part i: income

This section takes you through a calculation of your business income, including gross income (receipts from clients or sales), returns and allowances, and cost of goods sold. As a self-employed solopreneur, your self-employment income and business income are the same (unless you are a statutory employee).

As you work your way through the Schedule C form, you do the math as instructed.

Here’s how it goes:

- Line 1: enter your gross income from receipts or sales, before any self-employed tax deductions.

- Line 2: enter total returns and allowances (the amount issued in refunds for the tax year)

- Line 3: subtract line 2 from line 1 to complete line 3

- Line 4: enter cost of goods sold, if applicable, which you calculate later on in the form, in part 3

- Line 5: subtract line 4 from line 3 to complete line 5

- Line 6: enter any other income, such as a gasoline or fuel tax credit or refund

- Line 7: add lines 5 and 6 to calculate your gross income.

Did you know that you can use Bonsai for accounting? Or that Bonsai can help you be prepared for self-employment tax by providing tax estimates, filling date reminders, and identifying your tax write-offs? You could use a tax write-off template or have an app record all your expenses for you automatically.

Let's see how that works. First, head to your main Bonsai dashboard and have a close look on the left side - we'll be working with the accounting and taxes sections. First click on "Accounting".

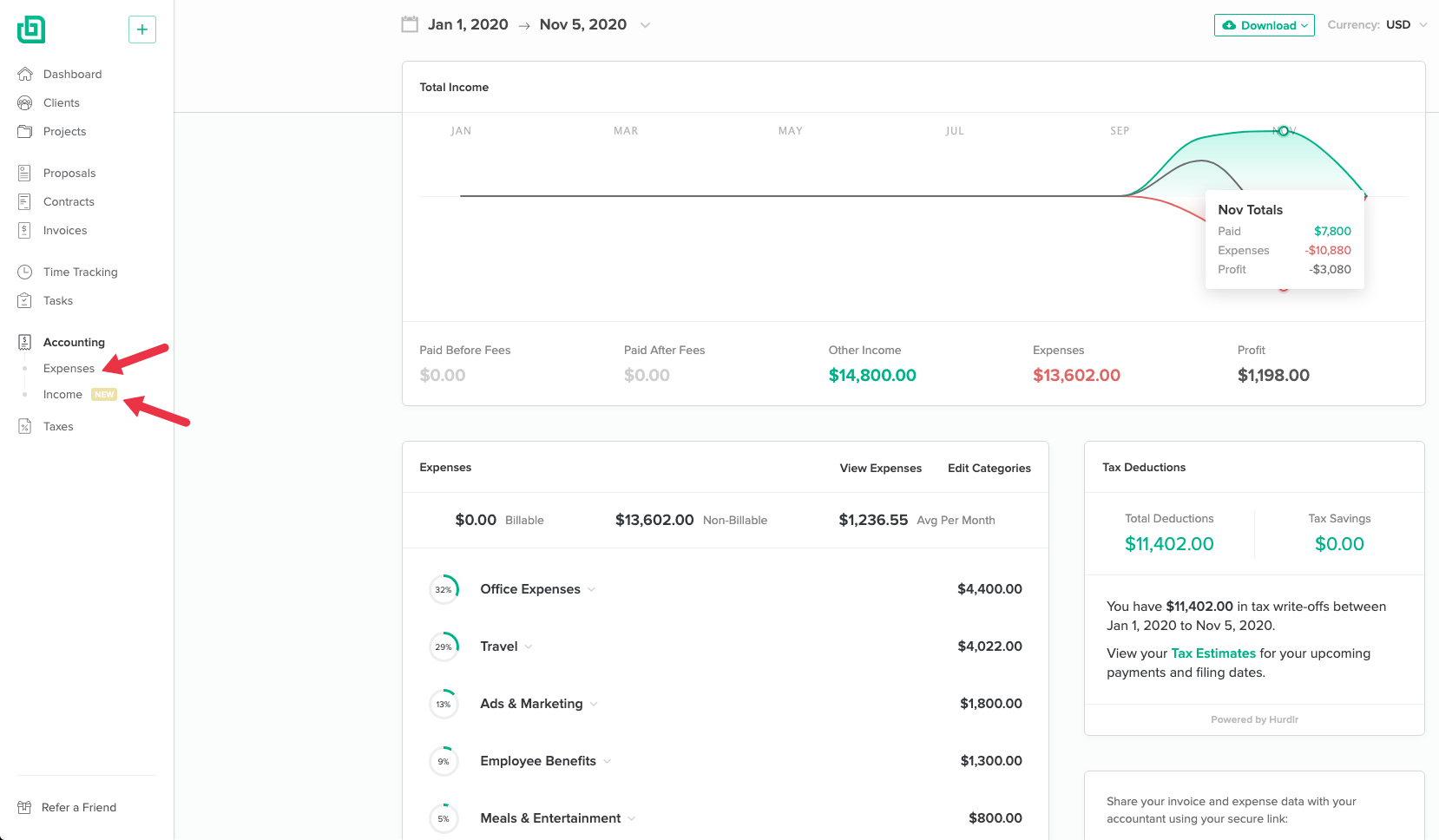

Inside the accounting section, you'll see a breakdown of your income and expenses. Both can either be automatically imported from your bank account, or manually added. Work you got paid for via Bonsai will also be registered here.

Make sure this section is properly filled in and click on "Taxes" next.

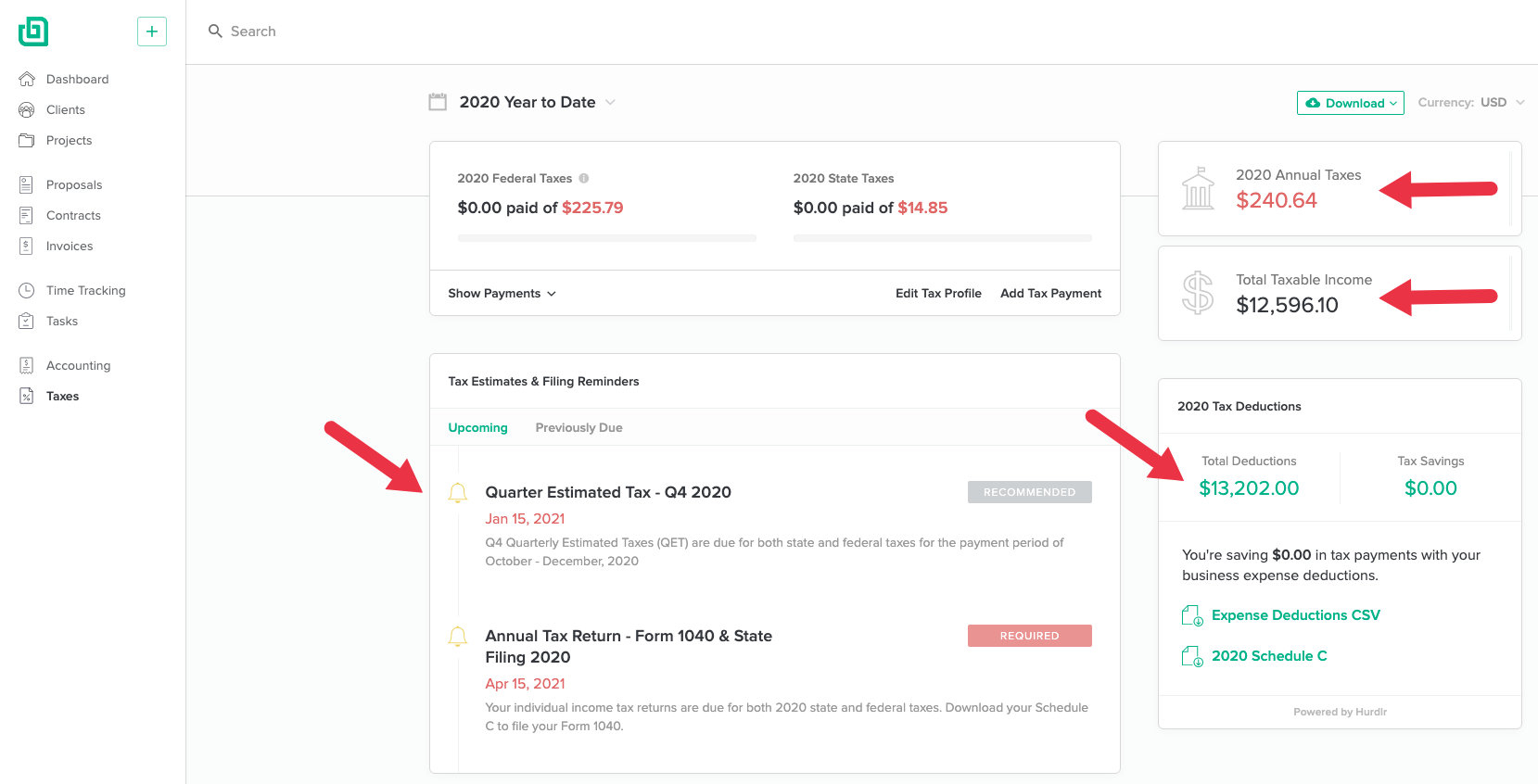

This is where the magic happens: Bonsai tax will do all the calculations for you, and we'll provide you with an overview of your tax estimates, a list of tax deductions you can use for the upcoming tax season, and reminders for all the upcoming filling dates.

Simple, right? If you're ready to check out Bonsai and explore all the features, go ahead and sign up for the free trial!

Schedule c instructions part ii: expenses

This section is where you report your business expenses. Lines 8 through 27b allow you to report expenses like:

- Advertising

- Commissions and fees

- Legal and professional services

- Taxes and licenses

- And more

If you have expenses that aren’t reflected in the boxes, you’ll record those later in Part 5, then record those on line 27a.

In Line 28, you add lines 8 through 27a to determine your total expenses before including any expenses for your business use of your home. Then you subtract line 28 from line 7 to arrive at line 29 which is your tentative or estimated profit or (loss).

Line 30 is dedicated to expenses incurred for using your home as your office or other business space, such as a studio. There are two ways to calculate this:

- By reporting your expenses using Form 8829 (track your receipts using out actual expenses worksheet)

- By using the simplified home office method, in which you insert the square footage of your home and the square footage used for business.

Using either form 8829, or the Simplified Method Worksheet in the IRS instructions, you will arrive at an amount that is entered on line 30.

You then subtract those expenses (line 30) from your tentative profit (line 29) to arrive at your net profit, if expenses are less than your income. That amount then gets reported on page 1 of Form 1040 or 1040-SR.

If your calculation determines that expenses are more than your income, then the net loss can usually be deducted from your gross income on page 1 of Form 1040 or 1040-SR.

Schedule c instructions part iii: cost of goods sold

This section is specific to those sole proprietorships that sell goods. If your business falls in this category, you will need information such as the inventory at the beginning and end of the year, costs of labor, materials, supplies and more.

You’ll arrive at Line 42, the cost of goods sold, which is the amount that you insert back in part 1, line 4.

Schedule c instructions part iv: information on your vehicle

If you’re claiming truck expenses and car deductions in Part 2, this is where you complete the documentation required by the IRS.

That includes:

- Mileage tracking

- Fuel and maintenance costs

- Depreciation

- Insurance and registration fees

- Parking and tolls

- Total miles driven for business, commuting, and other purposes

- Whether the vehicle was used in off-duty hours

- Whether you have documentation for the use

And more.

Note that if you do use a personal car for your business, you can either take a mile deduction or claim the exact expenses. Either way, you need to have documentation that proves your case.

How do I submit my Schedule C?

Filing Schedule C with your federal tax return

You must submit Schedule C as part of your Form 1040 federal income tax return. The Schedule C reports your business income and expenses, which directly affect your taxable income. For the 2024 tax year, the IRS requires you to file Schedule C electronically or by mail along with Form 1040 by the April 15, 2026 deadline, unless you file for an extension.

Most freelancers and small business owners use tax software like TurboTax, H&R Block, or TaxAct to prepare and electronically file their Schedule C. These platforms guide you through entering your income and expenses, automatically completing the Schedule C form and attaching it to your 1040. Electronic filing is faster and reduces errors compared to paper filing.

If you prefer paper filing, print out Schedule C from the IRS website, fill it out manually, and mail it with your Form 1040 to the IRS address listed in the instructions. Keep copies for your records. Filing electronically is recommended for faster processing and quicker refunds.

Submitting Schedule C with state tax returns

Many states require you to report business income on your state tax return, often using information from your federal Schedule C. While you don’t submit Schedule C directly to your state, the income you report there must match what you declare on your federal return. This ensures consistency and reduces the risk of audits.

For example, California requires sole proprietors to include business income on Form 540, the state individual income tax return. You should use tax software or consult your state’s department of revenue website to understand how to report your Schedule C income properly. Some states may have additional forms for business income or local taxes.

Double-check your state’s filing deadlines, which often align with the federal April 15 deadline but can vary. Filing both federal and state returns on time helps you avoid penalties and interest charges.

What to do after submitting Schedule C

After submitting Schedule C with your tax return, keep all supporting documents such as receipts, invoices, and bank statements for at least three years. The IRS may request these if they audit your return. Organize your records digitally using tools like QuickBooks, Expensify, or Bonsai Tax to simplify this process.

If you owe taxes based on your Schedule C income, pay them by the filing deadline to avoid penalties. You can pay online through the IRS Direct Pay system or by mailing a check with your return. If you expect to owe taxes regularly, consider making quarterly estimated tax payments using Form 1040-ES to avoid large year-end bills.

Finally, review your Schedule C filing each year for changes in tax laws or business circumstances. Staying informed about deductions and credits relevant to your business can save you money and ensure compliance.

Schedule c instructions part v: other expenses

The final section of Schedule C allows you to list any business expenses that are not included on lines 8-26 in Part 2, Expenses, or on Line 30, business use of your home.

The total of these expenses get recorded in the Expenses section on Line 27a.

Final thoughts on schedule c instructions

With these detailed instructions, you’ll be able to complete Schedule C with the necessary documentation for your small business, along with your personal income tax return.

Schedule C highlights the importance of keeping detailed records all year long. Keep receipts from clients, track expenses for the business, log mileage for business use of your vehicle, and determine costs of using your home as your business space.

Armed with this knowledge, tax time should be easier for any freelancer. Now, sign up to a free trial of Bonsai to see how we can put your freelancing on autopilot.

At the end of the tax year, we always recommend you contact a tax professional if you have any questions in regards to your form 1099, the accounting method to use for your tax return, or anything related to paying your self-employment taxes.