As a small business owner, it might be tempting to just use your personal bank account for all transactions. After all, it's your business, and the money ends up in the same pocket, right? Well, you might want to think twice about this one.

There are many perks of having a business bank account that don't come with the traditional personal accounts. From simply keeping your finances organized, to getting a business loan and protecting your identity, business bank accounts are definitely the way to go.

Let me run you through a few examples of what you can do with a business bank account, and why it would be of great benefit to your small business or freelance gig.

Note: If you are looking for an easy-to-use checking account for businesses like home services,construction, barbers,, check out the BlueVine. Easily manage, save and spend your funds to make your home services business finances shine. Open an account today.

What Are The Benefits Of A Separate Business Bank Account?

Separating your personal and business transactions is an important step to starting your small business. These special bank accounts are designed with businesses in mind, offering services focused on business owners instead of individuals.

Let's take a look at some important business aspects you can handle with a dedicated checking account.

Organize Your Business Expenses

Having clean, organized and easy-to-understand financial records is just smart business. For starters, it makes your accounting much easier. By having a separate business bank account you can easily keep track of all your expenses and send them to your accountant for tax time.

You can also track your expenses and keep your receipts organized by using an accounting software that you can link to your business checking account to automatically import and categorize your business transactions.

Keeping your business finances and paperwork organized will help you avoid problems caused by mixing your personal and business finances. This can also make it easier for you to apply for business loans, sell your business, or successfully get through an IRS (Internal Revenue Service) audit.

Accept Credit Card Payments And Electronic Deposits

Nowadays, the entire world runs on credit cards. Eventually you'll have to accept credit cards if you want to expand your business. In order to do this, you need to open a merchant account which is a type of bank account that allows you to process electronic payment card transactions.

Once you open the merchant account, you will link it to your business bank account, where the funds will be transferred after the payment is processed. This way you can not only accept electronic transactions online, but also physical cards by purchasing the necessary hardware.

Alternatively, you could link your business checking account to a payment processing service such as PayPal, Stripe or Bonsai. This makes the process a lot easier, especially if you run your business completely online, since you will not need special hardware to process payments.

Personal Liability Protection

By keeping your business and personal expenses separate, you separate your financial obligations as well. Since your company debts will be reported on your business credit report, your personal credit will not be impacted in case of any financial hardship your business may face.

Keep in mind that if you are registered as a sole proprietor instead of a corporation, your personal assets might still be compromised in case of a business liability since you are not considered a separate legal entity.

At the same time, having a dedicated business bank account can protect you from identity theft. As a freelancer or small business owner you probably have a large amount of transactions, which can put your financial information at a high risk of fraudulent activity.

By having a separate business account, you can limit the access to your information and avoid larger damage. It's always a good idea to link your business bank account to an EIN (Employer Identification Number) so you can also restrict access to your Social Security Number.

Build a Business Credit

Having a business checking account is the first step to building business credit, which is how a bank measures your business' creditworthiness. Having a good business credit score will help you get a business credit card or a loan with lower interest rates and without compromising your personal finances.

Additionally, once you establish a great business credit score, purchasing additional equipment and inventory will be easier for you by applying for credit from suppliers. If they can trust your business is financially stable and is capable of repaying debts, you won't be required to prepay for products or services purchased.

Of course, just like with your personal credit score, you have to make sure to pay your bills on time, repay your vendors, and stay on top of your self-employment taxes. This way you can build a good business credit score and enjoy all the perks that come with it.

Save on Taxes

When you run your business using a separate bank account, you are not only keeping your expenses organized, but you could also be saving some money by accurately filing your taxes. When preparing your business tax report, separating your expenses can get complicated, and this can lead to a loss in tax deductions.

People miss so many tax deductions just because they didn't have their paperwork in order, or simply couldn't tell between business and personal expenses on their bank statement.

With a business checking account, you can even use a tax software such as Bonsai Tax, to automatically identify deductible business expenses and help you maximize your tax write-offs.

Pay for business-related expenditures

Use your business checking account to pay for all ordinary and necessary costs to operate your business. This could be inventory, payroll, rent, business insurance, vendors, lenders, etc... This is a good way of staying on top of your business expense management.

To make your accounting process easier and more organized, to research what type of business-related expenses you can deduct taxes on, and pay for them with your business checking account.

Remember, depending on the nature of your business, the expenses you can deduct may be different. For example, if you run your business from home, there are certain home-office expenses that you can get a tax deduction on. The same goes for attorneys, therapists, etc.

Can I use my business account for personal use?

Whenever you need funds from your business to pay for personal expenses, it may be tempting to simply use your business checks or cards, especially if you are a sole proprietor and don’t have to share the funds with a partner. But this may not be such a good idea. There are many problems addressed by a business account.

Treat your business as a separate entity

If your business is an S-Corporation or a Limited Liability Company, the legal business structure protects your personal assets by treating your business as a separate entity. However, when you use your business bank account to cover personal expenses, you run the risk of losing that protection and being held personally liable for any of your business’ liabilities.

Even under other business structures that do not protect your personal assets, you may still run a risk in case of an IRS audit. If an agent discovers you are using your business account for personal purposes, they may declare your accounting records as ‘unreliable’ and this could lead to a complete examination of your business expenses.

How to use your business funds for personal expenses

The best way to use your business funds for personal purposes is to withdraw the money in the form of an owner distribution or paycheck, and then deposit it to your personal account. Make sure to include this in your accounting records for tax time.

I recommend you establish a regular monthly payment, allowing yourself a wage, just as you would do with employees. This is a great way to keep consistency in your records, rather than taking out random amounts of money whenever you need them for personal use.

Take the time to figure out a fair amount that will allow you to handle your personal finances as well as business expenses so that you can easily budget and forecast your company funds.

The Fuss-Free Business Banking Option

Bonsai's business account is one of the best options in the market and it makes your business finances management a bliss. There are little-to-no opening requirements, no monthly maintenance fees and no transaction fees.

With its added 'Envelopes' feature, you can also use it as a business savings account by creating sub-accounts and have a specific percentage of your transactions automatically transferred to them. You will easily save for a rainy day, vacations, tax season, or expansion projects.

With Bonsai's business account, you can pay for your business expenses online by using your virtual card or adding it to Apple Pay for in-store payments. You can also use your physical card, which you will get in just a few days after signing up. Do business any way, anytime.

It only takes 3 simple steps to open a business checking account with Bonsai's business account:

1 - Create an account

To get started, you first need to create an account by providing your full name, country and the currency in which you will be doing your business transactions. Create a strong password, and move on to the next step.

2 - Tell us about your work

Next, we'd like to get to know your business a bit more. Answer a few questions about what kind of work you do, how long you've been in business for and in which stage you are. This takes less than 3 minutes.

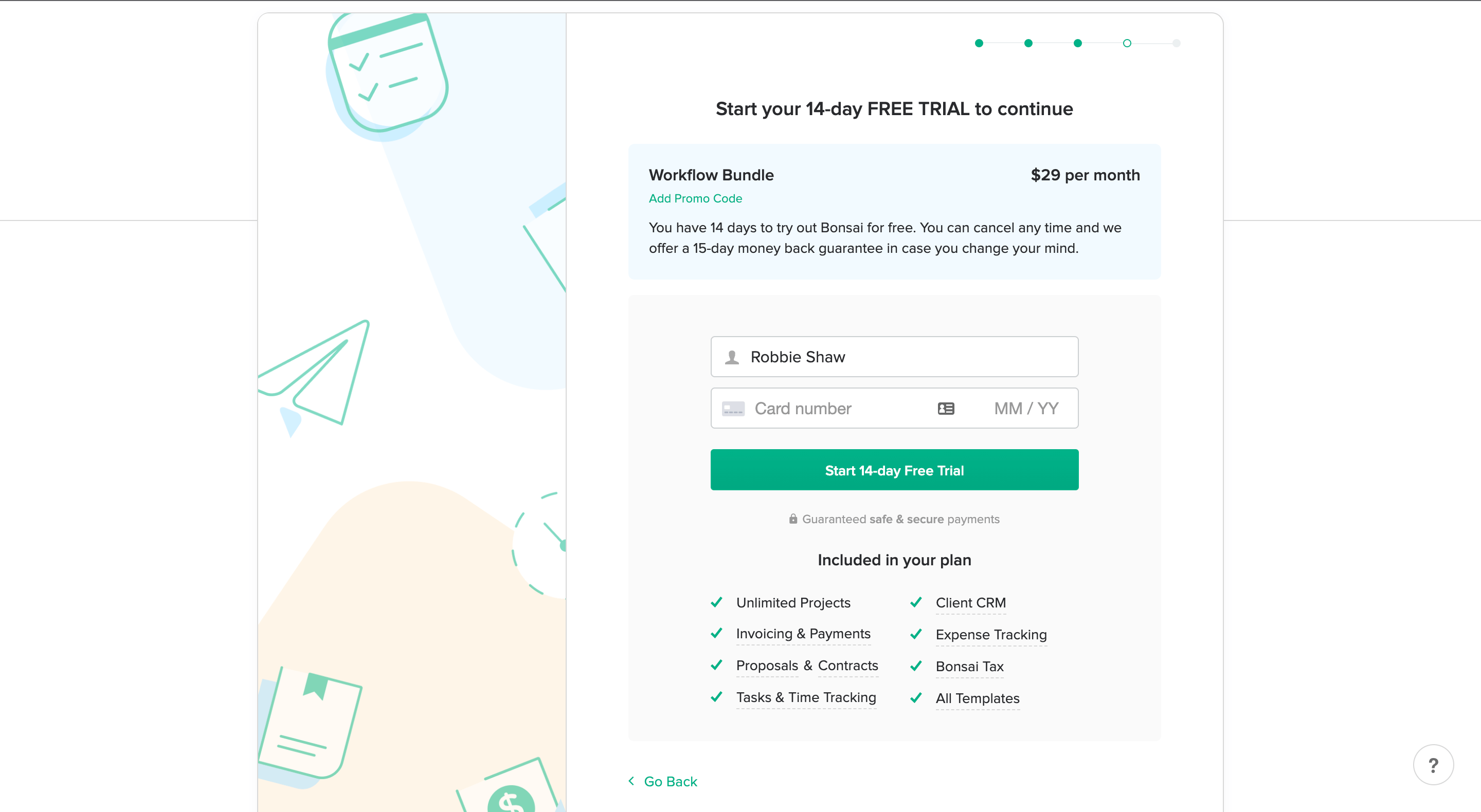

3 - Begin your Bonsai free trial

Bonsai's business account is part of the all-in-one business suite Bonsai. You will begin your 7-day free trial now by entering your credit card details.

You're ready for business!

Once you start your free trial, you will have access to everything you need to run your business. This includes automatic invoicing, customizable contract templates, expense tracking tools, tax reminders, income reports, and of course your new Bonsai's business account Business Checking Account.

Come on board, and take your freelance business to the next level.