It may not be the best part of being a freelancer, but accounting and invoice template management is an essential part of running your own business.

Tracking expenses and revenue, keeping on top of cash flow, preparing for tax time, and of course invoicing and getting paid are all key to a successful freelance business. And you want to spend as little time as possible doing all that, so it’s worth looking for a solution other than your own spreadsheets and an annual panic at tax time.

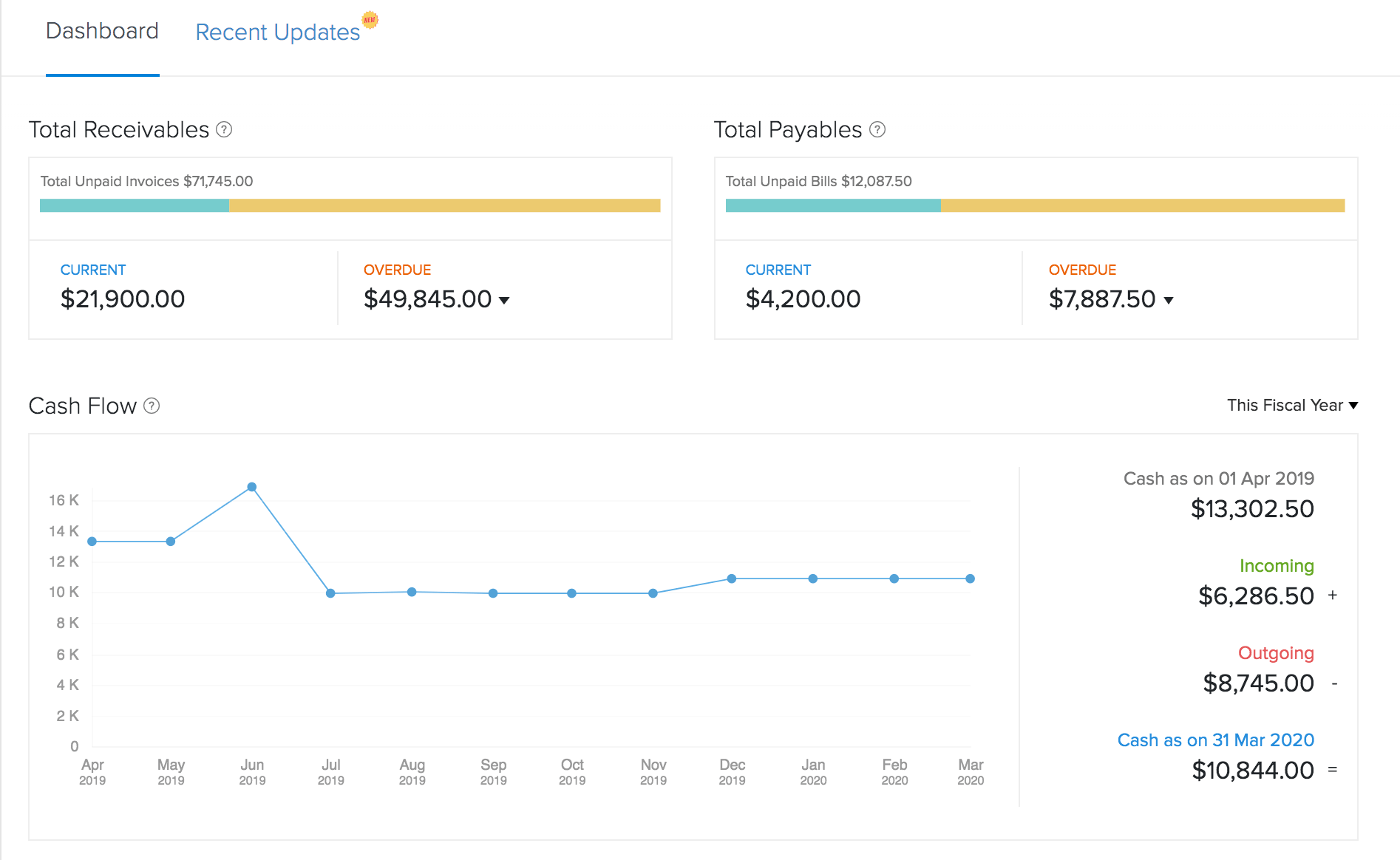

Xero is a solution that helps small businesses through its cloud-based accounting software. But it may not be ideal for your freelance business or, so it’s good to know there are other options.

In our list, you’ll learn about 10 great options to use instead of Xero, helping you tackle the important work of managing your accounting and finances.

Note: If you want to try the top-rated alternative to Xero to track your business expenses, try Bonsai Tax. You'll get access to our entire freelancer product-suite as well as our tax tools to save money and stress during tax time. The majority of the users save $5,600 during tax season. Try a free trial for 7-days today.

#1. Bonsai

Bonsai has an integrated suite of products made specifically for freelancers, including an impressive financial system and a tracker for 1099 expenses. Its invoicing tool is connected to proposals and contracts, making it easy to ask for payment, and customize the settings to allow partial payments, lock files until payment is made, and more, and it’s connected to several different payment systems.

An accounting tax assistant allows you to track expenses, including the ability to import expenses from your credit cards or bank. It will help you find tax deductions automatically, give you profit and loss reporting, provide quarterly estimated tax and annual filing reminders, and allow access by your accountant to make tax time easy. It's the perfect app to track receipts for taxes.

With the ability to work in 180 different currencies, your freelance business can be truly international. More than 200,000 freelancers and agencies have trusted Bonsai to date - are you ready to sign up for a free trial?

Bonsai even offers a free alternative to tracking business expenses. Try our 1099 excel template to manually track your write-offs.

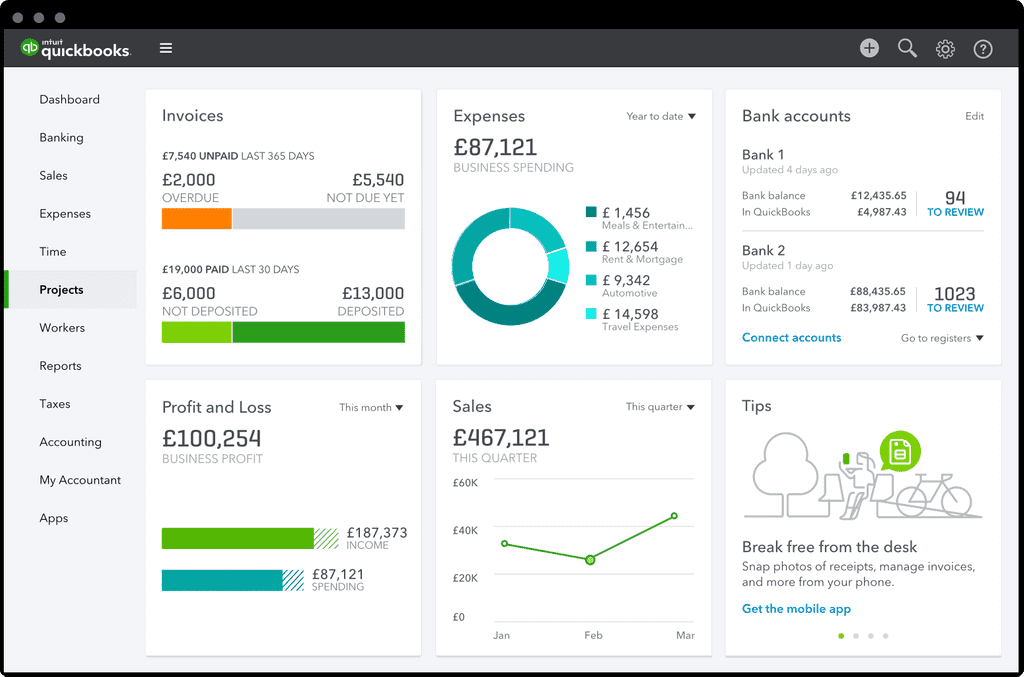

#2. QuickBooks

QuickBooks by Intuit is a great Xero alternative as it offers the same functionality, including the ability to download information from your credit cards and bank accounts. With the connection to your accounts, you’ll be able to track income and expenses and easily view profit and loss numbers. You can use your phone to take pictures of receipts to add to your expense tracking. Send invoices, know when they’re viewed and paid, and have the ability to do payroll as your business expands. QuickBooks offers added functionality too, like time tracking, sales tax tracking, inventory management and more. See our top QuickBooks self-employed alternatives.

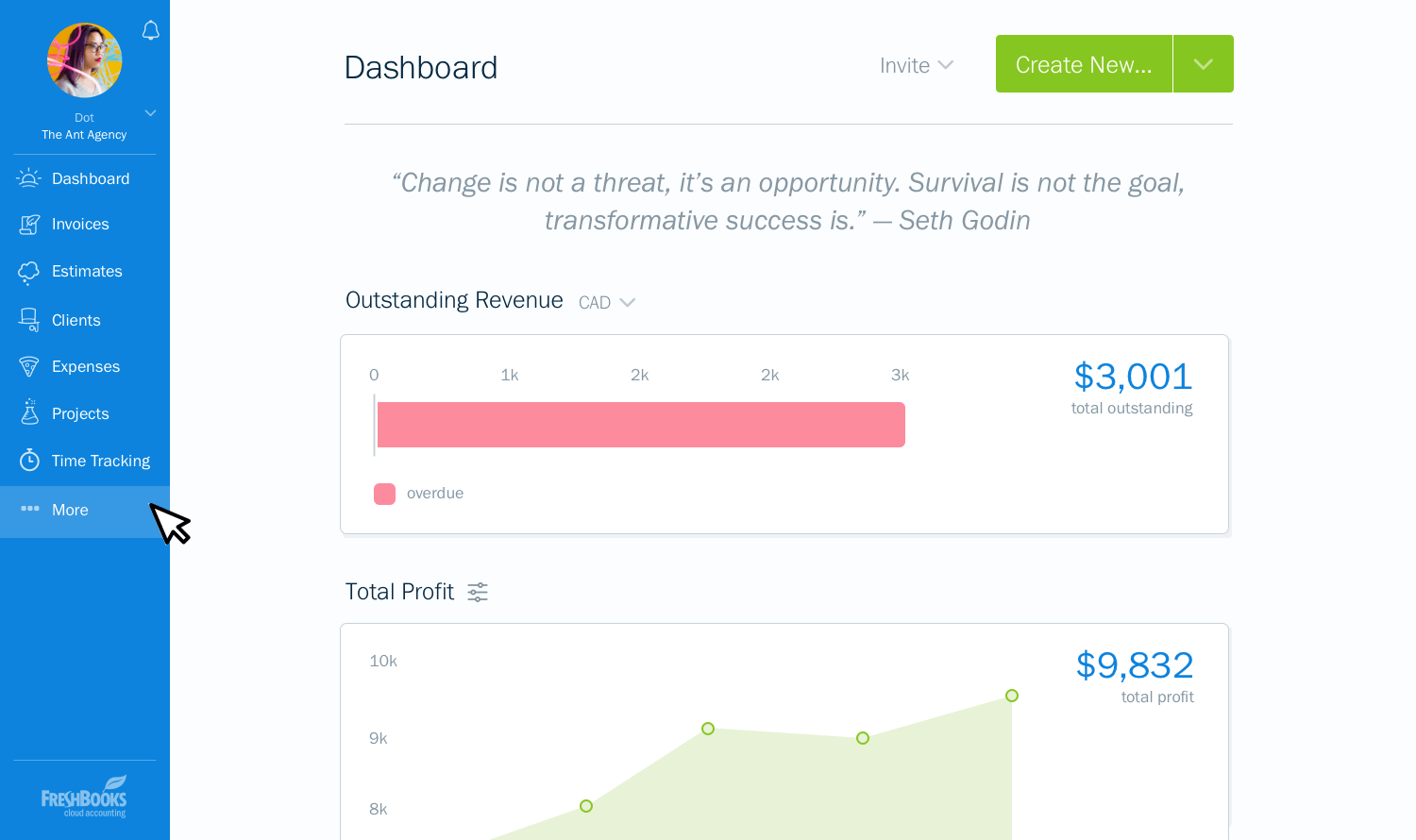

#3. FreshBooks

FreshBooks is a cloud-based system for small businesses that offers an all-in-one invoicing and accounting solution. Its invoicing system includes the ability to customize, send reminders and offer a variety of online payment alternatives. Time tracking and expense tracking, project views, estimates and reports are all part of this robust system. FreshBooks is good for solo freelancers or teams, and will also prepare you for tax time with all its bookkeeping and accounting tools. Discover more alternatives to Freshbooks here.

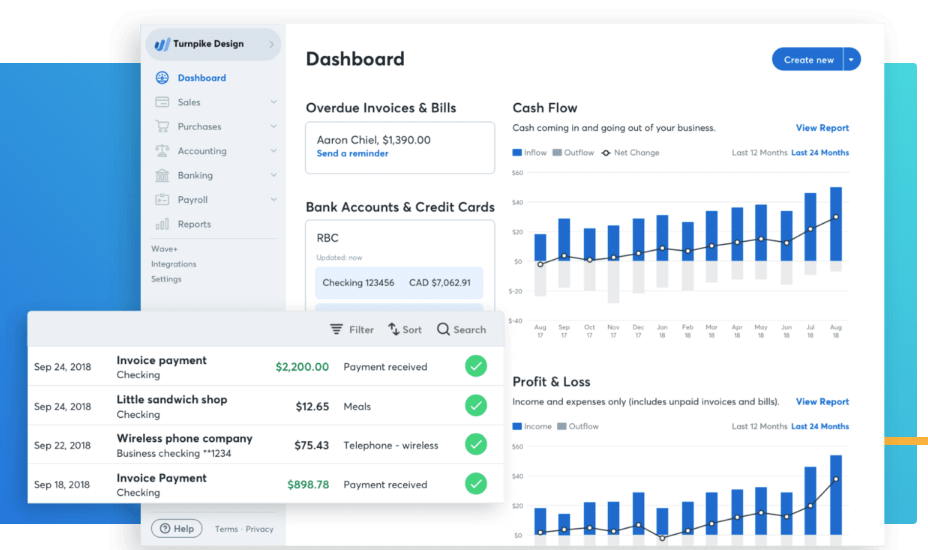

#4. Wave

Wave is an accounting software designed specifically for small business, making it a good choice for freelancers. It has everything you need for accounting: track income and expenses; scan receipts from your phone to make it easy to stay on top of expenses; customize and send invoices; accept online credit card and bank payments; add payroll capacity for employees or contractors, including tax calculations; and generate reports to stay on top of the progress of your business. Wave’s pricing system is a bit unique, too. Accounting, invoicing and tracking receipts is free. Payments are on a per-use basis, and the payroll service has a monthly base fee and cost per employee or contractor. Check out this article for more alternatives to Wave.

#5. Zoho Books

Zoho Books provides an online accounting software and the ability to add apps for other functions, such as a CRM or a Bookings app. In the accounting system, you can create estimates and convert them to invoices, send payment reminders and give your clients easy payment options. You can connect your bank to track transactions and be ready when tax season arrives. You can also do time tracking and create invoices from within projects. And then there are over 50 business reports including a custom dashboard, and the ability to schedule reports and email them to you and your team if you work with one. Filter the data to generate the reports that work for you.

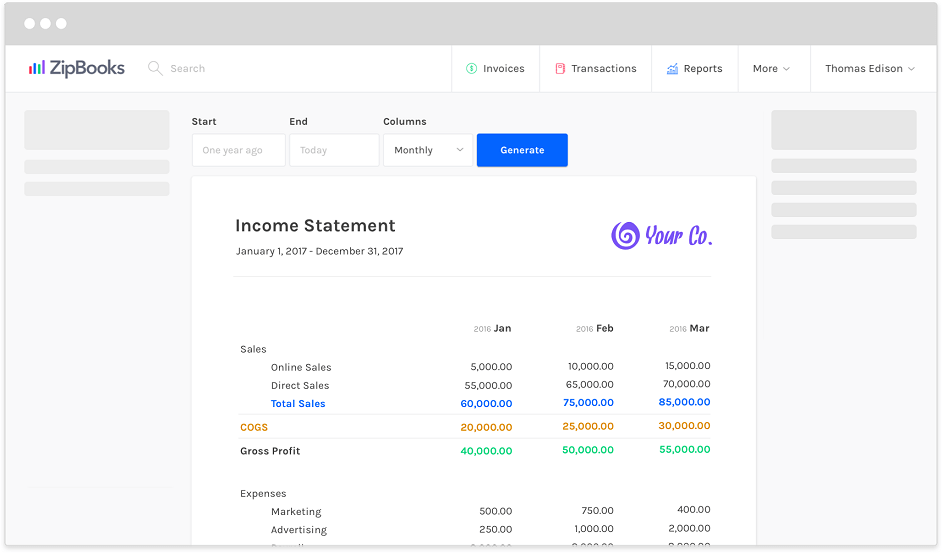

#6. ZipBooks

ZipBooks is another system that provides online invoicing and accounting services. For free, you get limited functionality, including online invoicing, the ability to accept digital payments from PayPal or Square, connect to one bank account, and receive basic reporting. You can add features with subscription plans that will provide capacity for tracking time, sending recurring invoices, automated reminders, connection to multiple accounts and the ability to add team members. The final level has greater reporting capacity, categorization of accounts, organization of books in a variety of ways, and the ability to securely share documents. It all depends what your freelance business needs, and you can scale when needed.

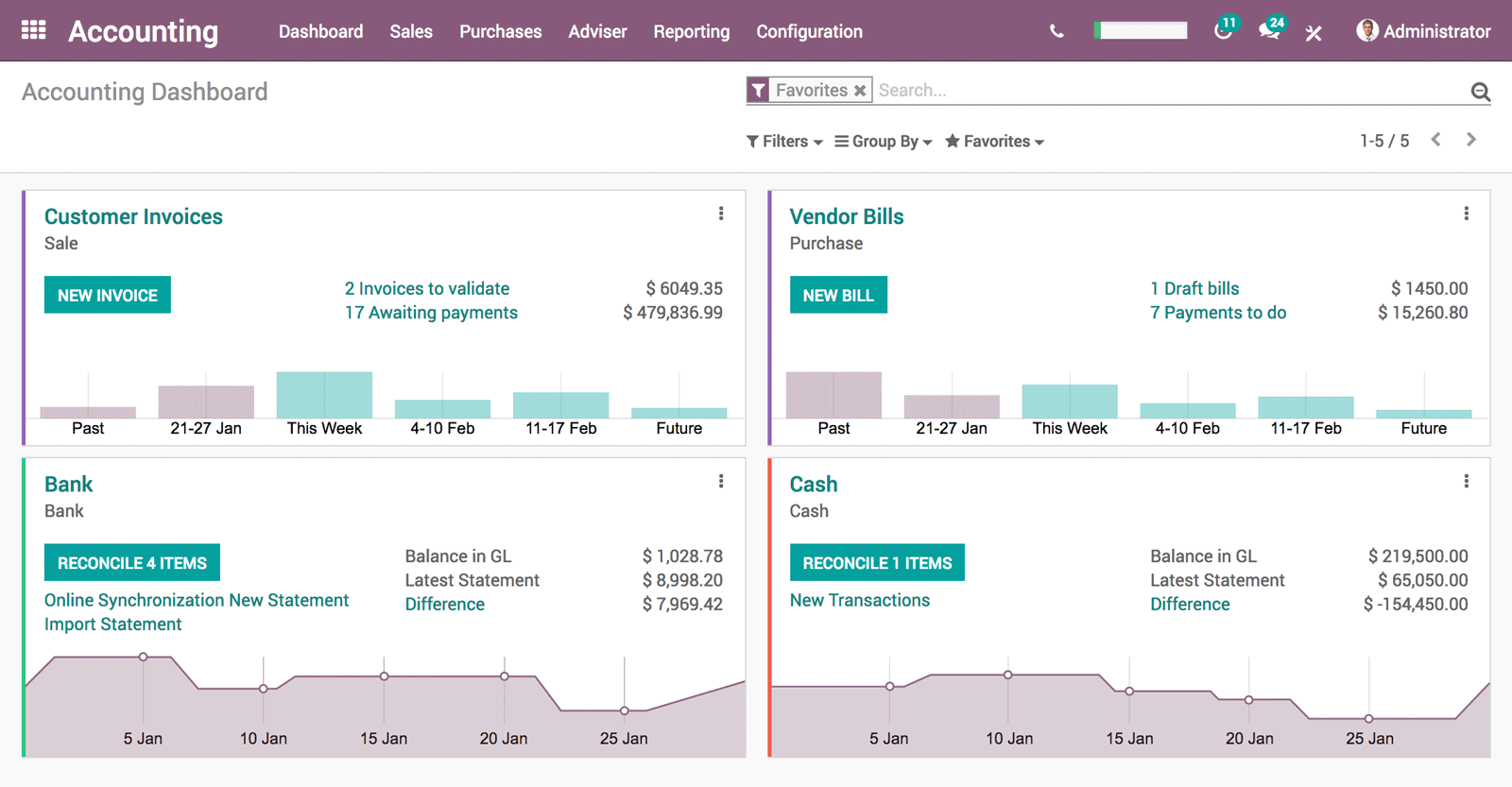

#7. Odoo

It may seem like it’s more suited to a larger business, but Odoo still has the financial tools you need to run your freelance business. It’s basically a suite of apps from which you choose depending on what you need for your business. On the financial side, there’s an invoicing app, an accounting app, an expenses app and more. You get the idea. You build the system you need and scale it as you require. Add a CRM, build a website, do planning and book appointments. You decide what you need and what you don’t need.

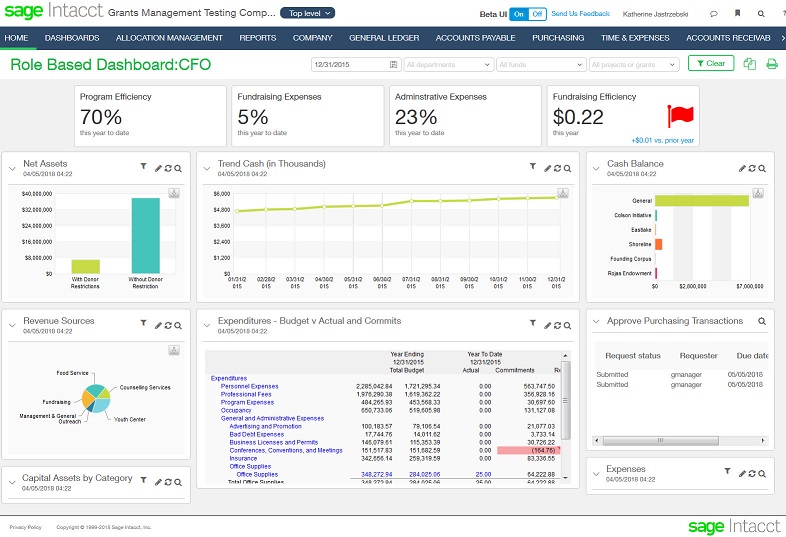

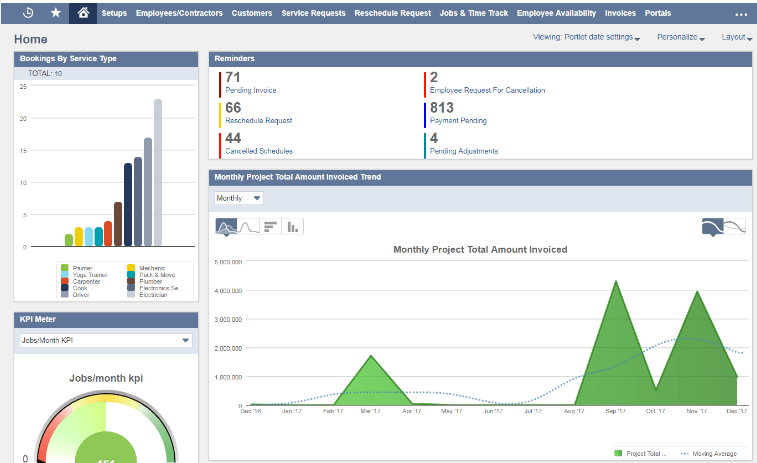

#8. Sage Intacct

Sage Intacct bills itself as a leading accounting software for any size of business. The core accounting and financial services track accounts payable and receivable, cash management and more. Use it as a tool for planning and budgeting, automating revenue and billing processes, and even generating industry-specific dashboards that provide details on financial and operational performance. For freelancers, the industry would likely be “professional services,” which includes digital marketing, IT services, consulting and more.

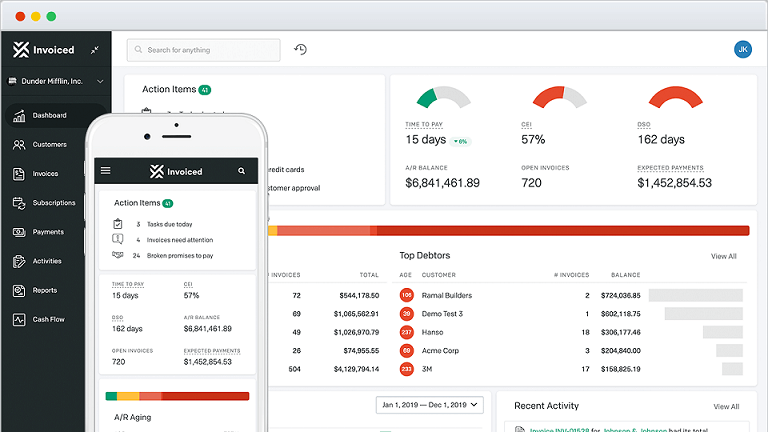

#9. Invoiced

Invoiced is - you guessed it - an invoicing system with added functionality. It’s an accounts receivable system built in the cloud, and intended for businesses with a lot of customers. The pricing reflects that, with the entry plan intended for up to 100 clients and 5 users within your business. Using it, you can offer your customers AutoPay, payment plans, subscription billing, and a customer portal to make it easy for them to interact with you - and make it easier for you to get paid. A simple payment platform makes it easy to get paid online too, speeding up the payment process and keeping it simple for clients.

#10. Netsuite

NetSuite by Oracle is a full-service system that includes ecommerce, along with Enterprise Resource Planning tools with financials, CRM, and more. A good choice for a freelance business that has employees or is looking to scale, the accounting software includes a Planning and Budgeting tool, with financial planning tools including modeling capabilities, and integration with Microsoft Office tools such as Outlook, Excel, Word and PowerPoint. Financial Management includes billing, revenue recognition and insight into the financial performance of your business, from a consolidated level down to individual transactions.

Ready to try out a freelance-focused solution?

Do you want to get started with Bonsai, the best Xero alternative? You can sign up for a free trial - no strings attached - and explore the powers of Bonsai to transform how you run your freelance business.